- Report: #711537

Complaint Review: Home Depot Credit Services - Sioux Falls South Dakota

Home Depot Credit Services Beware of Home Depot Credit card, they will make damage to your credit score even you are paying Sioux Falls, South Dakota

*Consumer Comment: Really?

*Author of original report: You don't know what you tolking about.

*Consumer Comment: Sorry...

*Consumer Comment: A few things

*Author of original report: Credit report form True Credit

*Author of original report: You rigth

*Consumer Comment: So

*General Comment: Wow.

*Consumer Comment: Blame yourself Jiri

*Consumer Suggestion: Suggestion

*Consumer Comment: Hmmm...

*Consumer Comment: Anytime your behind on your payments

I called to customer services and they told me they know, this thing make me damage on my credit score. So they doing this with purpose. Beware of them, don't take any credit cards from them. I got second card from Capital one and they always understand our problems and they give us time to figure out.

12 Updates & Rebuttals

Ken

Greeley,Colorado,

USA

Anytime your behind on your payments

#2Consumer Comment

Sun, September 18, 2011

with ANY credit card, it WILL affect your credit report. Don't worry, Capitol One will catch up sooner or later. Sorry for your troubles, but it's not your creditor's fault.

Seriously

Jacksonville,Florida,

United States of America

Hmmm...

#3Consumer Comment

Sun, September 18, 2011

So let us all understand you complaint. You are having trouble paying your debt not only to citibank but to your other creditors, and you are upset because they allow you to continue charging and making your debt larger. Seriously, if the bank lowered your credit line to prevent you from charging more, chances are good that your credit is already in the toilet. And by "chances are good" I mean definitely.

concerned

Colton,South Dakota,

USA

Suggestion

#4Consumer Suggestion

Tue, April 12, 2011

I'm sorry to hear you have had a hard time with Home Depot Credit Services. What I would suggest to you is to pay the card off because as in another post, I agree that your limit will be lowered as you pay it off because of the late payments. It sounds to me as you have a good credit score so save yourself some more grief and pay the card off & close it at your request so it shows on your credit bureau as closed by consumer instead of closed by grantor. Maybe you could transfer the balance to your new Capitol One Card! Good Luck!

coast

USABlame yourself Jiri

#5Consumer Comment

Thu, March 31, 2011

I got second card from Capital one and they always understand our problems and they give us time to figure out.

This statement indicates you have developed a pattern of late payments. Your late payments resulted in the reduction of your credit score. Not a rip off.

Christiana

Cincinnati,Ohio,

U.S.A.

Wow.

#6General Comment

Thu, March 31, 2011

My English is not good, I see you are out of arguments. On Iraq and Eastern Europe I have no problems with any true American just with commie.------------------WTH?

Susan

This City,Illinois,

USA

So

#7Consumer Comment

Thu, March 31, 2011

So your complaint is that your credit limit was lowered to what you owe?

Welcome to the real world. Your credit limit was lowered and your intrest rate raised just like everyone else.

The only part that would hurt your credit rating is debt to income ratio. Your credit score went down because you owe money and don't have income.

Jiri

Key West,Florida,

United States of America

You rigth

#8Author of original report

Wed, March 30, 2011

My English is not good, I see you are out of arguments. On Iraq and Eastern Europe I have no problems with any true American just with commie.

