- Report: #1320630

Complaint Review: Jason Springer - West Des Moines Iowa

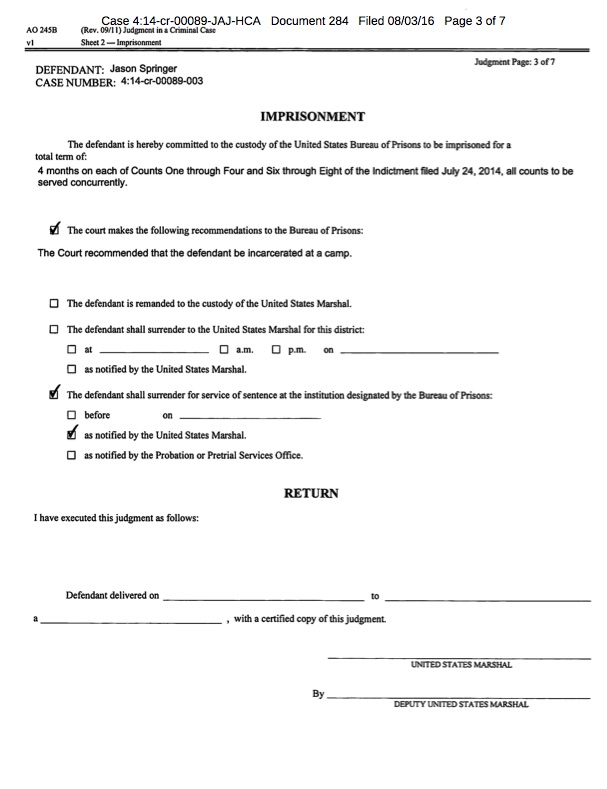

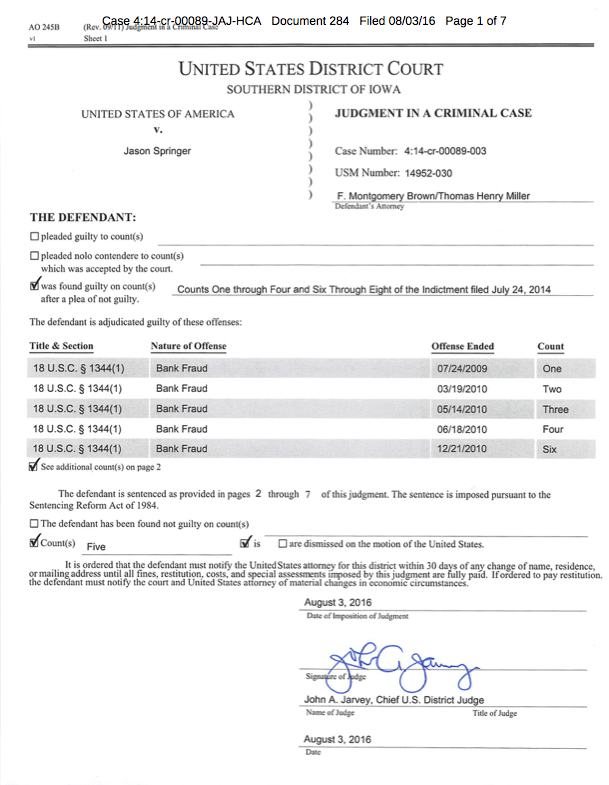

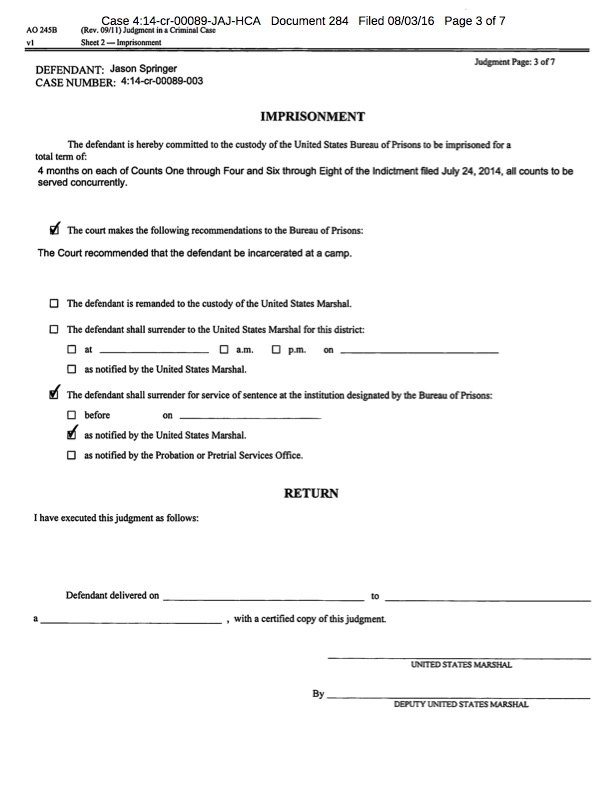

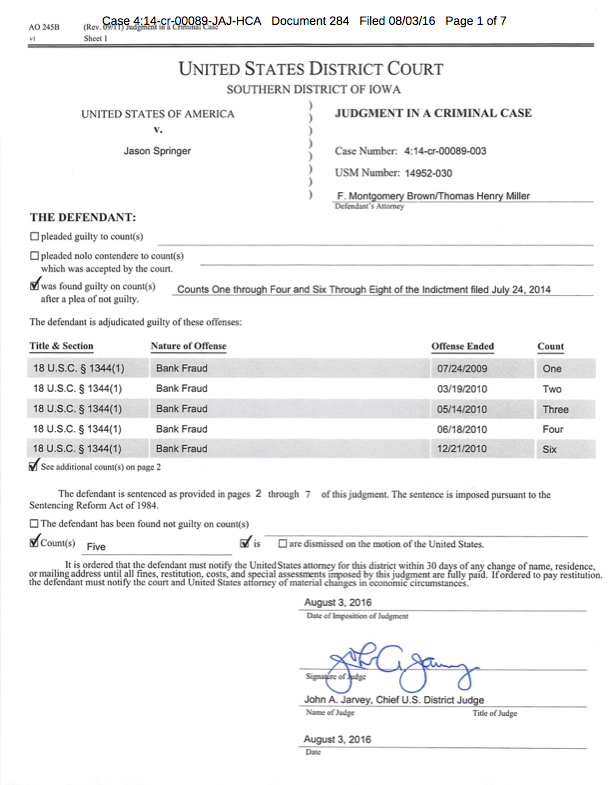

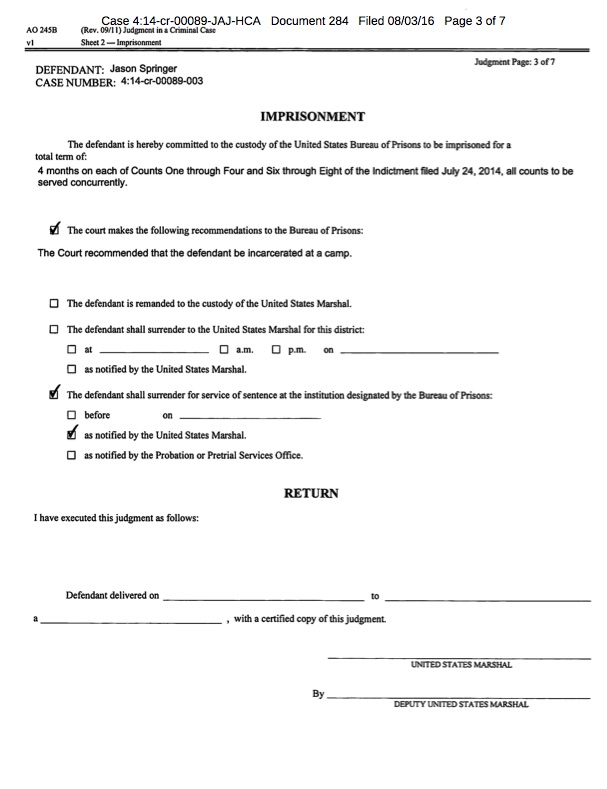

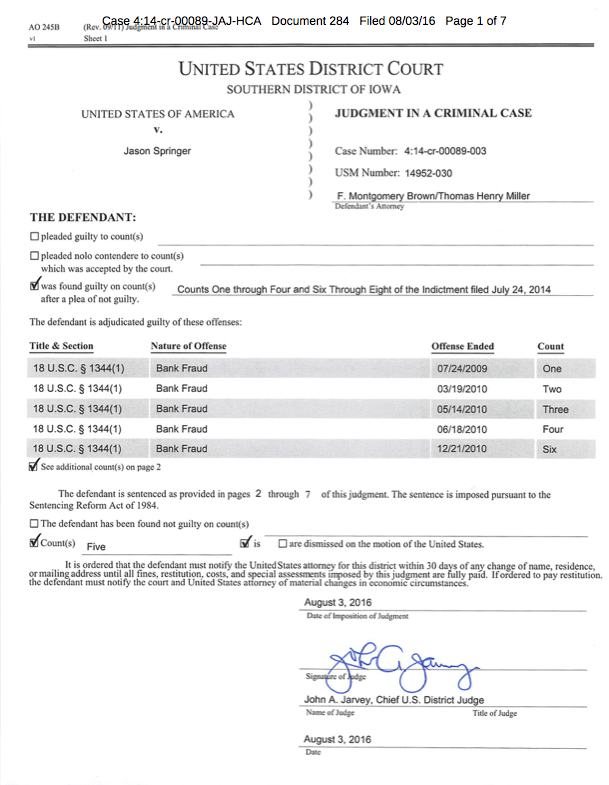

Jason Springer Law Firm CONVICTED: 7 Counts of Bank Fraud, but got off easy as the mortgage pump & dump scheme continues West Des Moines Iowa

Report Attachments

This is posted to further prove this conviction is only the tip of the iceberg of a MUCH larger "pump & dump" scheme with many players not prosecuted by the FBI (yet). Please use this blog to post your evidence to bring the rest to justice, so others won't fall victum. Hats off to the FBI for getting round #1 completed and this "pump & dump" scheme exposed.

COUNT ONE

(Bank Fraud)

1. At times material to this indictment:

a. Defendants NATHAN SMITH and PATRICK STEVEN owned Iowa

Loan Modifications and Iowa Short Sales, companies through which SMITH and STEVEN negotiated short sales with lenders on behalfofhomeowners, purchased homes on short sale, and resold the homes for a profit.

