- Report: #182548

Complaint Review: Wellsfargo Bank - JPMorgan Chase Bank - Minneapolis Minnesota

Wellsfargo Bank - JPMorgan Chase Bank Ripoff Wellsfargo told me that a $28,000 check was good and release the check to me and later told me it was counterfiet. Minneapolis Minnesota

*Consumer Comment: First, stay off the internet.

*Consumer Suggestion: My favorite part of this is...

*Author of original report: Right to do Business on the internet

*Consumer Suggestion: I'm concerned about the bank's role in this story

*Consumer Suggestion: Nigeria LOL

*Consumer Comment: How Embarrassing!

*Consumer Comment: Why are you blaming JP Morgan?!

*Consumer Suggestion: what kind of business do you have?

*Consumer Comment: Wow

*UPDATE Employee: hahahahahaha

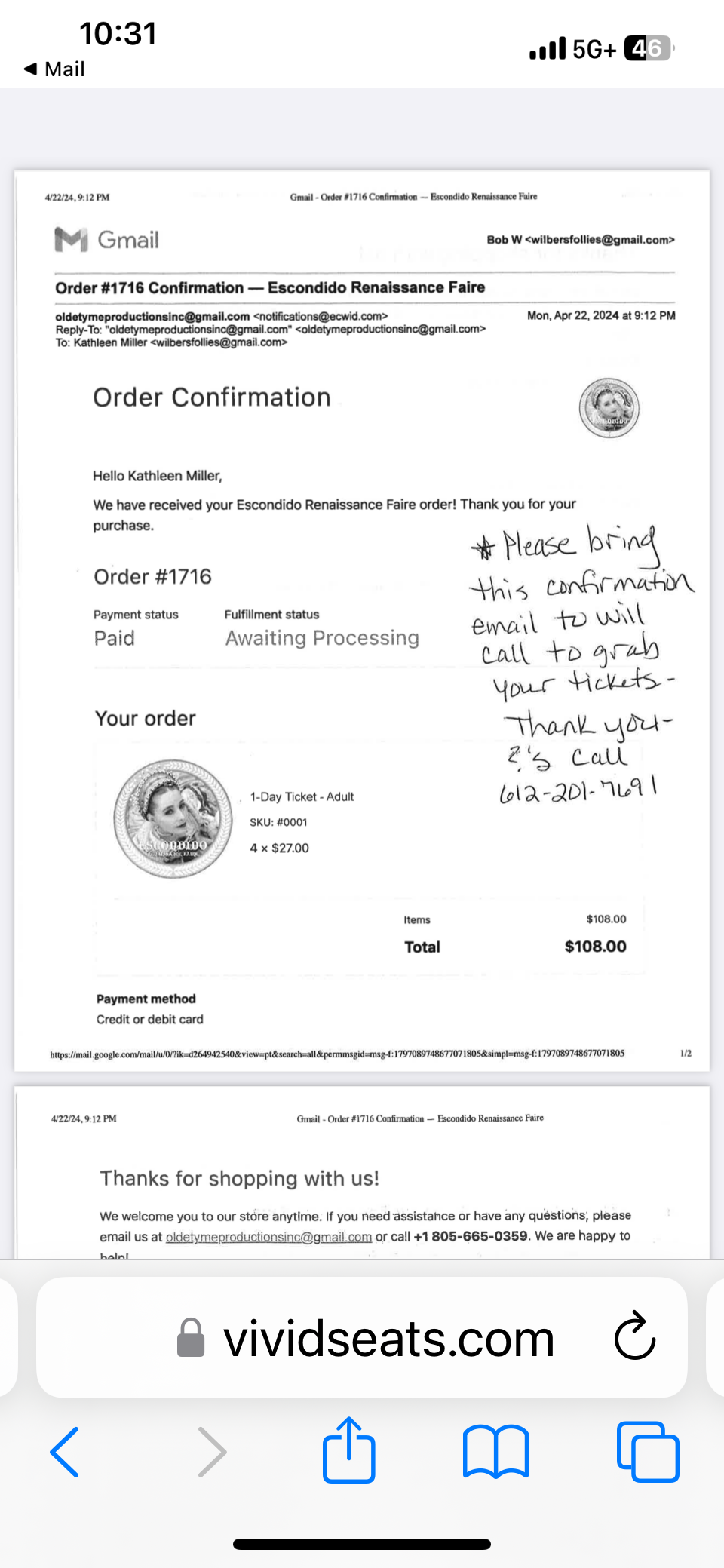

On December of 2004 I when in to wells fargo bank and ask them if this $28,000 check was good and Yusse a personal banker told me that this check was good. I ask him when can I make a withdraw he told me right now. Yusse than told me wait three days before I take any of the money.