Jiri

Key West,Florida,

United States of America

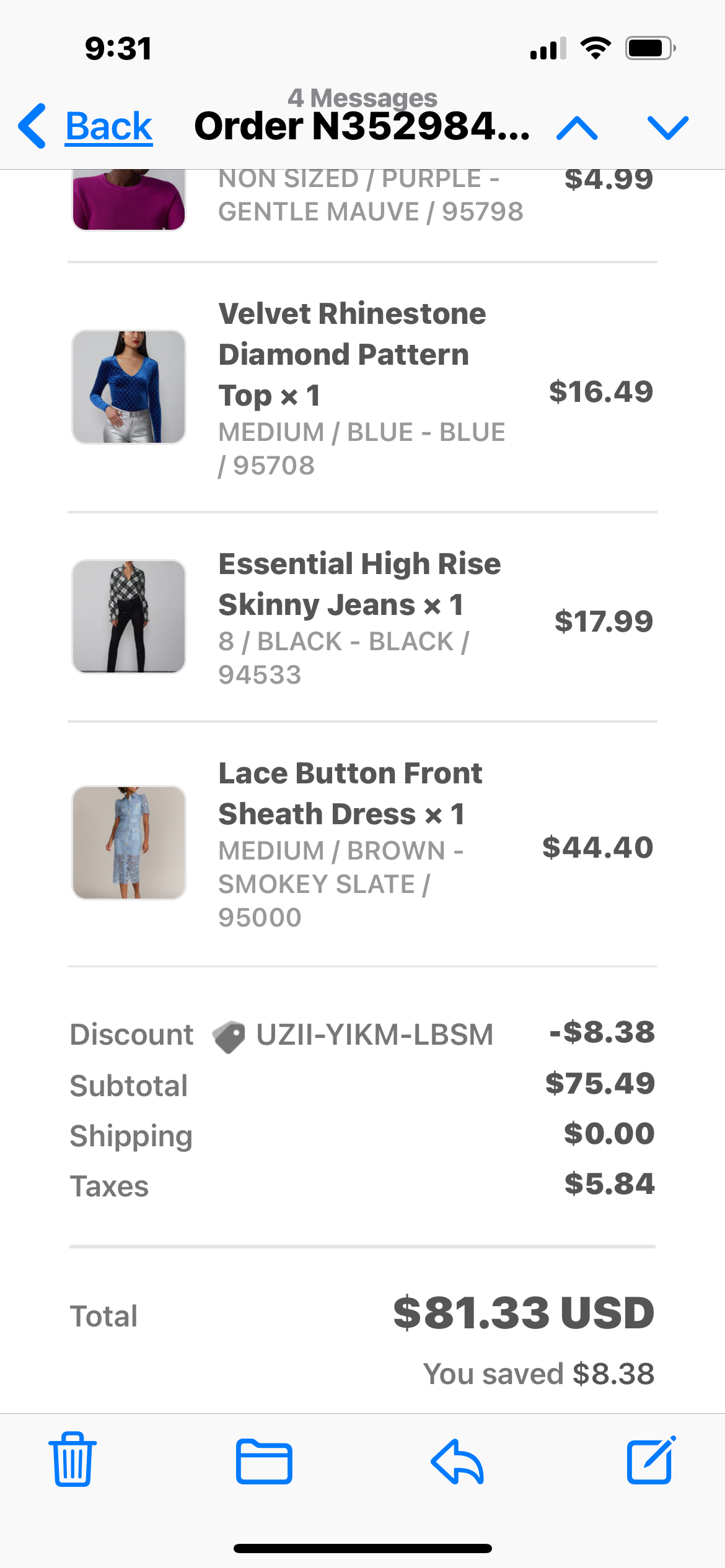

Credit report form True Credit

#9Author of original report

Wed, March 30, 2011

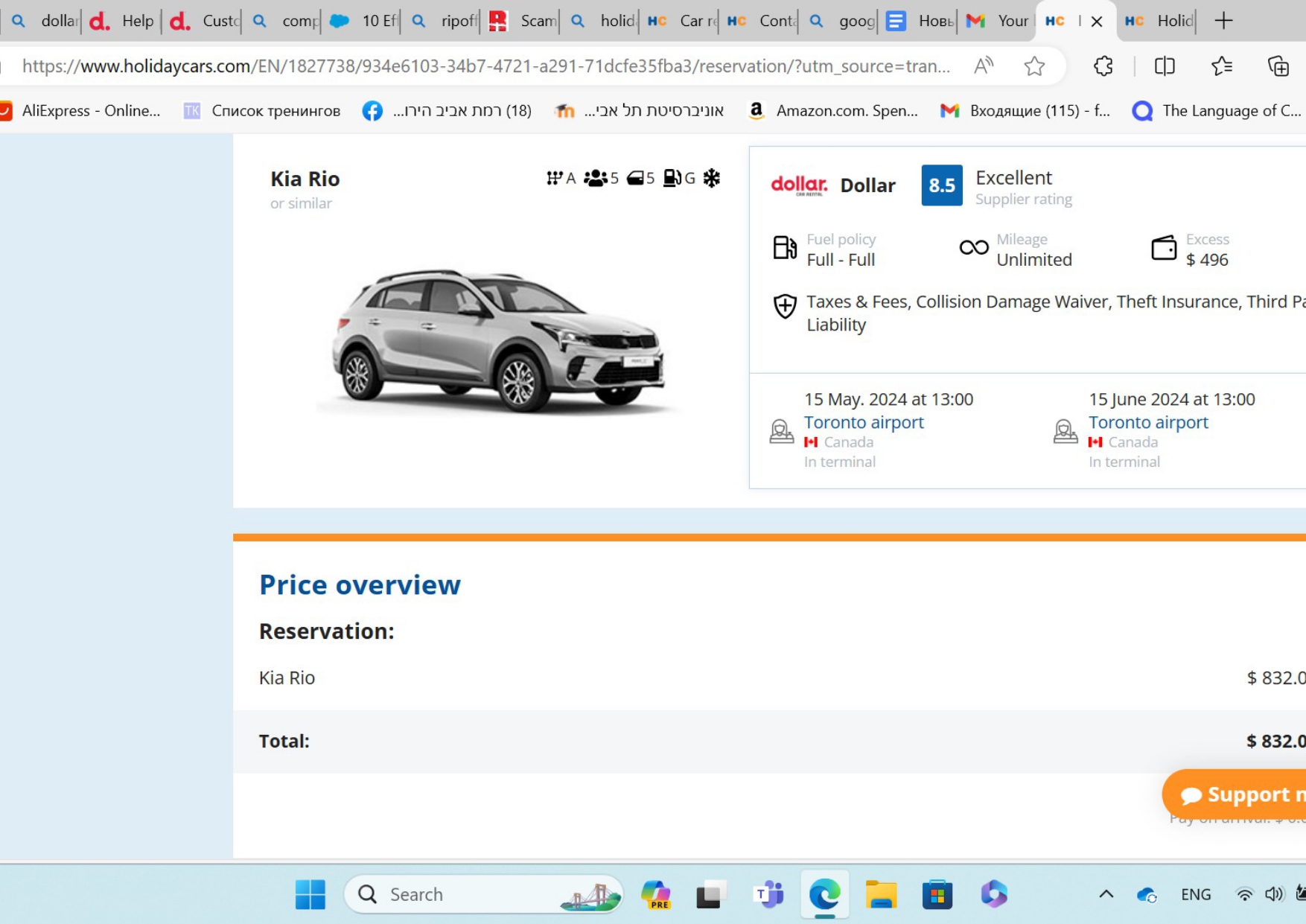

I was never late then a week. What happen look at this:

" Ratio of balances to credit limit too high."

I did double check on my True Credit, my credit score is down when Home Depot put my Credit limit down to balance. Before this happen I had 710 score after I have 680. I have no other problems at my credit report with nobody. If you got credit limit $3,000.- and your balance is $2,000.- your credit score is much better if you paying every month , what I did, them if you got credit limit same like your balance.

tigersy2k3

United States of AmericaA few things

#10Consumer Comment

Wed, March 30, 2011

Working in the credit industry I find that many people dont fully grasp how their credit works and how creditors report. Creditors such as Citibank and anyone else are responsible and liable to report to the credit agencies (Experian, TransUnion, and Equifax) if you are delinquent on a payment, this means your payment is 30+ days past the due date. A payment is considered the minimum balance due, not a partial payment. These marks against your credit effect your FICA credit score more then anything else.

Several factors go into your credit score, one of which being your ratio of available credit. Meaning if you have $10,000 credit limit on all your credit cards combined, how much available credit do you have. The only way them lowering your credit limit would have any kind of effect on your score is if you have no other form of open line of credit. So they would have essientially made it to where you have 0% avalible credit (as your balance and credit limit are the same). This is within any creditors right to do.

Now, it sounds like you were having trouble making minimum payments when you lost your job. If during this time you didnt make your minimum payment then within 30 days of the due date then it would have reported to your credit report as a late payment and lowered your credit score. The last two payment you made (above minimum) may not have reflected yet on your credit score as it usually takes 30-60 days for these to update depending on several factors.

This is not Citibank or Home Depots fault and this is a bad ripoff report. This sounds like you just got behind and upset that Citibank did their responsibility of reporting you even if you were in a hardship, just like any other company would do if you didnt work out a payment plan with them before falling behind. If you never were 30-days past due you can dispute their bad credit marks.