b. Defendant JASON SPRINGER was an attorney licensed in the State of Iowa.

c. Defendant RICK MAKOHONIUK was a realtor and the owner of a construction company called Motaymat, Inc.

d. Defendant JEROD HOGAN was a mortgage broker at a company in Urbandale, Iowa.

UNITED STATES OF AMERICA, v.

NATHAN SMITH,

PATRICK STEVEN,

JASON SPRINGER,

RICK MAKOHONIUK, and ) JEROD HOGAN, )

1

Case 4:14-cr-00089-JAJ-RAW Document 2 Filed 07/24/14 Page 2 of 11

e. Wells Fargo, Bank of America, U.S. Bank, CitiMortgage, GMAC Mortgage, and JPMorgan Chase were lenders that made loans secured by mortgages. These lenders were also financial institutions, in that their deposits were insured by the Federal Deposit Insurance Corporation, or they were mortgage lending businesses.

f. A "short sale" of a home occurs when the proceeds of the sale are less than the debt the homeowner owes on the property, and the lender agrees to accept proceeds that are less than the amount owed.

g. Lenders required applicants for short sales to provide truthful information, including, in some cases, information that the home had been marketed for a period o f time, and that the buyer had financing to pay the purchase price of the home. In some cases, lenders required buyers and sellers to provide affidavits stating that the buyer and seller had no relationship to one another and were conducting an arms-length transaction, and that the buyers had no current agreement to immediately resell the home at a higher price. In addition, buyers and sellers were required to provide truthful information on the HUD-I settlement statement. The information provided in these documents was material to the lenders' decision to agree to a short sale.

h. Some lenders had rules limiting or restricting "property flips," that is, when a buyer purchases a home and quickly resells it for a profit. To prevent such flips, many lenders specified that they would not approve a mortgage if the seller had purchased the home within a specified time period, such as ninety days. The Federal Housing Administration also had rules preventing it from insuring mortgages if the seller of a home had purchased the home within ninety days of the sale.