I when and waited three days and withdraw $24,000 ask John Peters requested for me to do. Nine days later I got a letter from the bank telling me that the check was counterfiet and they was going to do an investgation on me too see if I had anything to do with this check been counterfiet. I spoke with an lawyer and he told me that the bank was going to charge me with crime because the check was over $10,000 dollars. The bank told us if we did not paid them some money they will close all my account where I will not beable to check any of my business check and I will not beable to open another account with any other bank.

My husband and I was afraid and we let the bank take $7,000 dollars from my business account to cover part of the check and we proimse that we will make $1,000 dollars payment untill the hold $24,000 was paid off.

I told the bank that I felt that they are respond for cashing a $28,000 dollar check without verify too see if check was good.

When I went in to withdraw the money the bank manager at a different location held me for two hours and later she called Yusse and he told her that the check was good.

I included JPMorgan Chase Bank because the check came from them. I called the intergated system and they told me that on Janruary 5, 2005, one cash the same check but for a differet dollar amount.

Faith

Minneapolis,, Minnesota

U.S.A.

10 Updates & Rebuttals

Alison Cbar

Boca Raton,Florida,

United States of America

hahahahahaha

#2UPDATE Employee

Wed, November 25, 2009

You clearly are a horrible business person, let alone not that bright. You're verbage and grammar structure is horrific and reminds me of a child in elementary school. In regards to the scam created by Nigeria, how could you be so stupid as to fall for something like that? There has been publicity about scams coming out of Russia and Africa for years- people get mass mailed letters from "rich" African men who need x amount of dollars sent by "you" to get x amount of dollars out of the bank, or the scams that russian or african girls find men on dating sights on the internet and ask them for money to come to the states, or say that they are stuck there and need money to get back, etc etc.

Next I would like to let you know that nobody can verify just be looking at a check if it is real, they would have to actually call the bank in which the check is issued from to verify 1. that its an open account 2. that there is money in the account and 3. that the check has not be reported stolen. This is 2009, check and money fraud is frivelous and you can't tell the difference by eye of counterfiets. Next, I would like you to be aware that Chase/Jp Morgan could sue you for Slander and Defimation of character. You should be put in jail for being involved in a scam, you have no proof that you weren't readily in on it. What in God's good name made you decide to write on rip off report that you were scammed by the BANKS involved???? There is nobody responsible but yourself. You sould like a selfish, retarded individual who should be ashamed of your stupidity. How dare you blame banks for YOUR greed??? If I was you I would write a retraction and apologize for the individuals you named and the banks, because if I was them I would personally go after you in civil court!

Resty

Waunakee,Wisconsin,

U.S.A.

Wow

#3Consumer Comment

Wed, July 02, 2008

You're intelligence is being called into question big time with the filing of this RoR. I cannot believe ANY business owner today doesnt know of or isnt aware of this type of scam. Judging from the way the report is worded I would call into question the validity of the OP CYA tactics. Pure and simple......you let greed rule you. Anybody that falls for these d**n things deserves the repercussions. And the more people that fall for em the longer it will continue to happen.

Nancy

Steilacoom,Washington,

U.S.A.

what kind of business do you have?

#4Consumer Suggestion

Wed, July 02, 2008

What kind of business do you have? Your are not very literate (may 10 year old grandson has better grammar). You are very lucky the bank is not pressing charges against you. Don't be so stupid and trusting and greedy. And if you don't know about business, why start a business before you take some classes?

Edgeman

Chico,California,

U.S.A.

Why are you blaming JP Morgan?!

#5Consumer Comment

Wed, July 02, 2008

You actually listed JP Morgan as one of the entities that ripped you off? What did they do to you? That is just low.

Arthur

Wylie,Texas,

U.S.A.

How Embarrassing!

#6Consumer Comment

Tue, July 01, 2008

How Embarrassing! Me? I'd feel embarrassed to write this sort of report! Imagine somebody telling the world he or she got suckered into a scam where they offered free money and it turned out to be a fraud! Reminds me of the original Ponzi scheme where Charles K. Ponzi and his crooked bank had been shut down, and Ponzi himself in a cell, and there were people outside the jail so hungry and greedy for a fast buck that they were there with money in hand in the hopes of still -- even at that late date -- giving it to the parasitic Ponzi and profiting from his get-rich-quick scheme. Sucker beware! But then, there really is no way to warn someone to not succumb to one's own greed and lust for the quick buck, is there? It all takes place in the subconscious, and in the heart.

Lain

Minneapolis,Minnesota,

U.S.A.

