- Report: #1245168

Complaint Review: Tanya Stevens Hollis Lorenzo Maxfield - Dallas Texas

Tanya Stevens Hollis Lorenzo Maxfield

4400 Alpha Rd Dallas, 75244 Texas, USA

Phone:

972-803-7184

Web:

N/A

Categories:

Tanya Stevens, Hollis Lorenzo Maxfield Tonya Stevens is being played by Hollis Lorenzo Maxfield Dallas Texas

To whom it may concern:

This story is flat out lie, The person who put this story on Google and the other people want to charge you $10,000 to remove it is a conspiracy to defame me. Tonya Stevenson is putting these lies put out there by Hollis Lorenzo Maxfield.

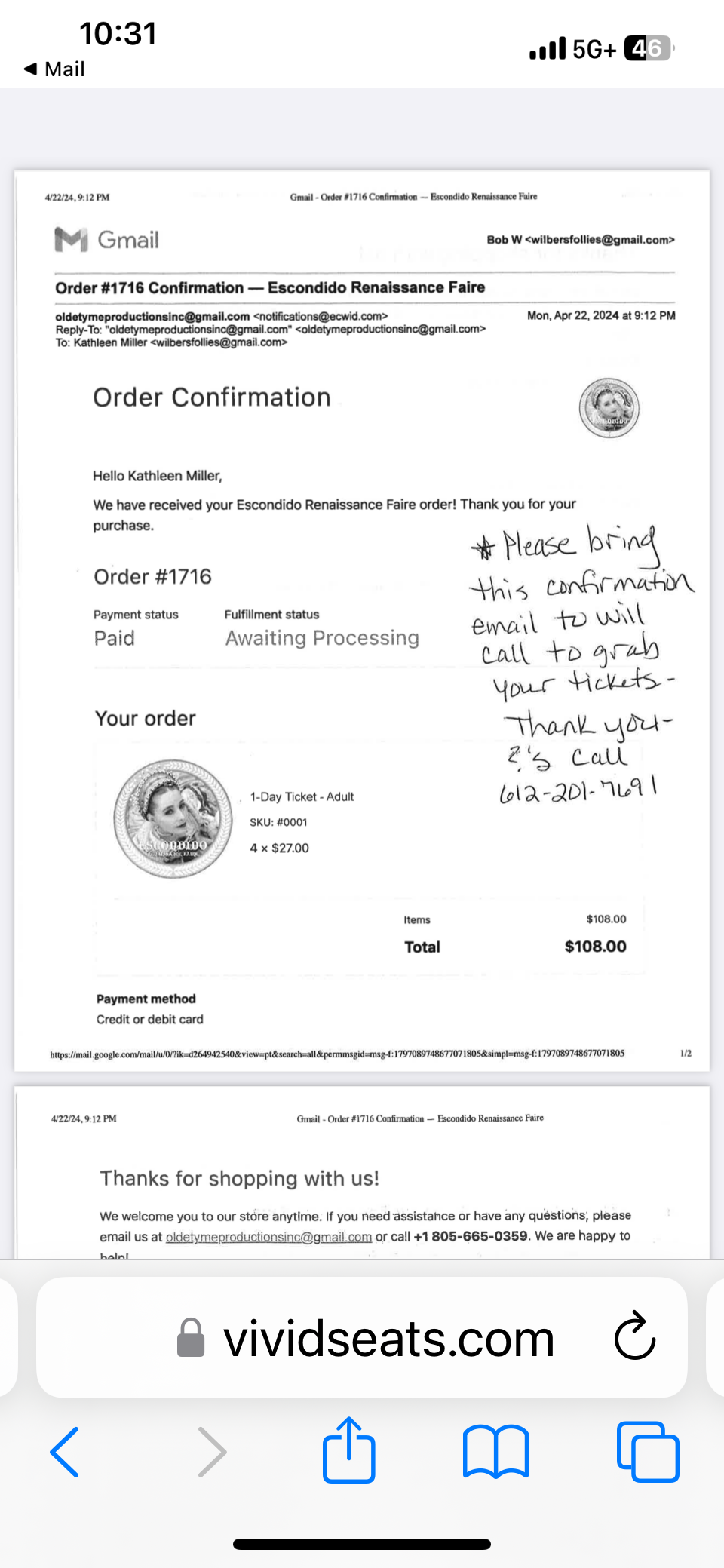

Hollis Larenzo Maxfield who was representing the owner in the lease on the house the person leased is saying I did not give him her money, which I did at his house in his garage, she is not a happy camper. Below are some stories about Maxfield for your perusal. I installed a garbage disposal, fixed the fence, shampooed the carpet and spent three days working on the house he gave the key code on the lock box and his tools to do the repairs which I still have to this day as evidence, with his name on them. As my Moma said if you will lie you will steal. I have been in the Mortgage industry for over 30 yeas and never been in trouble until I messed with this criminal. You can check my character with anyone and they will tell you I am a fine upstanding citizen who got caught up with this loser. These are reports below from the Securities and Exchange Commission, SEC about this guy Hollis Larenzo Maxfield, he did 10 years in the Federal Prison for lying and stealing 10,000 mil from people all over the world. Please see reports below, who would you believe.

I have had every License the State of has to gives, Insurance license in the seventies with Prudential Insurance, Real Estate in 1984, Mortgage Broker since they came out and was a broker before we had to have license, Liquor License for 3 different clubs in the 90's, Construction permits, and I also have a Permit to carry, gun permit license. issue this year. I ask you to reconsider this mistake on your part for the sake of my working. I pray you will see this below and you can Google his name and it will all pop up. There is much more for you to see on him, he is a liar and he uses people all the time. Larenzo Maxfield is a liar and con-man. Below are the facts on Hollis Lorenzo Maxfield.