2

Case 4:14-cr-00089-JAJ-RAW Document 2 Filed 07/24/14 Page 3 of 11

2. Beginning in or about March 2009 and continuing until in or about March 2011, in the Southern District of Iowa, defendants NATHAN SMITH, PATRICK STEVEN, JASON SPRINGER, RICK MAKOHONIUK, and JEROD HOGAN participated in a scheme to defraud financial institutions, and this scheme is further described below.

3. It was part of the scheme that SMITH and STEVEN, with the assistance of SPRINGER and others, fraudulently induced lenders to agree to the short sale of homes, purchased the homes on short sale at a below-market price, and then, without the lenders' knowledge, immediately resold the homes at a higher price. SMITH, STEVEN, and SPRINGER carried out this scheme with respect to approximately eighteen homes in and around Des Moines, Iowa, and sold those homes for a total of over $400,000 more than the amount they paid for the homes in the short sales.

4. It was further part of the scheme that SMITH and STEVEN used Iowa Loan Modifications to negotiate the short sale of homes with lenders on behalf of homeowners who retained SMITH and STEVEN for this purpose. At the same time that SMITH and STEVEN negotiated a short sale using Iowa Loan Modifications, without the lender's knowledge, SMITH and STEVEN used their other company, Iowa Short Sales, to purchase the home in the short sale. This was known as the "A-B" transaction.

S. It was further part of the scheme that, again without the lender's knowledge, SMITH and STEVEN sold the home for a higher price the same day they purchased the home in the short sale, or soon after. This was known as the "B-C" transaction.

3

Case 4:14-cr-00089-JAJ-RAW Document 2 Filed 07/24/14 Page 4 of 11

6. It was further part of the scheme that SPRINGER furthered the scheme by acting as the settlement agent who conducted real estate closings for many of the A-B and B-C transactions. SPRINGER was paid a commission for each real estate closing he conducted.

7. It was further part of the scheme that MAKOHONIUK furthered the scheme by acting as the real estate agent with respect to the A-B and B-C transactions involving a home on 56th Street in Des Moines, which is discussed further below. MAKOHONIUK was paid commissions for his role in the scheme.

8. It was further part ofthe scheme that HOGAN furthered the scheme by providing, or assisting in the production of, false documents that were submitted to lenders as part of the scheme.

9. I t was further part o f the scheme that SMITH, STEVEN, SPRINGER, MAKOHONIUK, and HOGAN employed material falsehoods, concealed material facts, and omitted material facts in order to deceive lenders and defraud them of money. Among other things:

a. During the period in which defendants SMITH and STEVEN were negotiating the short sale of a home with the lender, SMITH, STEVEN, and SPRINGER caused the homeowner to place the home in a trust controlled by SMITH and STEVEN. Months later, during the A-B transaction, SMITH and STEVEN, with the help of SPRINGER, purchased the home in the name of the trust. This was intended to conceal from the lender that SMITH and STEVEN had dual roles: they were negotiating the short sale with the lender, and buying the home in the short sale. The trusts also made it appear that the title to the home had remained in the name of the trust for months, which allowed SMITH and STEVEN to sell the home in the

4

Case 4:14-cr-00089-JAJ-RAW Document 2 Filed 07/24/14 Page 5 of 11

B-C transaction on or about the same day as the A-B transaction and evade the lenders' anti-flipping rules.

b. SMITH and STEVEN submitted false letters to lenders stating that the home had been marketed for sale, when in fact it had not. The purpose of such letters was to deceive the lender into believing that the price SMITH and STEVEN offered to purchase the home in the short sale was the fair market value.