However, if this is soley due to them lowering your credit limit, then there is nothing you can do, it sounds like they had just cause as you were paying them late and you must not have much credit history (as stated above, that would be the only way lowering your credit limit on a small credit card would effect your credit score)

Robert

Irvine,California,

U.S.A.

Sorry...

#11Consumer Comment

Wed, March 30, 2011

...I don't speak jibberish.

I paid them 3 times more like was minimum payment what they ask for last two months.

- What the heck does that mean?

Based on your posts so far it does not appear that English is your primary language. So any continued explanation of how Credit Cards work would obviously go right over your head.

Jiri

Key West,Florida,

United States of America

You don't know what you tolking about.

#12Author of original report

Wed, March 30, 2011

I spoke with them and they have no reason for what they did to me. I paid them 3 times more like was minimum payment what they ask for last two months. Now they damaged my credit score. Did you you read about creditors like Citybank. Nothing nice. Maybe you working for them.

Robert

Irvine,California,

U.S.A.

Really?

#13Consumer Comment

Tue, March 29, 2011

Your right Home Depot has a personal vendetta against you. In fact they were probably the ones who caused you to loose your job. Because they knew you would become delinquent, then they could use that as an excuse to cut your credit line for the sole purpose to lower your credit score. After all they have nothing better to do, right?

Here are some things to think about. First of all the creditor determines your credit limit. There is no law or regulation that states they must keep you at a certain credit limit. If they feel that you are a higher risk, and your payment history shows that, they have every right to lower your limit or even close the account. In fact what they did is often an indication that they plan to close your account anyways, so as you pay down the balance your credit limit will continue lower as well. Once it is paid off they will then close it.

As to your payment history. There is NOTHING in your agreement that states as long as you pay "something" you are okay. What you will find is that unless you pay the Minimum payment you are delinquent. There is nothing in your agreement that says you don't have to make your minimum payments if you run into problems.

My guess is that it is the delinquent payments showing up on your credit report that is causing you more of the problems than the reduction in your credit limit.