- Report: #655889

Complaint Review: Shaikh Nasser Al-Rashid NAR Foundation - Riyadh Internet

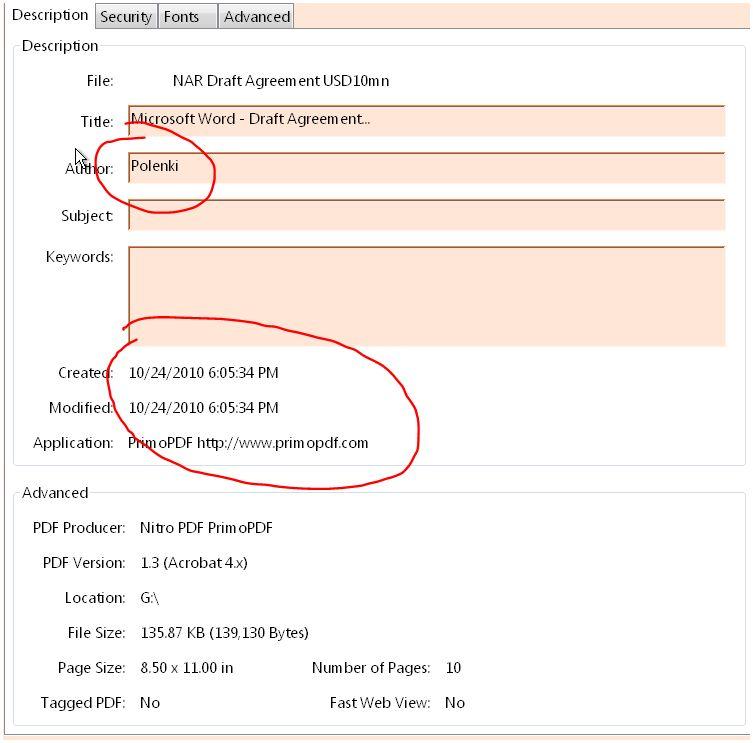

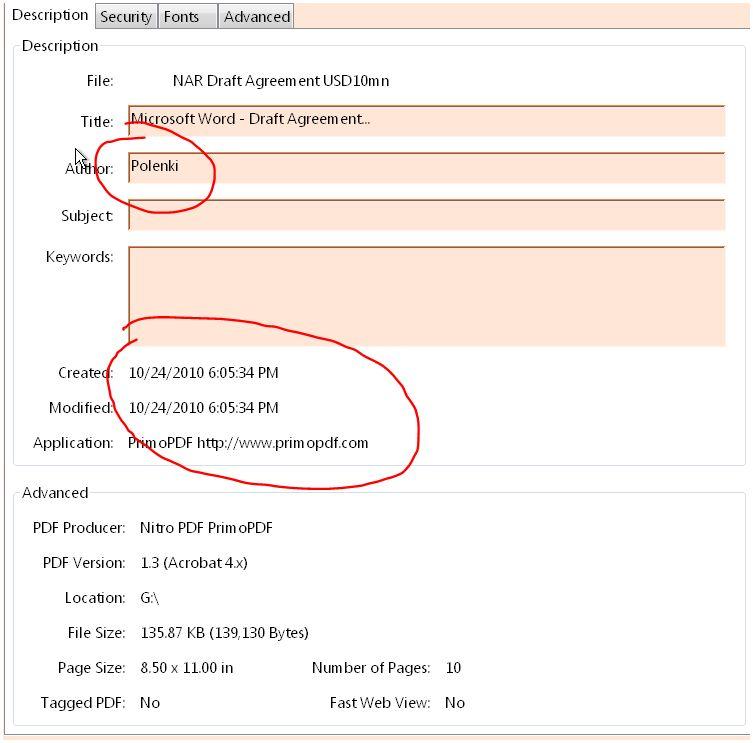

Shaikh Nasser Al-Rashid, NAR Foundation NAR Foundation English speaking Saud's, claimed billionaires' Former Finance Aid to Royal Saudi Kingdom, Offered USD10mn to USD10BN, minimal fee USD12,800 via Kelvin Anene, Transaction in Dubai, under UK Law. Riyadh, Internet

Report Attachments

An English speaking Saud's, claimed billionaires' with all profile stated in LinkedIn, based on Wikipedia stories, claimed as public figure (Former Finance Aid to Royal Saudi Kingdom?), Offered USD10mn to USD10BN, but minimal fee USD12,800 via Kelvin Anene, Transaction in Dubai, under UK Law. All I did was, prepare a jet for me to meet him in person, which then he refused.

