- Report: #38234

Complaint Review: Ocwen Federal - Orlando Florida

Ocwen Steals Homes on Purpose. People to Contact ripoff ruined my perfect credit mortgage of columbus ohio sent me to a bc lender home to be sold ripoff fraud corruption Orlando Florida

I fully believe this is the next Enron. If President Bush wants some good pr about fighting corporate fraud, let him issue an executive order stopping all foreclosures in anyway connected to Ocwen Federal, even if they sell the loan to try to scapegoat themselves. Or Attorney General John Ashcroft can take action, or the SEC. Give people a chance to save their homes, supervised by someone who will not continue to purposely try to strip them of their homes for a profit.

I have sent the letter at the end in the last day to: President Bush, Vice President Cheney, Laura Bush, Hillary Clinton, Rep. Deborah Pryce, Rep. Stephanie Tubbs Jones, US PIRG, Ohio PIRG, Ralph Nader, AARP, FDIC, Office of Thrift Supervision, President Jimmy Carter, Channels 4, 6 and 10 in Columbus, Ohio, WOSU TV, National Public Radio, C-Span, Phil Donahue, Hardball, and more that I can't think of at the moment.

Who I am thinking of sending the letter to:

The Pope (I may be just kidding about this one), The Ohio Attorney General, The New York Attorney General, Attorney General John Ashcroft, President Clinton, Vice President Al Gore, Jesse Jackson, Al Sharpton, 435 Congressional Represenatatives, 100 Senators, Legislators in all 50 states, The SEC, Better Business Bureau, selected Mayors and City Councils and Chambers of Commerce, any banking and thrift organizations I can find, The Nation Magazine, The New Republic Magazine, Mother Jones, Buzzflash.com, Harpers Magazine, CBS, NBC, ABC,Time, Newsweek, US News and World Report, 60 Minutes, Andy Rooney, Crossfire, President Ford, President Regan, Consumer Credit Counseling Services, Bob Woodward, Michael Moore, other authors (great book material here), and many more.

I've spend $27,000 trying to save my home in the last 15 months, and my arrearage only went down $2,000. I need help, and by god (literally) I'm asking for it.

They just offered me the 3 payment option, but from reading the reports here, it seems as if that could only be the continuation of my nightmare. I've just found out that this is also going on in Britain.

This shouldn't be happening to people, and SOMEBODY has to stop them.

LETTER:

December 13, 2002

To: ...........