c. HOGAN provided SMITH and STEVEN with false letters on the letterhead of HOGAN's employer, a mortgage lending business in Urbandale, Iowa. The letters falsely stated that SMITH and STEVEN had been approved for financing in order to pay cash for specific homes in short sales. In fact, SMITH and STEVEN had not been approved for such financing and did not have cash to purchase the homes in the A-B transactions. SMITH and STEVEN submitted the false letters to lenders.

d. SMITH signed and submitted to lenders false affidavits stating that SMITH, the buyer of the home in the short sale, had no relationship with the seller, and was conducting an arms-length transaction, when, in fact, and without the lender's knowledge, the seller had retained SMITH to negotiate the short sale with the lender on the seller's behalf.

e. SMITH and MAKOHONIUK signed and submitted to a lender a false affidavit stating that at the time of the short sale, there was no current agreement to immediately resell a home on 56th Street in Des Moines, Iowa at a higher price, when, in fact, there was such an agreement.

5

Case 4:14-cr-00089-JAJ-RAW Document 2 Filed 07/24/14 Page 6 of 11

f. SMITH and MAKOHONIUK created a false and misleading paper trail to conceal from the lender that SMITH profited from the resale of the home on 56th Street, which SMITH purchased in a short sale. MAKOHONIUK created a false invoice from his company Motaymat, Inc. billing SMITH for work that MAKOHONIUK and Motaymat, Inc. never performed. SMITH paid MAKOHONIUK for the amount of the invoice, making it appear that SMITH did not profit from the resale of the home, and MAKOHONIUK later returned the money to SMITH.

g. SMITH, STEVEN, and SPRINGER signed and submitted false HUD-J settlement statements stating that SMITH and STEVEN paid cash at closing for the A-B transactions. In some cases, SMITH and STEVEN brought no money to the A-B transaction closings. In other cases, SMITH and STEVEN provided checks in the amount of cash SMITH and STEVEN purportedly brought to closing. As SMITH, STEVEN, and SPRINGER knew, there were not sufficient funds in SMITH and STEVEN's bank account to cover the checks they brought to closings. The false HUD-I settlement statements and fraudulent checks concealed from the lenders that SMITH and STEVEN were immediately reselling the homes at a higher price, and that SPRINGER was using the proceeds of the B-C transactions to fund the A-B transactions.

10. It was further part of the scheme that SMITH, STEVEN, SPRINGER, MAKOHONIUK, and HOGAN misrepresented and concealed, and caused to be misrepresented and concealed, acts done in furtherance ofthe scheme and the purpose ofthose acts.

11. On or about July 24, 2009, in the Southern District of Iowa, defendants SMITH, STEVEN, and SPRINGER knowingly executed a scheme to defraud a financial institution,

6

Case 4:14-cr-00089-JAJ-RAW Document 2 Filed 07/24/14 Page 7 of 11

Wells Fargo, by submitting, or causing to be submitted, a materially false HUD-l settlement statement stating that SMITH paid $34,499.20 in cash to purchase a home on 1st Avenue in Slater, Iowa.

This is a violation of Title 18, United States Code, Sections 1344(1) and 2.

COUNT TWO

(Bank Fraud)

(Against Defendants SMITH, STEVEN, and SPRINGER)

12. The allegations in paragraphs 1 through 10 of Count One of this indictment are incorporated here.

13. On or about March 19, 2010, in the Southern District of Iowa, defendants SMITH, STEVEN, and SPRINGER knowingly executed a scheme to defraud a financial institution, Bank of America, by submitting, or causing to be submitted, a materially false HUD-l settlement statement stating that SMITH and STEVEN paid $58,766.48 in cash to purchase a home on E. Rose Avenue in Des Moines, Iowa.

This is a violation of Title 18, United States Code, Sections 1344(1) and 2.