Below is the sample agreement.

----------

LOAN AGREEMENT

Borrower:

X

AND

Lender:

Syaikh Nasser Al-Rashid

Alrashid Group/NAR Foundation

Alrashid Compound, Khurais Road,

P.o Box 6132, Riyadh 11442,

Kingdom of Saudi Arabia.

This LOAN AGREEMENT is effective as of the Effective Date, as that term is defined in Section 2 below, by and between X (hereinafter referred to as the Borrower), and Syaikh Nasser Al-Rashid, of Alrashid Group/Nar Foundation (hereinafter referred to as the Lender), is

made and executed on the following recitals, terms and conditions.

WHEREAS, Borrower submitted a letter of intent to the Lender requesting funding of the sum $10Million USD from the Lender; and WHEREAS, Lender considered Borrowers Application and the Lender agreed to approve funding in the amount of $10Million USD; and

WHEREAS, All such loans and financial accommodations, together with all future loans and financial accommodations from Lender to Borrower, are referred to in this Agreement individually as the Loan and collectively as the Loans; and

WHEREAS, Borrower understands and agrees that: (a) in granting, renewing, or extending any Loan, Lender is relying upon Borrowers representations, warranties, and agreements, as set forth and provided for in this Agreement; (b) the granting, renewing, or extending of any Loan by Lender at all times shall be subject to Lenders sole judgment and discretion; and (c) all such Loans shall be and shall

remain subject to the terms and conditions as set forth in this Agreement.

NOW, THEREFORE, for and in consideration of the agreements contained herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Lender and the Borrower agree as follows:

SECTION 1. FINDINGS INCORPORATED.

The foregoing recitals are hereby incorporated into the body of this Agreement and shall be considered part of the mutual covenants, consideration and promises that bind the parties.

SECTION 2. FUNDING TERM.

This Agreement shall be effective upon the signing by the parties and confirmation of receipt of loan amount by the Borrower (the Effective Date) and shall continue thereafter until all obligations of Borrower to Lender have been performed in full and the parties terminate this Agreement in writing, or at the end of the 8 (Eight) years term, unless terminated sooner under the provisions hereof.

The Lender agrees to provide for amount of US$ 10 million to the borrower in two increments. The Lender agrees to provide an initial $6 million USD to Borrower followed by a second payment of US$ 4 million to be paid at the conclusion of the Phase I studies.

SECTION 3. DEFINITIONS.

The following words shall have the following meanings when used in this Agreement.

(a) Agreement. The word Agreement means this Loan Agreement, together with all exhibits and schedules attached to this Loan Agreement from time to time, if any.

(b) Event of Default. The words Event of Default mean and include any of the Events of Default set forth below in the section entitled Events of Default.

(c) Indebtedness. The word Indebtedness means and includes without limitation all Loans, together with all other obligations, debts and liabilities of Borrower to Lender, or any one or more of them, as well as all claims by Lender against Borrower, or any one or more of them;

whether now or hereafter existing, voluntary or involuntary, due or not due, absolute or contingent, liquidated or unliquidated; whether Borrower may be liable corporately or jointly with others; whether Borrower may be obligated as a guarantor, surety, or otherwise; whether

recovery upon such Indebtedness may be or hereafter may become otherwise unenforceable.

(d) Lender. The word Lender means of Syaikh Nasser Al-Rashid, its successors and assigns, and whose address for the purposes of this Agreement is Al-Rashid Compound

Khurais Road, P. O. Box 6132, Riyadh 11442, Kingdom of Saudi Arabia with liaison

office in Dubai UAE.

(e) Loan. The word Loan or Loans means and includes any and all loans and financial accommodations from Lender to Borrower, whether now or hereafter existing, and however evidenced, including without limitation those loans and financial accommodations described in

this Agreement and described on any exhibit or schedule attached to this Agreement.