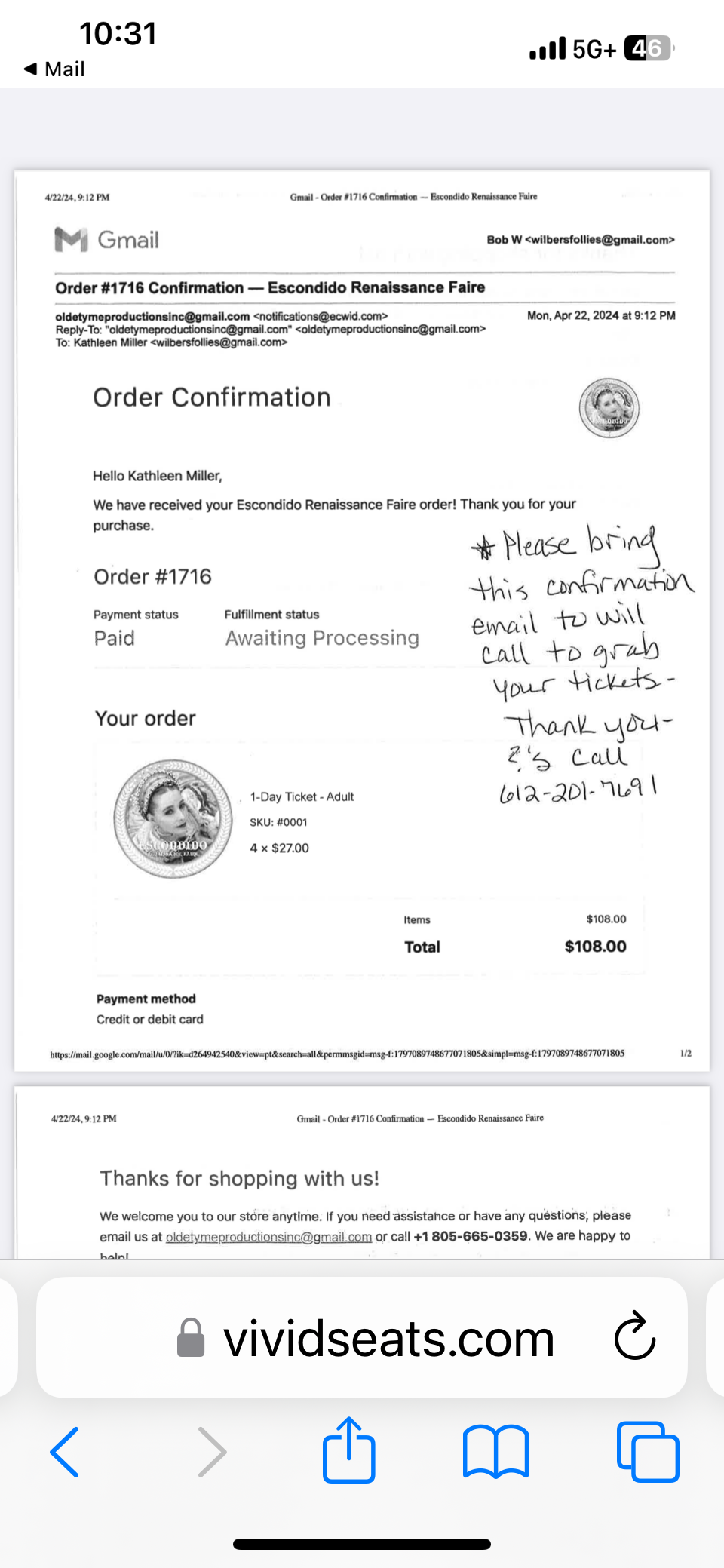

I am writing to try desperately to save my home. I have been the victim of predatory lending through Crew Mortgage/Scott McCann of Columbus, Ohio (currently license is revoked) and Ocwen Federal Bank. I have today written to President Bush and Vice President Cheney, and have also written to Mayor Mike Coleman of Columbus, Ohio, and Stephanie Tubbs Jones who does a great deal of work on predatory lenders. I talked this afternoon to Irving Schottenstein of MI Homes who built my home 18 years ago, and he was so nice and said he would try to find an investor who could help me. I will continue to ask for help in getting someone to convince Ocwen Federal Bank to work with me so that I can stay in the home I love, or find an investor who can help me.

I have had my home for for 18 years and I dearly love it. It backs to woods with all kinds of wildlife, and my whole life is in this house. I have been trying for 3 years to save it, even paying $27,000 through a Chapter 13, but it is scheduled to go to sherrif's sale on January 24, 2003.

Ocwen Federal has the reputation of trying to get people's homes when they have financial difficulties and selling them for a profit. I have done research on the web and there are hundreds of complaints about how they refuse to allow people to make up payments, and there is currently a class action lawsuit against them in Connecticut. There is an article in a financial magazine that comments I can't believe they treat people this way. I am working with an attorney who has worked with Ocwen before and is familiar with how difficult they are to work with. A letter from you to Ocwen would help tremendously. Ocwen has a 40% foreclosure rate.

I refinanced 5 years ago through a broker, Scott McCann of Crew Mortgage, who has since lost his license for predatory lending practices. If you look on the www.dispatch.com web site for Crew Mortgage or Scott McCann, you will find 5 articles about this company. The refinancing was done in November of 1997. At that time, I had perfect credit and had no need for or way of knowing that I was being given a sub-prime mortgage. I was told my closing costs would be $1800, and they ended up being $5600. I was told that my interest rate would start at 6 5/8, and would not go higher than 8 5/8. It started at 7 5/8 and went to 11 in the first two years. I had to go through with the mortgage because I was scheduled to change jobs within days. Of course, Mr. McCann knew this.

Because my payments increased so rapidly, I fell behind on my mortgage in December of 1999. I called Ocwen Federal, the institution to which my mortgage had been sold and tried to arrange to work the arrearage out. I don't have the name of the person I talked to at that time, but I was told I had to send everything owed at once or nothing. Since I did not have enough to send the total owed, I saw no other way but to earn all of the arrearage and then to try to work things out with Ocwen. By July of 2000, I had earned enough to pay what I thought was the whole arrearage of around $10,000.

