- Report: #622579

Complaint Review: New York Life Insurance & Annuity Corp - Sleepy Hollow New York

New York Life Insurance & Annuity Corp Agent Alan McGaw Sells Single Woman w/NO DEPENDENTS Guaranteed Death Benefit Annuity costing 1.6% of value per year as her RETIREMENT VEHICLE. Sleepy Hollow, New York

Report Attachments

Single, childless woman charges that New York Life Insurance agent and documentation at fault in sale of unsuitable Variable Annuity with a Guaranteed Death Benefit with the blessing of the Washington State Insurance Commissioners Office.

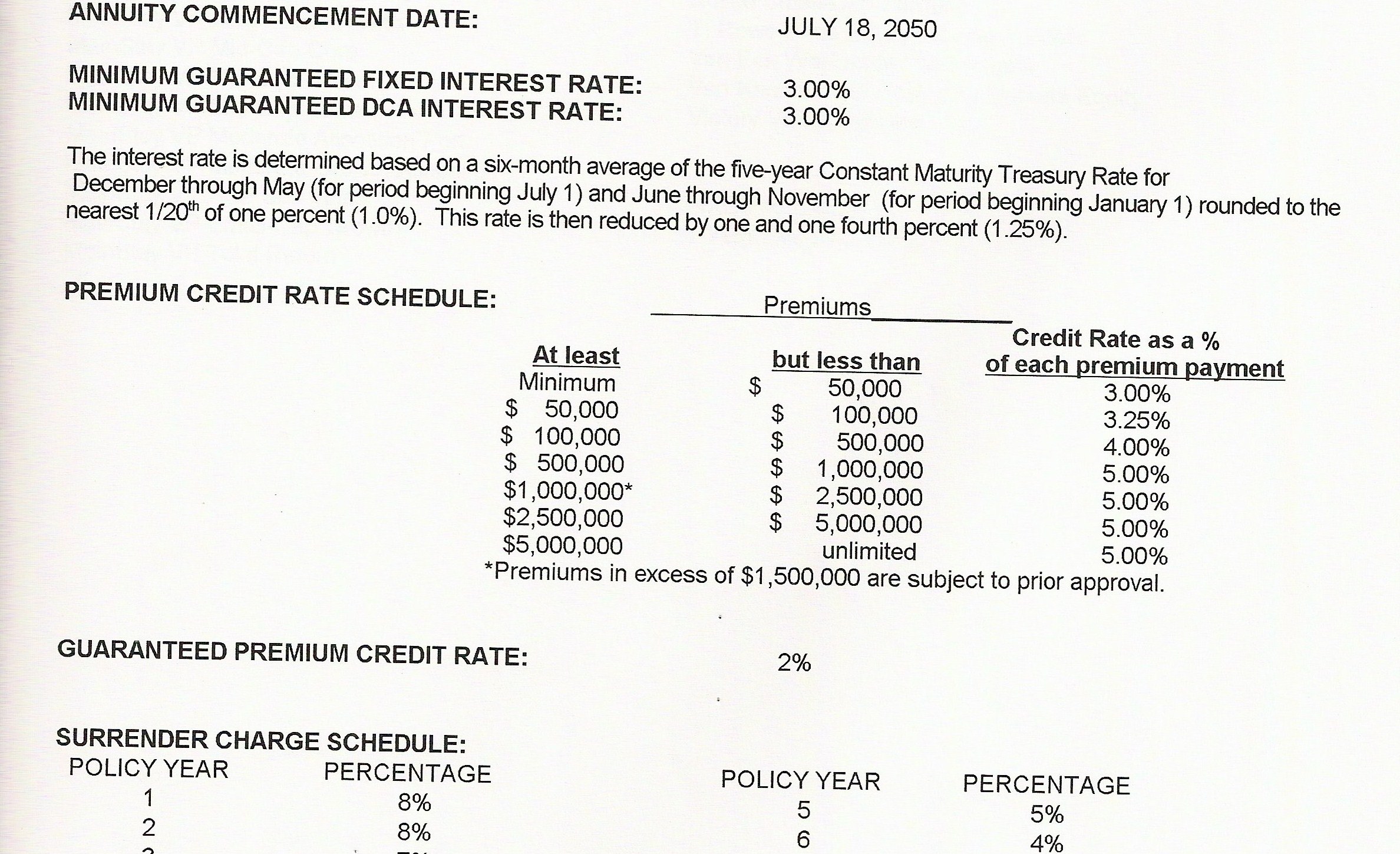

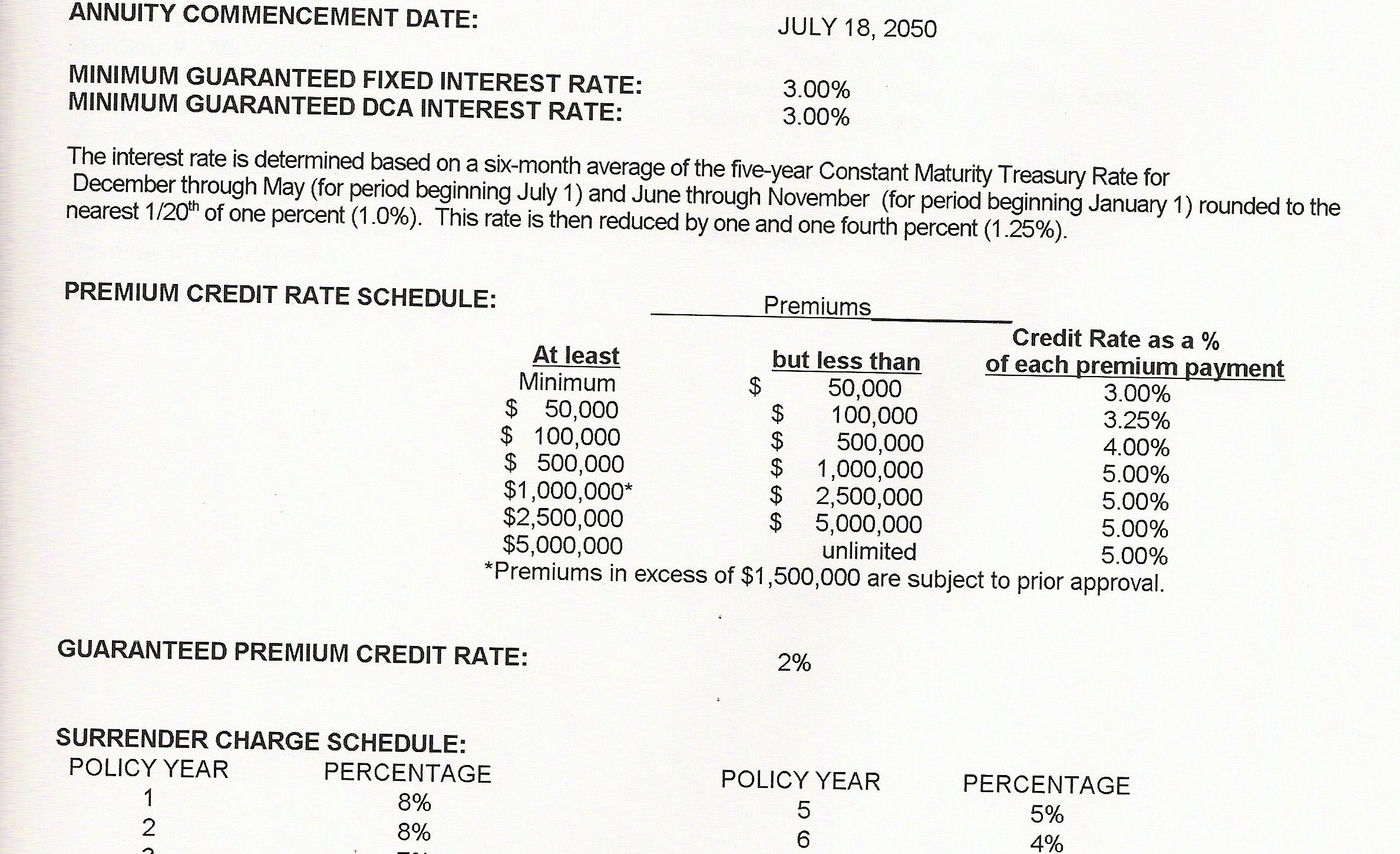

According to the St of WA Office of the Insurance Commissioner Mike Kreidler: Even though this policy did not provide a minimum guaranteed fixed interest rate, it is perfectly acceptable for New York Life Insurance to state in the Policy: Minimum Guaranteed Fixed Interest Rate: 3%. The policy holder should have known that this was an Option explained elsewhere.

