- Report: #1370505

Complaint Review: Ocwen Loan Servicing LP - West Palm Beach Florida

Ocwen Loan Servicing, LP, Mr. Ronald M. FarisPresident and Chief Executive Officer, U. S. Bank, NA as Trustees OCWEN IGNORES COURT ORDERED, NATIONAL SETTLEMENT LAWSUIT FOR LOAN MODIFICATIONS West Palm Beach Florida

Report Attachments

Ocwen has refused to modify my loan that is predatory with a interest rate of nearly (12)%. I do not know if the balance is principal or interest. Last March of 2016 NACA sent Ocwen a loan modification for an affordable monthly payment between $500 to 600. They kept asking me for the same paperwork over and over again. Come to find out after a month or so they were talking about another co-borrower on the loan who was never involved in the loan other then the origination of loan.

The loan modification was sent over several more times but was told by Ocwen that my stepfather had to sign loan modification papers in order to get the loan modification. I informed them he had been estranged nearly (20) years. Ocwen never did anything to resolve the problem and requested I get a Quick Claim Deed removing from the loan and off of the title.

While I was in the throws of the loan modification, Ocwen attorneys Brock & Scott continued to schedule auction sales in June, August and November of 2016 on my property which shouldn’t have been allowed. Because of Ocwens negligence in not complying with the “National Settlement” lawsuit I was forced into Bankruptcy and made to pay them an unfordable monthly payment of $1,000 up to $1,600, which they have con me out of $5,000 in payments. However, use the excuse that they couldn’t do the loan modification because I was behind on the loan which would not be true since payments are being made on the loan.

A law firm did a search and found out were he lived and contacted him about the loan modification. He is elderly 81 years old and on a fixed income and can not afford any monthly payments on a small retirement income.

I went to all the trouble to get the Quick Claim Deed and to locate my stepfather for him to sign the paperwork removing him from the loan and title.

NACA sent another loan modification application to Ocwen with the "Quick Claim Deed" and they come back and say they can do the loan modification rambling something about they can't reduce my principal which is what the "National Settlement Lawsuits," the court and judge requires them to do.

These people meaning Ocwen are evil and should be ran out of business. They have harassed me ever since they took over my loan since (2011).

