- Report: #1473104

Complaint Review: Intuit -

Intuit Charged me $39.99 for taking their fees from my federal tax refund without confirming the Fees they would Charge

Feb 7, 2019 I used online Turbo Tax, an Intuit product to file my taxes.

Throughout the tax entry process, TurboTax has the customer verify entries two or more times.

There is constant verification of information -- EXCEPT WHEN TurboTax SHOULD BE TELLING THE CUSTOMER HOW MUCH THE FEES WILL BE FOR FILING THOSE TAXES -- BEFORE THE TAXES ARE E-FILED.

When the tax forms are complete -- right before filing, Turbo Tax asks how you would like to pay your TurboTax fees -- a new option is to have the fees taken from your federal refund (if it is large enough). I could have paid my fees with a credit card -- which would cost me nothing and would earn cashback points. There was no BOLD print saying if you choose "the refund" option to pay fees, we will charge you $39.99.

I would like to point out that $39.99 is the same fee one pays to e-file state tax forms -- which adds to the confusion.

It is true that one must agree to this -- but the agreement screens are in a series of screens that also include signing for state forms to be e-filed and all of this becomes confusing.

TurboTax DOES NOT list all the fees you are paying them BEFORE filing taxes, so that a customer can see that there are two charges of $39.99 in addition to the fee for using TurboTax. Instead, TurboTax e-files the tax forms with the instructions to take their fees from the federal refund, and After that confirms to the customer that the forms were filed and then lists the fees charged. (That is when it is clear that there are two $39.99 charges - and one is for the privilege of having your TurboTax fees taken out of your refund before you get your refund.)

When I realized I was paying $40 for the priviliege of letting TurboTax take the fees from my tax refund, I immediately called them.

It took the rep over an hour to try to pull up the information -- which she never was able to do, telling me the system was very slow due to workload. She also checked with supervisors -- the result is -- nothing we can do once the tax forms are e-filed.

THIS IS A SCAM TACTIC.

THE government allows Intuit/TURBOTAX TO E-FILE; Intuit should not be allowed to charge customers $40 for taking their fees from the tax refund -- unless the customer has very clearly in bold print been told that using this option will cost them $40 and it is clear the paying by credit card costs nothing.

2 Updates & Rebuttals

Karole

Kimberling City,Missouri,

United States

Not Really a Rebuttal -- More of an Apology

#2Author of original report

Sat, February 09, 2019

As this person has stated -- going back to my return -- it was stated that the fee for paying Intuit from the federal refund was given -- and I missed it! I only saw it when the fees were listed/itemized when the confirmation of e-filing was provided. My error!

I too have used TurboTax for many years, and in the past always paid by credit card -- no TurboTax fee for that, Had I noticed a fee of $39.99 for taking Intuit's fee from the refund, I would never have selected that option -- because that fee is totally outrageous.

So, since my initial complaint cannot be deleted, I would like to say that my perception of where the fees were stated was in errot.

I do maintain that Intuit is taking advantage of it's "valued" clients in charging $39.99 for that "service".

I have decided that I will recoup this fee next year by copying this year's one page federal tax return, and using it as a guide to put in next year's numbers, and file 2019 taxes without TurboTax's help.

Jim

Beverly Hills,United States

It's VERY Clear

#3Consumer Comment

Fri, February 08, 2019

I have been using Turbo Tax for more than 10 years; I still have all of the CD's that go back that many years. I use it not only for myself, but for family as well, so I am quite familiar with this part of the process. The fees they charge are quite clear and can come out of your Federal Return; I can't even remember a time when they didn't come out of the Federal refund. All of the fees are documented and available to review and verify before you hit the button to e-file. The calculation looks something like this, assuming a Federal refund of $500:

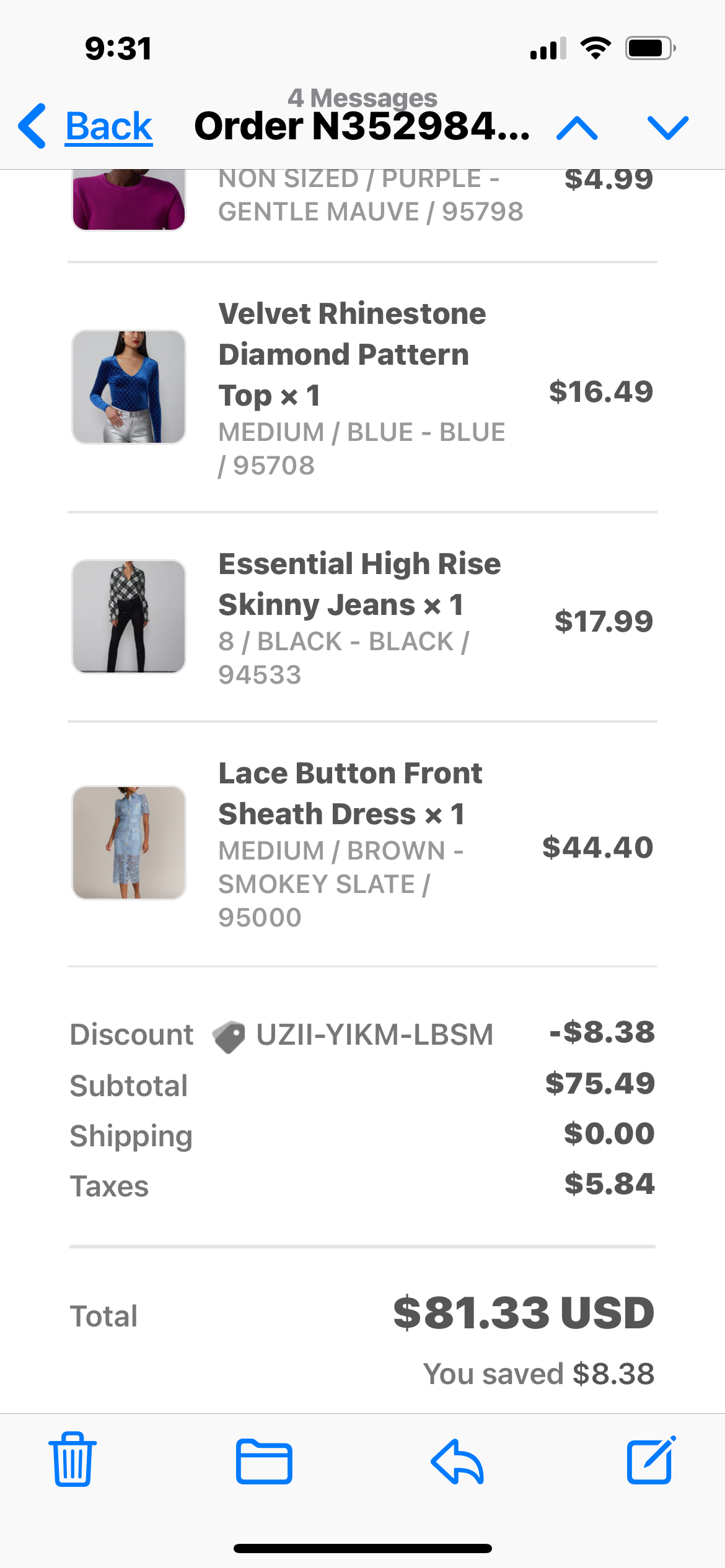

Federal Refund $500.00

Less: State E-file fees: ($ 39.99)

Less: Turbo Tax Fee ($ 39.99)

Total Federal Refund $420.02

I mean this calculation actually appears before you decide to submit for e-file and there is double verification here as well. Now, the only way it wouldn't be clear is if you went through the screens either too quickly, or got distracted by something and missed it - twice. I mean I suppose it does happen, but the idea it isn't clear....I don't think so.

Now, this doesn't address the question of whether it's worth it to e-file; that's up to each individual filer. But the idea that it isn't clear or that the choice is unclear - well, in all the years I've used it for all the returns I've done, I think it's pretty clear. And yes, once you e-file, there's really nothing Intuit can do.

Best of luck to you...