Nigeria LOL

#7Consumer Suggestion

Tue, March 25, 2008

First of all, this has nothing to do with the banks. ANYONE who possibly falls for this Nigeria scam stuff is absolutely RETARDED. how can you even be on the internet, find this site, yet you have NO IDEA that all those scam/spams from nigeria/africa are fake? I noticed some people seem to feel sorry in the comments, I apologize but this is the most ridiculous story EVER! 25 million from Nigeria !! LOL classic

Dave

New Westminster,British Columbia,

Canada

I'm concerned about the bank's role in this story

#8Consumer Suggestion

Wed, March 22, 2006

Google "nigerian 419 scam" and you'll have hours of reading about similar schemes. It is unfortunate that you were made a victim by the scammers. But what bothers me about reading your story is the advice that the Wells Fargo employee gave you. When dealing with the 419 fraud artists, meeting face-to-face has resulted in injury and even death. That someone who works at a bank, who is himself from Nigeria yet, was not aware of the possibility of a scam troubles me. Personally, I'd suspect some sort of involvement. Hopefully the FBI is all over this one and it all gets sorted out for you.

Faith

Minneapolis,,Minnesota,

U.S.A.

Right to do Business on the internet

#9Author of original report

Wed, March 22, 2006

In June 2003, I added my company too do business with African companies or people. One year later through the internet Iam taking business classes. One of my class was consummer law from this book help me to not lost more money from the bank than I did. At the sametime I had 25 employees and we all was looking for more work for the company. Our fight with people in the Unite State was costing us to loss more money than we was taking in. After I started to get hits for Nigeria and other african country I was not aware the Nigeria scam. I e-mail back to few of the people that told me that they had large sums of money they want to invest in the US. Those that responded back to me I spoke with them for a year before I receive this check. Many time I had large check too come to me but I will take the check to the bank it was drawn off not to my bank. This time the check came from a out of town bank so the only way I could make sure the money was in the account was my bank Wellsfargo bank. I had blind faith in my bank to make sure the check I was dealing with was good. At this time I was been introduct to the bank system on how it works. Doing my 20 years dealing with banks I never though that it was that easy to work in a bank with a $28,000 Check and cash it without any verifying of that check. The same people gave me a $98,000 check the money was to cover the $28,000 check and for me to send the remaining to people in the Unite State. The bank cash that check within 10 days and the bank manager told me that they got the money and I can take it. One of the personal banker over heard me talking with the bank manager and told me that I need to let the money set for at less four more days so the bank can review the check. I left the money in the account and the bank manager called me ask me will I be picking up the money I told him I wanted to let the money set for awhile he told me he will put a hold on that money and he did. Few days later they told me that the $98,000 check was a counterfiet check. I called in the IFB myself because I did not understand how a bank can tell you that the check was good and later put a hold on the money because you want to let your money set.

Douglas

Worcester,Massachusetts,

U.S.A.

My favorite part of this is...

#10Consumer Suggestion

Wed, March 22, 2006

Let me know if I am reading the initial report correctly...Did the author actually spend the $24,000 that she withdrew in less than 9 days? The report claims that she took out the money and when she was contacted 9 days later and told the check was bad, she didn't have the money to pay it back... Is it just me, or does it seem odd that someone would withdraw that much cash from a check they received from a complete stranger. Heck, almost immediately upon receipt of said check she spent 86% of it. Not in debits or transfers mind you, but a $24,000 cash withdrawel. I bet I know where that money went too...she didn't mention how it was spent for one of two reasons...either it was spent on frivolous crap or more likely I'd bet that she was told to keep the $4,000 she left in her account and give the other $24,000 to the Nigerian scam artist as part of the trial run before sending they send the 25 million over...lmao. Now, when her shady deal to rip off the Nigerian government (thats the offer if I remember correctly, help the scam artist avoid taxes on the money and in exchange you get a piece of the pie) anyway, when her scam turns out to actually be a plan to rip her off...she doesn't take any responsibility for her own actions, and she doesn't blame the folks who scamed her...nope... she actually blames the bank that she decided to drag into this mess and files a report claiming that they are somehow wrong for wanting to recover their missing funds... To avoid bad deals like this in the future, remember these 3 little things: 1. There is no such thing as free money. 2. If the main goal of the deal is trying to rip off someone else, the deal is probably not legitimate 3. If you type the basics of the deal into any internet search tool and get 2 million hits explaining that the deal is a scam and how to avoid it...get out.

Robert

Wallingford,Connecticut,

U.S.A.

First, stay off the internet.

#11Consumer Comment

Wed, March 22, 2006

You are, however, not alone. There are many other gullible greedy people that have become entangled in this very old scam. Didn't it seem like a strange arrangement to get involved in? Perhaps you should have consulted your lawyer before you got involved instead of after. I just don't get it. I live on a tight budget. Some weeks are a struggle. Yet, I still would have warning sirens going off if someone proposed such a scheme. None of it sounded the least bit illegal or even questionable? The other thing that surprises me is that WF employees were not aware of this ongoing scam. Although you were misled by WF employees you still are responsible for the money you stole from WF and their depositors. I hope things work out for the best for you. If it sounds too good to be true it is.