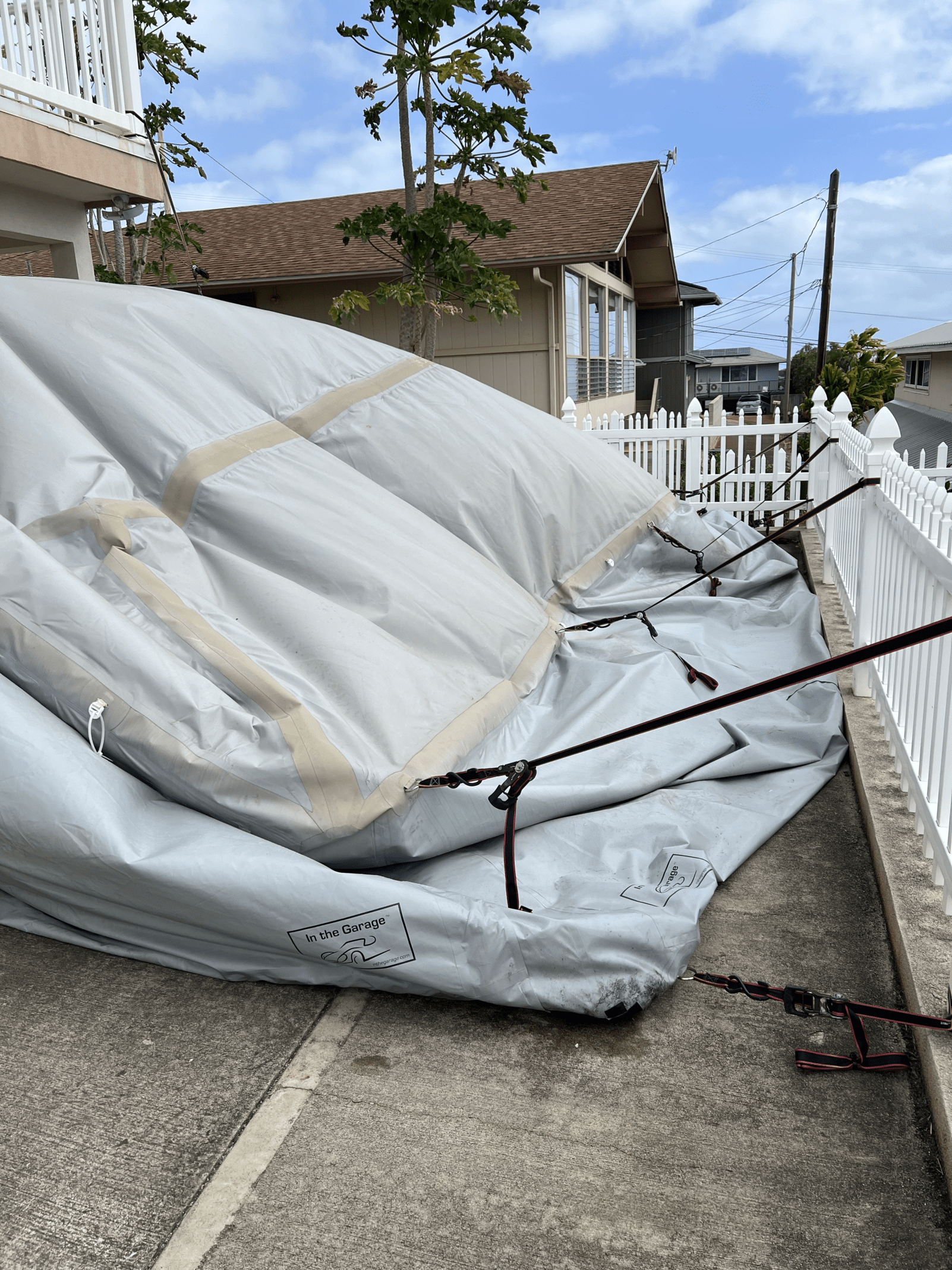

Criminally trespassing on to my property breaking locks, doors, windows and putting "Lock Boxes" on my doors. They have also cause me to loose my homeowners insurance by calling my own insurance company telling them to cancel my insurance policy and then turn around and put "Force Placed Insurance" on my property for (3) times the amount when I was only paying $800.00 with my prior insurance company before they called them.

I don't know who they are in cohorts with but they are well connected to be able to get away with all of this criminal activity.

Any of person did these unlawful acts would be put in jail or made to pay a fine. I blame the lawmakers for their behavior and the attorneys who refused to file cases against them and want homeowners io pay exuberant fees to them to bring legal actions.

Ocwen has refused to modify my loan that is predatory with a interest rate of nearly (12)%. I do not know if the balance is principal or interest. Last March of 2016 NACA sent Ocwen a loan modification for an affordable monthly payment between $500 to 600. They kept asking me for the same paperwork over and over again. Come to find out after a month or so they were talking about another co-borrower on the loan who was never involved in the loan other then the origination of loan.

The loan modification was sent over several more times but was told by Ocwen that my stepfather had to sign loan modification papers in order to get the loan modification. I informed them he had been estranged nearly (20) years. Ocwen never did anything to resolve the problem and requested I get a Quick Claim Deed removing from the loan and off of the title.

While I was in the throws of the loan modification, Ocwen attorneys Brock & Scott continued to schedule auction sales in June, August and November of 2016 on my property which shouldn’t have been allowed. Because of Ocwens negligence in not complying with the “National Settlement” lawsuit I was forced into Bankruptcy and made to pay them an unfordable monthly payment of $1,000 up to $1,600, which they have con me out of $5,000 in payments. However, use the excuse that they couldn’t do the loan modification because I was behind on the loan which would not be true since payments are being made on the loan.

A law firm did a search and found out were he lived and contacted him about the loan modification. He is elderly 81 years old and on a fixed income and can not afford any monthly payments on a small retirement income.

I went to all the trouble to get the Quick Claim Deed and to locate my stepfather for him to sign the paperwork removing him from the loan and title.