PAGE 2 of 7

(f) Qualified Expenditures. The words Qualified Expenditures mean those expenditures made by the Borrower as stated as purpose of loan.

(g) Related Documents. The words Related Documents mean and include without limitation all promissory notes, loan agreements, and all other instruments and documents, whether now or hereafter existing, executed in connection with Borrowers Indebtedness to Lender.

SECTION 4. AFFIRMATIVE COVENANTS.

Borrower covenants and agrees with Lender that, while this Agreement is in effect,

it shall comply with the following terms and conditions:

(a) Reimbursement.

The Borrower will provide an Interest of 4% simple interest per annum will be paid yearly to the Lender on the Loan, upon the clearance clinical trials from necessary administrative authorities . Interest payments will begin to accrue then, and be payable or settled at maturity.

amount to Borrower for a period 6 years. This interest will be paid to the lender annually.

(b) Compliance Letters. Borrower shall provide the Lender with copies of invoices and/or receipts for the expenditures authorized and required by Section 4(a) above. Borrower shall provide Lender with compliance letters upon making the expenditures authorized

by Section 4(a), such letters to be attached to the submitted invoices or receipts required by this subsection. In the compliance letter, Borrower shall represent and warrant that the expenditures were made in compliance with this Agreement by and between

Borrower and Lender and towards the Qualified Expenditures.

(c) Additional Assurances. . The Borrower agrees to repay both the principal and accrued interest on the earlier of a significant transaction such as a licensing agreement or the sale of the company being completed or the sixth anniversary of the Loan Agreement. The repayment can be made either in cash or in equity, as valued at the time of the conversion, at the discretion of the borrower.

(d) Performance. Borrower agrees to perform and comply with all terms, conditions, and provisions set forth in this Agreement and in all other instruments and agreements between Borrower and Lender.

SECTION 5. CESSATION OF ADVANCES OR DISBURSEMENTS.

If Lender has made any commitment to make any Loan to Borrower, whether under this Agreement or under any other agreement, Lender shall have no obligation to advance or disburse

PAGE 3 of 7

Loan proceeds if: (i) Borrower becomes insolvent, files a petition in bankruptcy or similar proceedings, or is adjudged bankrupt; or (ii) an Event of Default occurs.

SECTION 6. LOAN FORGIVENESS.

Notwithstanding the provisions hereof and the obligations contained in the Note executed incident hereto, any advance or disbursement hereunder shall be forgiven at the lenders sole discretion and not be payable to Lender upon verification of costs for

Qualified Expenditures equaling the amount of the advance or disbursement, and completion of affirmative covenants provided in Section 4 of this Agreement. However, any advance or disbursement, not previously forgiven under the foregoing, shall not be forgiven

in an Event of Default under Section 7 and Section 8 herein, and shall become immediately due and payable in accordance with this Agreement and the Note.

SECTION 7. EVENTS OF DEFAULT.

Each of the following shall constitute an Event of Default under this Agreement:

(a) Reimbursements. Failure of Borrower to work in accordance with the provisions of

the Application shall be an event of default.

(b) False Statements. Any warranty, representation, or statement made or furnished to Lender

by or on behalf of Borrower under this Agreement or the Related Documents that is false or misleading in any material respect, either now or at the time made or furnished.

(c) Insolvency. Borrowers insolvency, appointment of receiver for any part of

Borrowers property, any assignment for the benefit of creditors of Borrower, any type of creditor workout for Borrower, or the commencement of any proceeding under any bankruptcy or insolvency laws by or against Borrower.

(d) Other Defaults. Failure of Borrower to comply with or to perform any other term, obligation, covenant or condition contained in this Agreement or in any of the Related Documents, or failure of Borrower to comply with or to perform any other term, obligation,

covenant or condition contained in any other agreement between Lender and Borrower.

SECTION 8. EFFECT OF AN EVENT OF DEFAULT.