February

On February 22, 2001, Judge John Dietz of the 53rd District Court, Travis County, Texas, issued orders of receivership over the assets of Brian Russell Stearns and Trans-Global Asset Management, Inc. in connection with cause number GV 100254, State Of Texas v. Brian Russell Stearns, et al. Earlier this year, Mr. Stearns was convicted of 80 counts of fraud related conduct in United States District Court-Austin Division. The receivership action was brought by the Texas Attorney General pursuant to the provisions of the Texas Securities Act at the request of the Texas Securities Board. The purpose of the receivership is to locate and obtain assets for equitable distribution to defrauded investors.

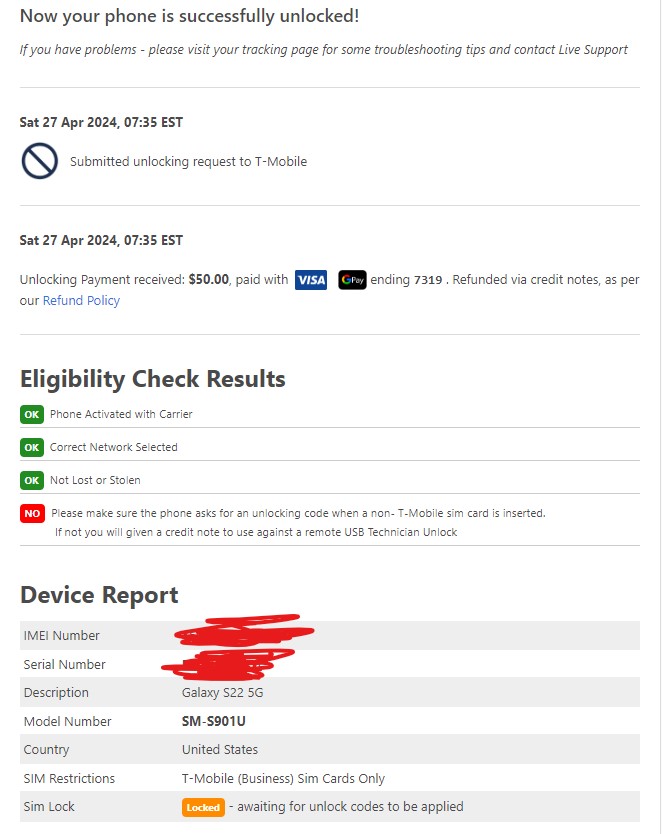

On February 22, 2001, Hollis Larenzo Maxfield pled guilty to Wirefraud, count 75 of an indictment, in the United States District Court for the Northern District Of Texas--Dallas Division, in cause number 3-00: CR-389-L(4). In connection with his guilty plea, Mr. Maxfield admitted that he, along with co-conspirators, through companies called Progessive Financial Services & Group, Inc., and Futurenomics International, Ltd., fraudulently obtained funds from investors throughout the United States and Puerto Rico. Mr. Maxfield admitted that the funds were invested into non-existent "high yield " programs and were diverted and misapplied. Additionally, Mr. Maxfield admitted that returns paid to investors as profits were, in fact, other investor funds. The stipulated loss was between $2.5 million and $5 million. The matter was prosecuted and investigated by the Securities Fraud Task Force for the Northern District Of Texas, which includes the cooperative efforts of the FBI, Office Of The United States Attorney and the Texas State Securities Board, as well as investigated by the Memphis Office of the FBI.