NACA sent another loan modification application to Ocwen with the "Quick Claim Deed" and they come back and say they can do the loan modification rambling something about they can't reduce my principal which is what the "National Settlement Lawsuits," the court and judge requires them to do.

These people meaning Ocwen are evil and should be ran out of business. They have harassed me ever since they took over my loan since (2011).

Criminally trespassing on to my property breaking locks, doors, windows and putting "Lock Boxes" on my doors. They have also cause me to loose my homeowners insurance by calling my own insurance company telling them to cancel my insurance policy and then turn around and put "Force Placed Insurance" on my property for (3) times the amount when I was only paying $800.00 with my prior insurance company before they called them.

I don't know who they are in cohorts with but they are well connected to be able to get away with all of this criminal activity. Any of person did these unlawful acts would be put in jail or made to pay a fine.

I blame the lawmakers for their behavior and the attorneys who refused to file cases against them and want homeowners to pay exuberant upfront legal fees to them to bring legal actions.

Report Attachments

2 Updates & Rebuttals

Liz

Halethorpe,To Ocwen or its attorneys. Why are you Confused... AUTHOR: Robert - (USA) SUBMITTED: Tuesday, May 02, 2017

#2REBUTTAL Individual responds

Fri, January 11, 2019

Let me first start off by saying that this company has a reputation for making it very difficult for Loan Modifications, so I am not saying that you are or are entitled to one. However, you have rasied some items that are very confusing that perhaps you could clarify.

Why is this(or any) company responsible for your family "issues"? Your Step Father was on the original loan and deed, and you can't just remove him because you haven't talked to him in years. It is also not their responsibility to get him off of the deed so you can move forward...they are a mortgage company not Dr. Phil.

ANSWER:

I DON'T KNOW WHO YOU ARE SINCE YOU DID NOT IDENTIFY YOURSELF. FURTHERMORE, I DON'T KNOW WHERE YOU ARE GETTING YOUR MISGUIDED INFORMATION FROM.

FACT: NO ONE ASK OCWEN TO BE DR. PHIL ONLY TO DO WHAT THE NATIONAL SETTLEMENT AND U. S. DISTRICT COURT JUDGE ORDERED THEM TO DO AND 49 STATES ATTORNEY GENERALS AS WELL WAS TO ASSIST HOMEOWNERS WHO REQUESTED MODIFICATION OF ANY PREDATORY TERMS OF THEIR LOAN.

FACT. MY STEP DAD WAS NOT ON THE ORGINAL DEED AND WAS PUT ON BY THE UNSCROUPOLOUS INDIVIDUALS WHO DREW UP THE FRAUDULENT DOCUMENTS AND THEN RECORDED THEM WITHOUT MY PERMISSION.

FACT: NO ONE WANTS TO DRIVE 600 MILES AND THEN FIND OUT THAT AFTER THEY'VE DONE ALL THAT AND THEN LEARNED THE LOAN MODIFICATION WOULD STILL BE TURNED DOWN BY OCWEN WHO STATED IN ORDER TO GET THE LOAN MOD DONE. I NEEDED TO GET THE QUICK CLAIM DEED ASAP. SINCE YOU ARE SO FLIPENT ABOUT IT. LET'S SEE HOW YOU WOULD FEEL IF SOMEONE DID THIS TO YOU.

Next, why would they be harrassing you since they took over the mortgage in 2011? Were you paying on-time and were you paying the full amount? Or was this "harrassment" due to the fact that you wanted them to make exceptions right from the beginning?

AS I STATED THERE WERE NUMEROUS OF PHONE CALLS BY ALTISOURCE, WHO IS ONE OF OCWENS AGENTS THAT UNLAWFUL TRESPASSED AND POSSESSION ATTEMPTS PUTTING LOCK BOXES ON MY HOME THAT CAUSED ME EMOTIONAL AND MEDICAL ISSUES LOCKING ME OUT MY HOME, BREAKING WINDOWS AND REMOVING DOORS OFF OF MY HOME.

SINCE I DO NOT KNOW WHO YOU ARE AND SURMISE THAT YOU ARE NOT A HOMEOWNER. THE PAYMENT DISPUTE WAS OVER AND STILL OVER A $85,000 UNDISCLOSED AND UNAUTHORIZED BALLOON RIDER THAT I HAS RECENTLY LEARNED IS FORGED.

