- Report: #217934

Complaint Review: Canadianautofinder - Calgary Alberta

Canadianautofinder fraud Calgary Alberta

Federal Trade Commission

FTC, Partners Put Stop to Canadian Cross-Border Frauds

Commission Works With Toronto and Alberta Strategic Partnerships to Fight Advance-Fee Schemes

September 27 , 2005 -- The Federal Trade Commission today announced federal court action taken against two groups of Canadian-based defendants, each allegedly engaged in widespread cross-border fraud schemes. In the first complaint, FTC v. Centurion Financial Benefits , the Commission alleges the defendants placed unsolicited outbound telemarketing calls to U.S. consumers, falsely offering them pre-approved MasterCard and Visa credit cards for an advance fee of $249. The second complaint, FTC v. Pacific Liberty Benefits, alleges the defendants engaged in the same type of fraud, with the company's telemarketers promising credit cards, as well as an array of gcomplimentaryh gifts, for $319. The FTC alleges that in neither case did consumers actually receive the credit cards or other goods that they were promised, and in each U.S. consumers lost millions of dollars.

gThe Commission continues to work diligently to monitor, track, and prosecute cross-border fraud cases,h said Lydia Parnes, Director of the FTC's Bureau of Consumer Protection. gWe value the assistance of our local, state, and international law enforcement partners in bringing these important cases to help protect and inform consumers both in the United States and abroad.h

In each case, the Commission contends the defendants' conduct violated Section 5 of the FTC Act and the Telemarketing Sales Rule (TSR), as amended. Judges in the U.S. district court in Chicago, Illinois have issued temporary restraining orders barring the alleged illegal conduct and freezing the assets of defendants. In each case, Canadian law enforcement agencies also executed criminal search warrants and made arrests.

Centurion Financial Benefits

According to the first complaint, since at least 2004, the Centurion Financial Benefits defendants have used outbound telemarketing to contact consumers in the United States, falsely offering major credit cards, such as MasterCard and Visa, to people who agreed to have the defendants electronically debit their bank accounts for an advance fee of $249. The defendants typically claimed that the credit cards would have a $2,000 credit limit, zero percent interest, and no annual fees, and often targeted their offers at consumers with poor credit histories. Consumers who provided their bank account information to the defendants did not receive a major credit card, but instead were sent an application for either a gstored value cardh or gcash cardh that had no line of credit associated with it and could only be used if the consumer first loaded funds onto the card. The complaint also alleges that the defendants violated the law by calling consumers on the FTC's National Do Not Call Registry.

The Centurion matter, filed on September 21, 2005, involved a number of corporate and individual defendants. The complaint names the following individuals as defendants, both individually and as corporate officers: Sean Somma aka Sean Soma, individually and as an officer of corporate defendants Centurion Financial Benefits LLC and 1629936 Ontario Ltd, also dba Spectra Financial Benefits; Antonio Marchese aka Tony Marchese, individually and as an officer of corporate defendant 1644738 Ontario Ltd., also dba Sureway Beneficial, Simple Choice Benefits, and Oxford Financial Benefits; Tony Andreopoulos, individually and as an officer of corporate defendants American Getaway Vacations Inc., Credence Travel Processing Inc., and Topstar Media Inc., also dba Integra Financial Benefits; and Dennis Andreopoulos, individually and as an officer of corporate defendants American Getaway Vacations Inc., Credence Travel Processing Inc., and Topstar Media Inc., also dba Integra Financial Benefits.