On February 12, 2001 before Judge Bert Richardson of the 379th Criminal District Court of Bexar County, Texas, Bradley J. Farley entered a no contest plea to Misapplication of Fiduciary Property and selling unregistered securities in cause number 2000-CR-3149. The case stemmed from the sale of interests in a program known as ABBA Funding, which was an alleged certificate of deposit related fraud. Sentencing will occur in approximately 90 days. The case resulted from an investigation conducted by the Texas Securities Board and the Bexar County District Attorneys Office. In addition to the criminal action, a receivership and injunctive action was filed at the request of the Texas Securities Commissioner through the Office of the Texas Attorney General. That matter is pending in the 166th Judicial District Court, Bexar County, Texas, Cause Number 2000-CI-02173.

February

On February 21, 2003, Roy Birk, of Llano, Texas, was sentenced in the 290th Judicial District Court of Bexar County to three years probation for selling unregistered securities. The indictment related to the sale of Cash4Titles promissory notes to the public. The cause number was 2002CR 8427A.

On February 18, 2003, in U.S. District Court, Dallas, Andrew Ramsey, Lisa I. Dale, Kevin DeWayne Spencer and Hollis Larenzo Maxfield , were sentenced to 97 months, 78 months, 78 months and 57 months in prison, respectively, with restitution to be determined at a future date, by the Honorable Judge Sam A. Linsay. Through corporations known as Progressive Financial Services & Group and Futurenomics International, Inc. the defendants raised about $10,000,000 from investors throughout the United States and Puerto Rico promising high returns by investing in "high yield " programs. Funds were not invested but were used for personal expenses such as cars and houses. Both Ms. Dale and Mr. Spencer were convicted after trial of multiple counts of wire fraud, securities fraud and money laundering. Mr. Ramsey was convicted of Interstate Transportation of Money Taken by Fraud and Mr. Maxfield was convicted of Wire Fraud, based upon their guilty pleas. The cause numbers were 3:00-CR-389-L(01- 04). The matter was prosecuted by Rhonda Rogers of the Texas Securities Board and Len Senerote of the Office of the United States Attorney, Northern District Of Texas, and was investigated in conjunction with the Memphis Office of the FBI.

On or about February 13, 2003, James Everett Surber, of Houston, Texas, was indicted by a Harris County Grand Jury for securities fraud involving an amount over $100,000 and violations of the criminal registration provisions of the Texas Securities Act. The matter involves the sale of Cambridge International Bank & Trust Company, Ltd certificates of deposit to investors in the Houston area.

On February 12, 2003, David M. Phillips, III, was sentenced by U.S. District Court Judge Jorge A. Solis to serve 34 months in prison and ordered to pay approximately $2 million in restitution in connection with his conviction for securities fraud. The indictment related to misrepresentations made in connection with the offering of investments in the Del Norte Well Program by Phillips Exploration, Inc. also known as Phillips Exploration International Corp. and Addison Exploration, Inc., both with offices in Dallas, Texas. The case number was 302-CR-200-P.

April

On April 26, 2002, after a two week jury trial before The Honorable United States District Judge Sam A. Lindsay, Kevin Dewayne Spencer and Lisa L. Dale were convicted by a Dallas jury on more than 80 counts each including securities fraud, wire fraud, money laundering. Two co-defendant's, Andrew Ramsey and Hollis Larenzo Maxfield were already convicted in connection with the scheme. Through corporations known as Progressive Financial Services & Group and Futurenomics International, Inc. the defendants raised about $10,000,000 from investors throughout the United States and Puerto Rico promising high returns by investing in "high yield " programs. Funds were not invested but were used for personal expenses such as cars and houses. Sentencing is scheduled for July 15, 2002.

Thank You,