You said that the interest rate is "Preditory". They can NOT change the terms of the Mortgage so if the loan was sold to them, how are they responsible for the rate? That would have been a rate you agreed to when you originally got the loan. Now, if this is was an Adjustable Rate loan it of course could have adjusted up after they took over the loan, but they did it because that is what YOU agreed to when you got the loan.

ANSWER:

THAT'S WHY OCWEN AND OTHER BANKS WHERE SUED BY STATE AND FEDERAL ENFORCEMENT AGENCIES BECAUSE THEY WERE FAILING TO ASSIST CUSTOMERS IN MODIFYING THE TERMS OF THEIR LOANS AND INSTEAD WERE WRONGFULLY FORECLOSING ON HOMES. THE LAWSUITS WERE BROUGHT SO THAT THESE FINANCIAL INSTITUTIONS WOULD ASSIST BORROWERS. HOWEVER, THEY HAVE AND STILL ARE FAILING TO ASSIST HOMEOWNERS AND ARE CONTINUING FORECLOSURE ACTIONS.

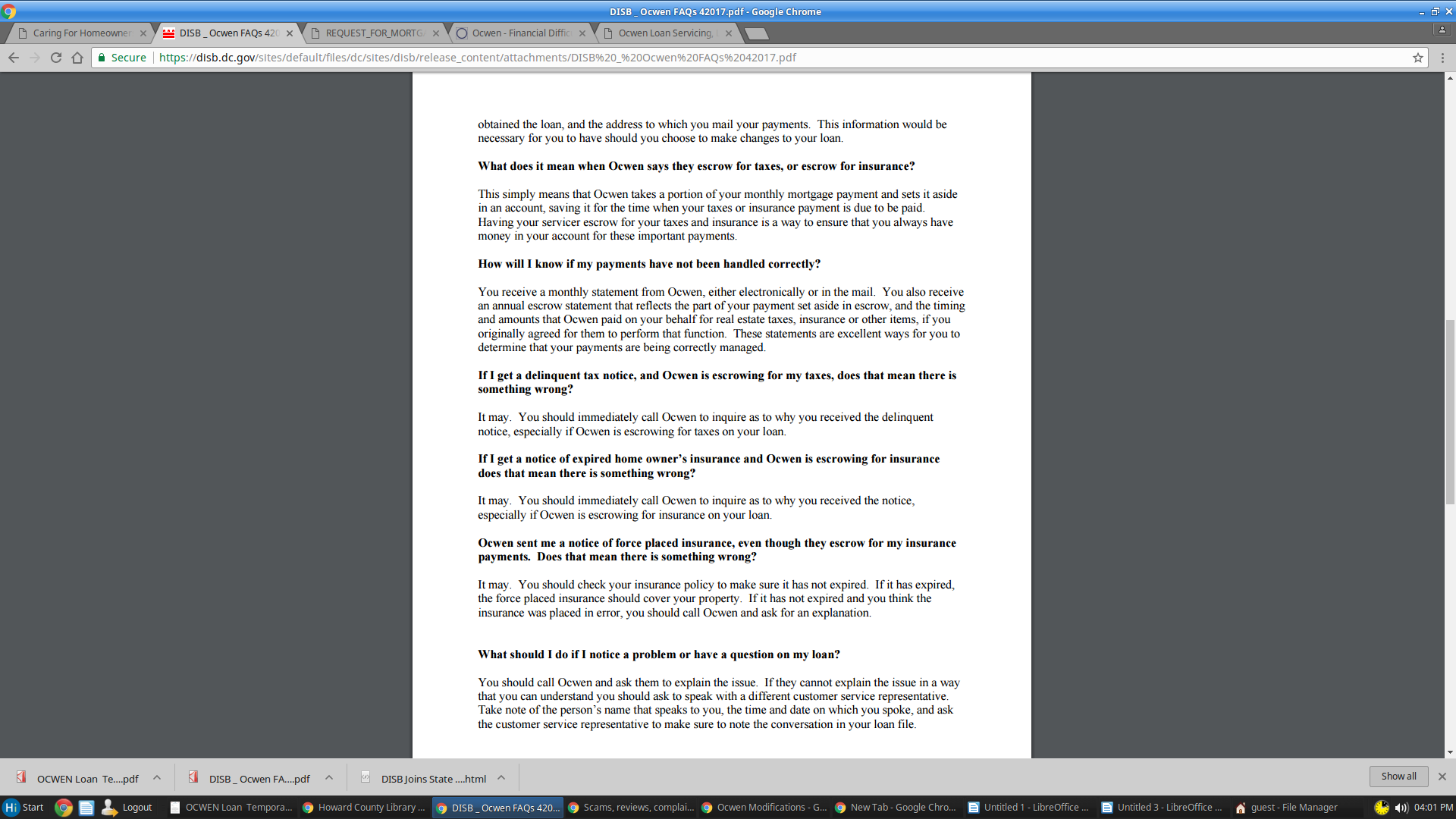

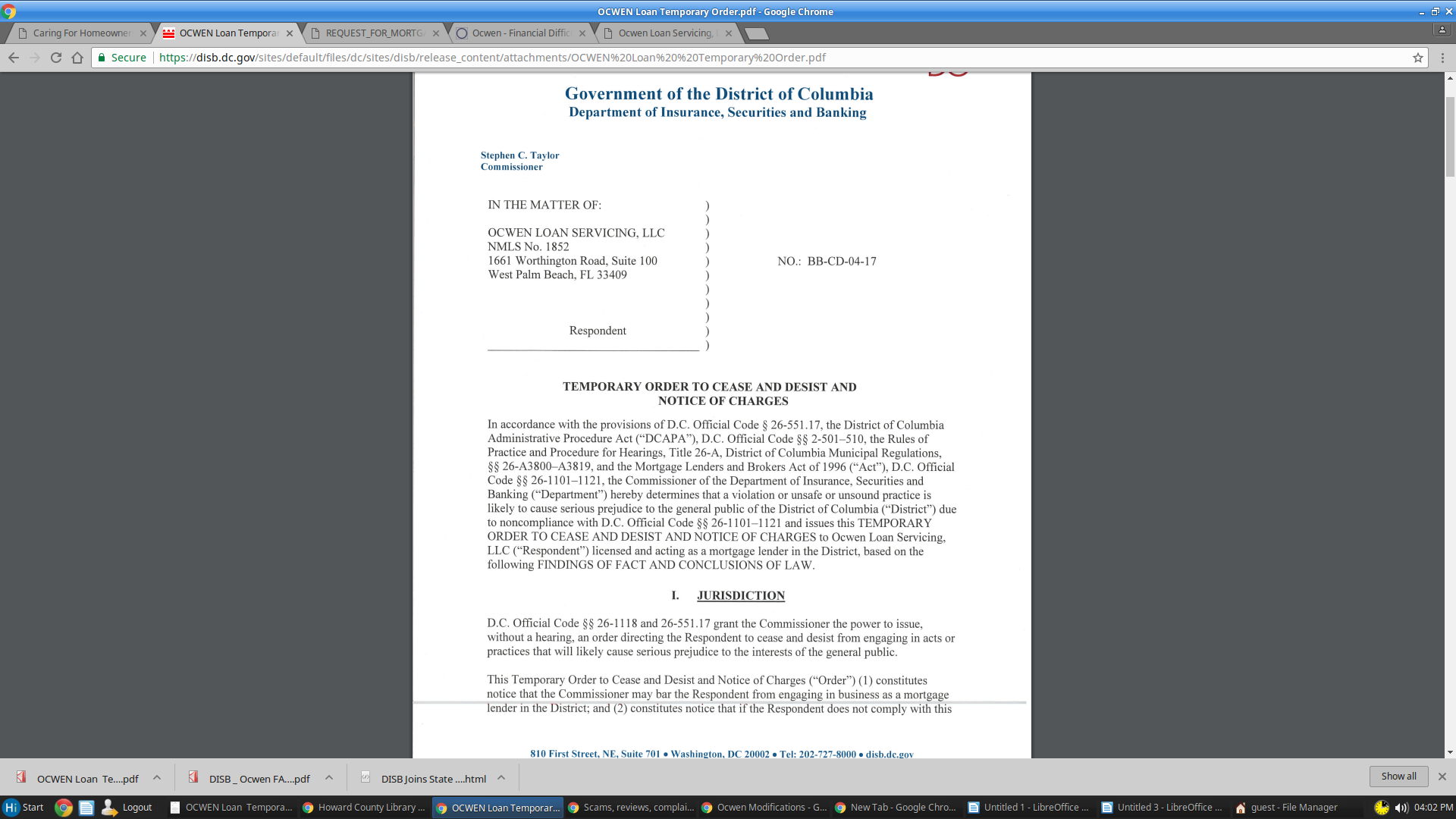

If there was a "National Settlement" they were REQUIRED to abide by, why did you not bring this up in your Bankruptcy proceedings? Not only that if you are trying to use the documents you posted as some sort of proof, those were documents with orders issued for residents of the District of Columbia ONLY and it was issued on April 20th of 2017 which would most likely have been after your Bankruptcy.

ANSWER:

YOU ARE CONFUSED. THOSE DOCUMENTS I LISTED WHERE LEGAL ACTIONS BROUGHT AGAINST OCWEN/U. S. BANK FROM THE (OCC) OFFICE OF COMPTROLLER OF THE TREASURY WHO IS A FEDERAL AGENCY LOCATED IN WASHINGTON, D.C. FOR FILING WRONGFUL AND BOGUS PROOF OF CLAIMS IN BANKRUPTCY COURT AND MONEY LAUNDERING. ANY CITIZEN CAN USE THEM. AS THEY ARE A PUBLIC RESOURCE. REGARDING BANKRUPTCY MATTERS CONCERNING THE LEGAL ACTIONS BROUGHT BY THE OCC. IT WAS DURING THE BANKRUPTCY PROCEEDING AND WAS PUT IN WRITING.

CONCLUSION: THE RIP OFF REPORT IS FOR INDIVIDUALS WITH LEGITIMATE CONSUMER CONCERNS WHO NEED THEIR ISSUES RESOLVED BY EITHER THE COMPANY WHO THEY ARE HAVING THE ISSUE WITH OR ANY OTHER INDIVIDUALS WHO WANT TO BRING CONSTRUCTIVE DIALOUG AND A SOLUTION OR REMEDY TO THEIR PROBLEM. IF YOU CAN NOT DO THAT. YOU SHOULD STAY OFF OF RIP OFF REPORT AND REFRAME FROM FURTHER HARASSMENT OF CONSUMERS WHO NEED HELP AND SUPPORT AND NOT CRITICISM FROM AN "UNIDENTIFIED INDIVIDUAL" THAT MISSTATES FACTS AND MAKES UNFOUNDED JUDGEMENT CALLS AND/OR WRONGFUL COMMENTS.

Robert

Irvine,California,

USA

Confused...

#3Consumer Comment

Tue, May 02, 2017

Let me first start off by saying that this company has a reputation for making it very difficult for Loan Modifications, so I am not saying that you are or are entitled to one. However, you have rasied some items that are very confusing that perhaps you could clarify.

Why is this(or any) company responsible for your family "issues"? Your Step Father was on the original loan and deed, and you can't just remove him because you haven't talked to him in years. It is also not their responsibility to get him off of the deed so you can move forward...they are a mortgage company not Dr. Phil.

Next, why would they be harrassing you since they took over the mortgage in 2011? Were you paying on-time and were you paying the full amount? Or was this "harrassment" due to the fact that you wanted them to make exceptions right from the beginning?

You said that the interest rate is "Preditory". They can NOT change the terms of the Mortgage so if the loan was sold to them, how are they responsible for the rate? That would have been a rate you agreed to when you originally got the loan. Now, if this is was an Adjustable Rate loan it of course could have adjusted up after they took over the loan, but they did it because that is what YOU agreed to when you got the loan.

If there was a "National Settlement" they were REQUIRED to abide by, why did you not bring this up in your Bankruptcy proceedings? Not only that if you are trying to use the documents you posted as some sort of proof, those were documents with orders issued for residents of the District of Columbia ONLY and it was issued on April 20th of 2017 which would most likely have been after your Bankruptcy.