Continue

Related Links

News Releases

2006

2005

2004

Backgrounder

Fraud Prevention Forum

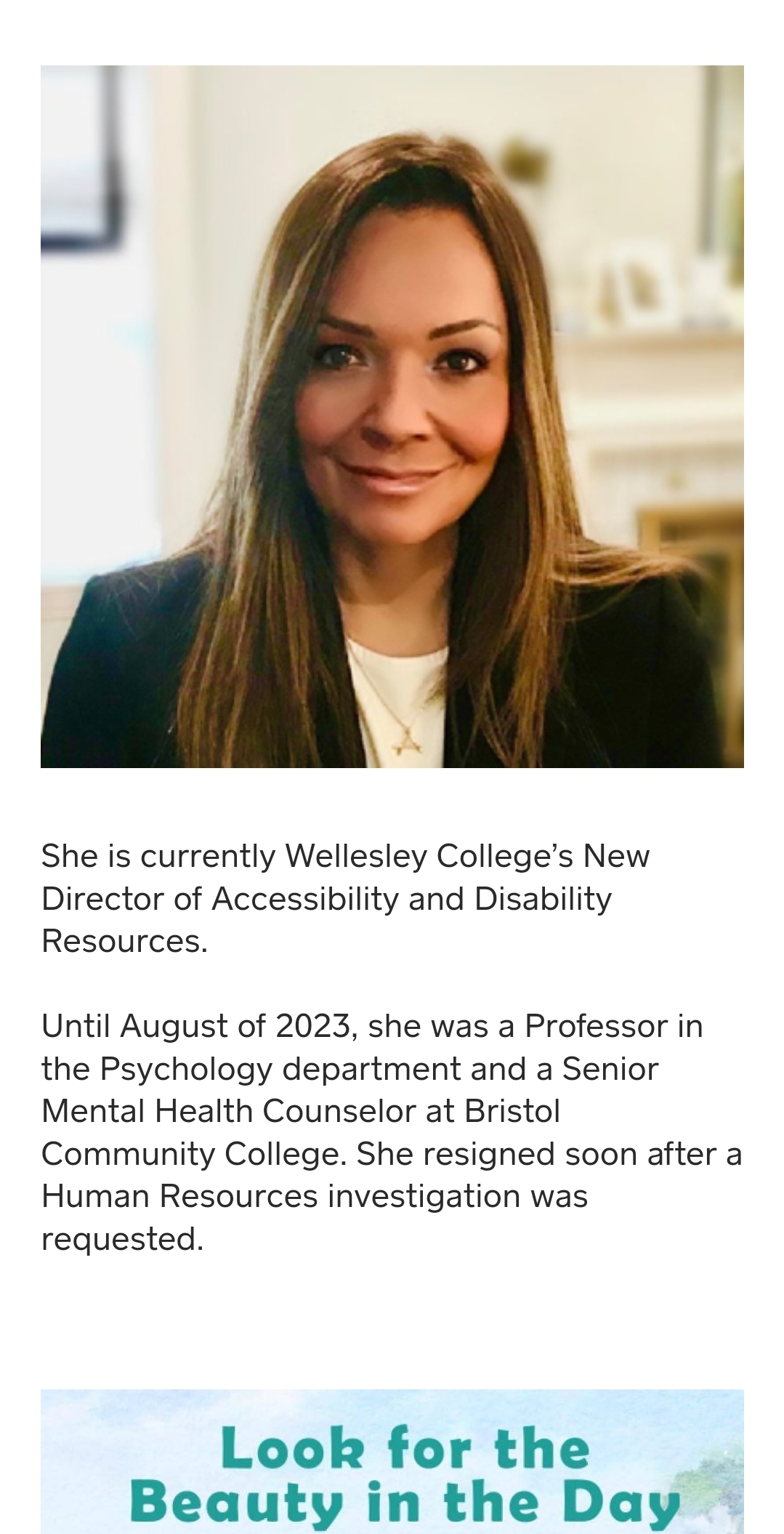

wendy

calgary, Alberta

Canada

2 Updates & Rebuttals

Gordon

Calgary,Alberta,

Canada

are you kidding

#2Author of original report

Mon, November 06, 2006

You realy do not get it tony is running yet another scam yes they do take personal information credit cards by phone all of the above what will they do with all the imformation when the company closes ? they have already changed the name several times just check out the last name they used carz4u.biz hmm it seems to go to canadian auto finder but if you call them they say they never heard of it why hide behind bad business how many people will get taken in the long run i would not even think about dealing with tis company

Dave

New Westminster,British Columbia,

Canada

Missing Link

#3Consumer Suggestion

Fri, October 27, 2006

I read with interest, wondering how you were going to tie the news article to CanadianAutoFinder.ca. I don't see the connection. They don't do telemarketing. They don't collect personal info on the web-site. Name and address, yes. SIN/SSN, Bank Acct, Visa/MC Account numbers, no. Did they do something to you?