COUNT THREE

(Bank Fraud)

(Against Defendants SMITH, STEVEN, SPRINGER, and HOGAN)

14. The allegations in paragraphs 1 through 10 of Count One of this indictment are incorporated here.

15. On or about May 14, 2010, in the Southern District of Iowa, defendants SMITH, STEVEN, SPRINGER, and HOGAN knowingly executed a scheme to defraud a financial

7

Case 4:14-cr-00089-JAJ-RAW Document 2 Filed 07/24/14 Page 8 of 11

institution, US Bank, by submitting, or causing to be submitted, a materially false HUD-l settlement statement stating that SMITH paid $58,901.84 in cash to purchase a home on Kenyon Avenue in Des Moines, Iowa.

This is a violation ofTitle 18, United States Code, Sections 1344(1) and 2.

COUNT FOUR

(Bank Fraud)

(Against Defendants SMITH, STEVEN, and SPRINGER)

16. The allegations in paragraphs 1 through 10 of Count One of this indictment are incorporated here.

17. On or about June 18,2010, in the Southern District of Iowa, defendants SMITH, STEVEN, and SPRINGER knowingly executed a scheme to defraud a financial institution, CitiMortgage, by submitting, or causing to be submitted, a materially false HUD-l settlement statement stating that STEVEN paid $125,522.31 in cash to purchase a home on E. 52nd Street in Des Moines, Iowa.

This is a violation ofTitle 18, United States Code, Sections 1344(1) and 2.

COUNT FIVE

(Bank Fraud)

(Against Defendants SMITH, STEVEN, and SPRINGER)

18. The allegations in paragraphs 1 through 10 of Count One of this indictment are incorporated here.

19. On or about June 30, 2010, in the Southern District ofIowa, defendants SMITH, STEVEN, and SPRINGER knowingly executed a scheme to defraud a financial institution,

8

Case 4:14-cr-00089-JAJ-RAW Document 2 Filed 07/24/14 Page 9 of 11

American Home Mortgage, by submitting, or causing to be submitted, a materially false HUD-I settlement statement stating that SMITH paid $173,465.65 in cash to purchase a home on Caldwell Circle in Johnston, Iowa.

This is a violation of Title 18, United States Code, Sections 1344(1) and 2.

COUNT SIX

(Bank Fraud)

(Against Defendants SMITH, STEVEN, and SPRINGER)

20. The allegations in paragraphs I through 10 of Count One of this indictment are incorporated here.

21. On or about December 21, 2010, in the Southern District of Iowa, defendants SMITH, STEVEN, and SPRINGER knowingly executed a scheme to defraud a financial institution, CitiMortgage, by submitting, or causing to be submitted, a materially false HUD-l settlement statement stating that SMITH paid $26,453.20 in cash to purchase a home on Garden Avenue in Des Moines, Iowa.

This is a violation of Title 18, United States Code, Sections 1344(1) and 2.

COUNT SEVEN (Bank Fraud) (Against All Defendants)

22. The allegations in paragraphs 1 through 10 of Count One of this indictment are incorporated here.

23. On or about February 18, 2011, in the Southern District of Iowa, defendants

,

SMITH, STEVEN, SPRINGER, MAKOHONIUK, and HOGAN knowingly executed a scheme 9

Case 4:14-cr-00089-JAJ-RAW Document 2 Filed 07/24/14 Page 10 of 11

to defraud a financial institution, GMAC Mortgage, by submitting, or causing to be submitted, a materially false HUD-l settlement statement stating that SMITH paid $62,321.41 in cash to purchase a home on 56th Street in Des Moines, Iowa.

This is a violation of Title 18, United States Code, Sections 1344(1) and 2.

COUNT EIGHT

(Bank Fraud)

(Against Defendants SMITH, STEVEN, SPRINGER, and HOGAN)

24. The allegations in paragraphs 1 through 10 of Count One of this indictment are incorporated here.

25. On or about March 25, 2011, in the Southern District of Iowa, defendants SMITH, STEVEN, SPRINGER, and HOGAN knowingly executed a scheme to defraud a financial institution, JP Morgan Chase Bank:, by submitting, or causing to be submitted, a materially false HUD-l settlement statement stating that SMITH paid $371,737.20 in cash to purchase a home on 142nd Street in Urbandale, Iowa.

Report Attachments