If any Event of Default shall occur, all commitments of Lender under this Agreement immediately will terminate, (including any obligation to make Loan advances), and the remaining outstanding balance of the Loan will become immediately due and payable, at the option of Lender,

all without notice of any kind to Borrower, except for an Event of Default described in the

PAGE 4 of 7

Insolvency subsection above, in which case such acceleration shall be automatic and not optional.

SECTION 9. INDEMNIFICATION.

Borrower shall indemnify, save, and hold harmless Lender, its directors, officers, agents, attorneys, and employees (collectively, the Indemnities) from and against: (i) any and all claims, demands, actions or causes of action that are asserted against any Indemnitee if the

claim, demand, action or cause of action directly or indirectly relates to tortuous interference with contract or business interference, or wrongful or negligent use of Lenders loan advances by Borrower or its agents and employees; (ii) any administrative or investigative proceeding by any governmental authority directly or indirectly related, to a claim, demand, action or cause of action in which Lender is a disinterested party; (iii) any claim, demand, action or cause of action which directly or indirectly contests or challenges the legal authority of Lender or Borrower to enter into this Agreement; and (iv) any and all liabilities, losses, costs, or expenses (including reasonable attorneys fees and disbursements) that any Indemnitee suffers or incurs as a result of any of the foregoing; provided, however, that Borrower shall have no obligation under this Section to Lender with respect to any of the foregoing arising out of the gross negligence or willful misconduct of Lender or the breach by Lender of this Agreement. If any claim, demand, action or cause of action is asserted against any Indemnitee, such Indemnitee

shall promptly notify Borrower, but the failure to so promptly notify Borrower shall not affect Borrowers obligations under this Section unless such failure materially prejudices Borrowers right to participate in the contest of such claim, demand, action or cause of action, as

hereinafter provided. If requested by Borrower in writing, as so long as no Default or Event of

Default shall have occurred and be continuing, such Indemnitee shall in good faith contest the validity, applicability and amount of such claim, demand, action or cause of action and shall permit Borrower to participate in such contest. Any Indemnitee that proposes to settle or

compromise any claim, demand, action, cause of action or proceeding for which Borrower may be liable for payment of indemnity hereunder shall give Borrower written notice of the terms of such proposed settlement or compromise reasonably in advance of settling or compromising such claim or proceeding and shall obtain Borrowers concurrence thereto.

SECTION 10. BORROWERS REPRESENTATIONS.

By execution hereof, the signators warrant and represent that they have the requisite authority to execute this Agreement and the Related Documents and that the representations

SECTION 11. CONFIDENTIALITY

Each of the parties hereto shall maintain complete confidentiality concerning this Agreement and all transactions, processes and procedures contemplated hereby, including all loans and the business, business sources, proprietary knowledge and know-how of each other party hereto. Without limiting the generality of the foregoing, this Agreement (including its existence), or any other agreement entered into

among the parties shall be kept confidential and shall not be reproduced, communicated or distributed in any manner whatsoever, except on a "need to know" basis to persons directly

PAGE 5 of 7

involved with the negotiation, closing and/or administration of any transaction among all or any of the parties or except to a party's legal counsel or other professional advisor.