According to the Office of the Insurance Commissioner Mike Kreidler: It is perfectly acceptable for the Guaranteed Death Benefit feature costs to be excluded from the Policy because it is covered in the Prospectus. The consumer should have known that this feature and its costs were part of what was purchased by reading about them in the Prospectus. The consumer should have also known that the cost of the Guaranteed Death Benefit was discussed as "Mortality & Expense Risk."

According to the Office of Mike Kreidler: It is perfectly acceptable that the Free Look Provision (the 10 days you have to cancel with no penalty) only refers to the reviewing the policy and does not inform the consumer that the policy is not a complete or exclusive description of the products purchased and their related costs. The consumer should know that key information is only contained in the Prospectus.

According to the Office of Mike Kreidler: It is perfectly acceptable for the consumer to be required to refer to both the Prospectus and the Policy to determine the products, features, and costs of products being purchased.

Section 10 of the policy 10.1 states: "This entire contract consists of this policy, any attached riders, endorsements, and a copy of the application." In the ongoing dispute, NYL refers to the PROSPECTUS repeatedly.

Additionally, when an Agent meets with a customer, they review the parts of the prospectus that apply to the annuity(ies) and features they are recommending. However, the customer is asked to sign a Client Profile that states, I/We have read and understood the prospectus and above disclosure .. This information is then used against the consumer in the event of a dispute.

I have been fighting this for over a year and a half and they all still maintain that (1) any misunderstanding of their documentation is the sole responsibility of the consumer; (2) they are convinced that consumers can read and understand the documentation independent of an Agent; (3) the documents from New York Life clearly specify the products and related costs being purchased.

Am I alone in thinking that they are placing an unfair burden on the consumer to understand industry specific terms and concepts spread across three documents totally over 100 pages? Is it too much to ask for a summary of what you bought and what it cost?

Am I alone in thinking that you need an agent to translate: The charge equals 1.60% (annualized) of the daily average Variable Accumulative Value for the New York Life Premium Plus Variable Annuity and 1.75% (annualized) of the daily average Variable Accumulative Value for the New York Life Premium Plus II Variable Annuity (From Page 12 of the Prospectus explaining Mortality & Risk Expense that I was supposed to know was part of the Guaranteed Death Benefit included in my purchase but left out of the Policy.) It really shouldnt matter that New York Life and the Office of the Insurance Commissioner dont think the documentation is incomprehensible. It should matter what consumers believe.

2 Updates & Rebuttals

Emily3264

Rainier,Washington,

Completely Missed the Point

#2Author of original report

Thu, August 08, 2013

Your reply aptly demonstrates my point. No one outside of the insurance industry would have a clue what you wrote or said. This is why it is imperative that the documentation be accurate and complete. At the time, I contacted 6 other agents and an attorney who confirmed that there are very sleazy agents out there who are able take advantage of people by hiding behind indeciferable documentation and forcuing people to make decisions based on their verbal descriptions. Additionally, I still maintain that a policy that would have left me penniless but guaranteed my Non-Existant heirs an inheiritance was inappropriate. It's not just about great returns, you have to protect the principle on sums that people are depending upon being there when they retire.

Brian

Middle River,Maryland,

Why inappropriate ?

#3UPDATE Employee

Thu, August 08, 2013

Apparently you have never been a registered representative, and you assume that all retirement vehicles must have the numbers 401k or 403b in them. A variable annuity is COMPLETELY appropriate, especially if it has a rider guaranteeing the cost basis of the client. If the client wants market sensitivity, yet is afraid to lose money, how else would you protect them? The 1.55% annual fee is based on the ORIGINAL INVESTMENT most of the time.... As long as the option chosen is adjusted premium as opposed to account value. If the value of the annuity DOUBLES over the course of time, then the client is effectively paying fees of less than .80%. If you place $200,000 of the clients money with a money manager with, lets say Merrill Lynch, the MINIMUM that the Merrill guy or gal can charge is 1.6% annually. That is $3200 annually. If the SAME money doubles over time, the client is paying $6400 MINIMUM ANNUALLY with NO guarantee of the money. You need to find out the persons wishes before you make assumptions.