The person I talked with at Ocwen was Michael Roberts. I talked with him four times and received a different answer every time. No matter what I told him I could do, it seemed as if he purposefully made it so that I was just unable to meet his requirements. The amount owed at one point went up $3,000 in 5 days. It seemed as if he wanted my home.

I gave up trying to work things out with them and hired a lawyer to file a Chapter 13. I have been paying $1752 per month since October of 2000. I was able to make those payments for 15 months, then after missing several payments, the trustee filed to dismiss the Chapter 13 on July 26, 2002. I paid $27,000 to the Chapter 13 Trustee, and my mortgage delinquency only went down $2,000.

Suing the mortgage broker or Ocwen at this point will not save my home. I am desperately trying to find someone who can help me save my home. If I was able to pay $1,752 per month for 15 months, surely I can pay $1,000 per month on a regular mortgage, which is what I should have had.

Please help me. Losing this home will be devastating to me. You can reach me at (phone number)

Sincerely,

Sandy

Dublin, Ohio

U.S.A.

Click here to read other Rip Off Reports on OCWEN Federal Bank Financial Services

4 Updates & Rebuttals

Ryan

Zephyrhills,Florida,

U.S.A.

Here's an idea...

#2Consumer Comment

Mon, December 16, 2002

...the former customers of the now defunct ContiMortgage, who had their loans purchased by CitiFinancial (a division of CitiGroup), who in turn sold the servicing rights on the mortgage loans to Fairbanks Capital Corp. (just read any of the Rip-off Reports on Fairbanks and you'll get an idea on what kind of company Fairbanks is), as well as others who have their mortgage loans serviced by Fairbanks, have a website set up specifically for them with information, message boards, articles and resources intended to help borrowers deal with Fairbanks. They also work in conjuction with this site for borrowers to share their horror stories. Former customers of Homeside Lending (a division of Washington Mutual) also have a website like this as well. I think Ocwen borrowers would benefit from having a resource like that as well. By the way, the people that administer the Fairbanks borrowers' site are also well aware of Ocwen and how it operates.

Jon

San Diego,California,

U.S.A.

Yes! We need to find a way to combine and organize our fight!

#3Consumer Comment

Sun, December 15, 2002

Does anyone have any idea on how this can be done effectively? We must all join together and act as one! We have the law and justice on our side! We need to make this fight as personnal for them as they have made it for us. Give them a taste of their own medicine. Please post any suggestions. But remember they are always watching! Let the whole world know what evil they are doing, including their friends and family.

Project Fair Play

#40

Sun, December 15, 2002

I'm sending this to people in every state and especially those in or near Washington DC. You need to get some paper and a new printer ribbon and print off every one of these report. Then go to a copy shop and have several copies made.

Then call your local media. Most of the have a consumer help department. Tell them about how we are trying to make sure that our elected officials can't say they don't know about this company.

Then go to your state capitol, or possibly if you live near Washington, go there. Have the local media if you possibly can, TV station, local newspaper reporters, and give a copy to the State Attorney General (and if he says it isn't in his purview, remind him that the foreclosure sales take place in his state) and the Governor. Go to your state house and ask to speak to your senator and representative, or the leader of the Senate or House. Give them a copy.

Our government's only function is the protection of it's citizens, and they're not doing their job. If they try to pass you along, remind them of this. They know people who know how to stop this in it's tracks with an injunction against Ocwen until it can be investigated by the OTC and the Justice Department.

Also, by the way, it would be really great if we could have a way to communicate with each other. We have a huge battle before us.

People shouldn't have to go through this.

Jon

San Diego,California,

U.S.A.

Please keep us up-to-date regarding responses you may receive.

#5Consumer Comment

Sun, December 15, 2002

I too have written many letters, including one to the Office of the Attorney General (Bill Lockyer) in CA requesting assistance from his office. In return, I received a rather discouraging response. They said I needed to contact the "Office of the Comptroller of the Currency" as that type thing was out of their purview. Well that would be fine if I was having problem with a National Bank. But I'm not... Ocwen Federal Bank is a Federal Bank, and as such, it falls under the jurisdiction of the Office of Thrift Supervision (OTS). Better named by Mr Hanson as "Old Toothless Stinky" Oh well I guess if they are bright enough to figure that one out they wouldn't have been much help anyway.