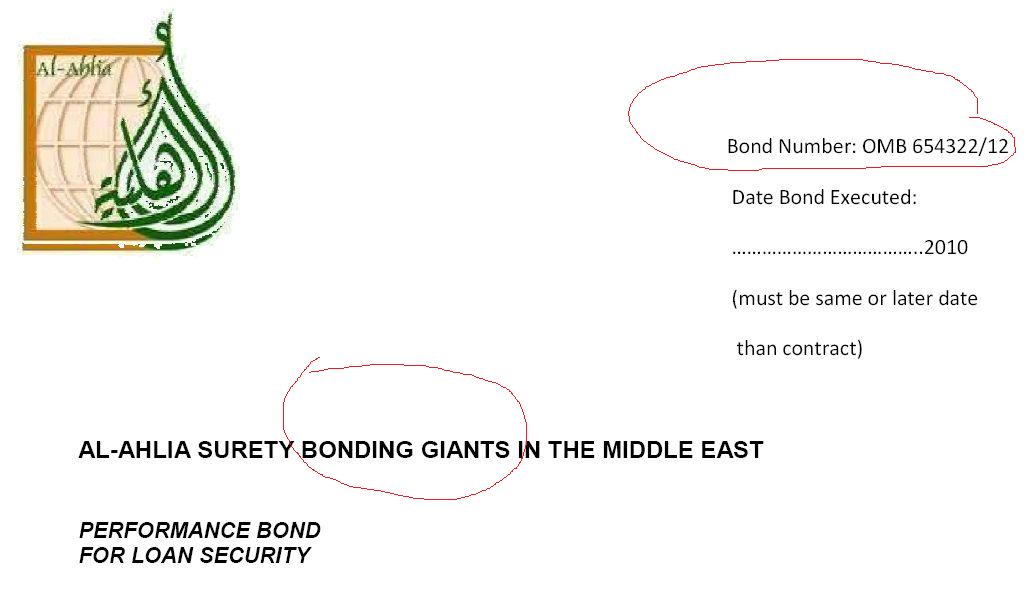

SECTION 12. SECURITY

The Borrower and the Lender agrees with the purchase of a Surety Bond as security on the investment Loan. Both Borrower and the Lender will equally share the cost for the procurement of the Surety Bond.

SECTION 13. MISCELLANEOUS PROVISIONS.

The following miscellaneous provisions are a part of this Agreement:

(a) Amendments. This Agreement, together with any Related Documents, constitutes the entire understanding and agreement of the parties as to the matters set forth in this Agreement. No alteration of or amendment to this Agreement shall be effective unless given in writing and

signed by the party or parties sought to be charged or bound by the alteration or amendment.

(b) Applicable Law and Venue. This Agreement has been delivered to Lender and accepted by Lender. Borrower agrees to submit to the jurisdiction of the courts of the United Kingdom. This Agreement shall be governed by and construed in accordance with the

laws of the United Kingdom and applicable Federal and State laws.

(c) Caption Headings. Caption headings in this Agreement are for convenience purposes only and are not to be used to interpret or define the provisions of the Agreement.

(d) Notices. All notices required to be given under this Agreement shall be given in writing and shall be effective when actually delivered or when deposited in the mail, first class, postage prepaid, addressed to the party to whom the notice is to be given at the address

shown on Page 1 of this Agreement. Any party may change its address for notices under this Agreement by giving formal written notice to the other parties, specifying that the purpose of the notice is to change the party's address. For notice purposes, Borrower agrees to keep Lender informed at all times of Borrowers current address.

(e) Severability. If a court of competent jurisdiction finds any provision of this Agreement to be invalid or unenforceable as to any person or circumstance, such finding shall not render that provision invalid or unenforceable as to any other persons or circumstances. If feasible, any such offending provision shall be deemed to be modified to be within the limits of enforceability or validity; however, if the offending provision cannot be so modified, it shall be stricken and all other provisions of this Agreement in all other respects shall remain valid and enforceable.

PAGE 6 of 7

(f) Survival. All warranties, representations, and covenants made by Borrower in this Agreement or in any certificate or other instrument delivered by Borrower to Lender under this Agreement shall be considered to have been relied upon by Lender and will

survive the making of the Loan and delivery to Lender of the Related Documents, regardless of any investigation made by Lender or on Lenders behalf.

BORROWER ACKNOWLEDGES HAVING READ ALL THE PROVISIONS OF THIS BUSINESS LOAN AGREEMENT, AND BORROWER AGREES TO ITS TERMS. THIS AGREEMENT IS DATED AS OF EFFECTIVE AS OF THE DATE FIRST WRITTEN ABOVE.

Borrower:

X

Signature: ____________________

Date: ________________________

Investor

Syaikh Nasser Al-Rashid

Alrashid Group/NAR Foundation

Alrashid Compound, Khurais Road,

P.o Box 6132, Riyadh 11442,

Kingdom of Saudi Arabia.

Signature: ____________________

Date: ________________________

PAGE 7 of 7

-----------

As we arrived at UK Law, and check on the internet, and repeating the same names as per reported by others, I feel good that other potential reader of this offer, to be extra careful.

Shame is that this Arabs talks in English. But as it goes

Report Attachments