- Report: #991912

Complaint Review: HSBC - Baltimore Maryland

HSBC Household Bank You will never have credit again. Baltimore, Maryland

1 Updates & Rebuttals

Robert

Irvine,California,

U.S.A.

A bit dramatic but....

#2Consumer Comment

Sat, January 05, 2013

If you are telling the 100% truth you may actually have some recourse.

The first thing is you need to be aware of the Fair Credit Reporting Act(FCRA), and the Fair Debt Collection Practices Act(FDCPA).

By law a negative item can only remain on your report for 7 years from the last action(actually it turns out to be about 7.5 years from the date of the first delinquency). It doesn't matter how many times your account is sold or transferred..this date can not be re-aged on it's own. The little "Gotcha" in this is that if you do anything such as make a payment it could re-age the account and start the clock again. So if you have done no actions(such as a payment) depending on when in 2006 this happened, by Mid-2013 to Early 2014 these items MUST by law be removed from your account. If they show up again..you have the legal right to have them removed.

You need to look at your credit report and find out who is reporting this. You then must send them a "Debt Validation Letter". This requires them to "validate" the debt. If they fail to validate the debt within 30 days, again by law you can have it removed from your credit report and they can take no action against you, until they do validate it.

But there is no such thing as an FDIC Bank Statement. Do you have anything in writing from these other companies that said that the account was paid in full? If you just have your bank statements showing you made a payment that unfortunately is NOT proof that it was a)for that account and b)that the amount paid it in full.

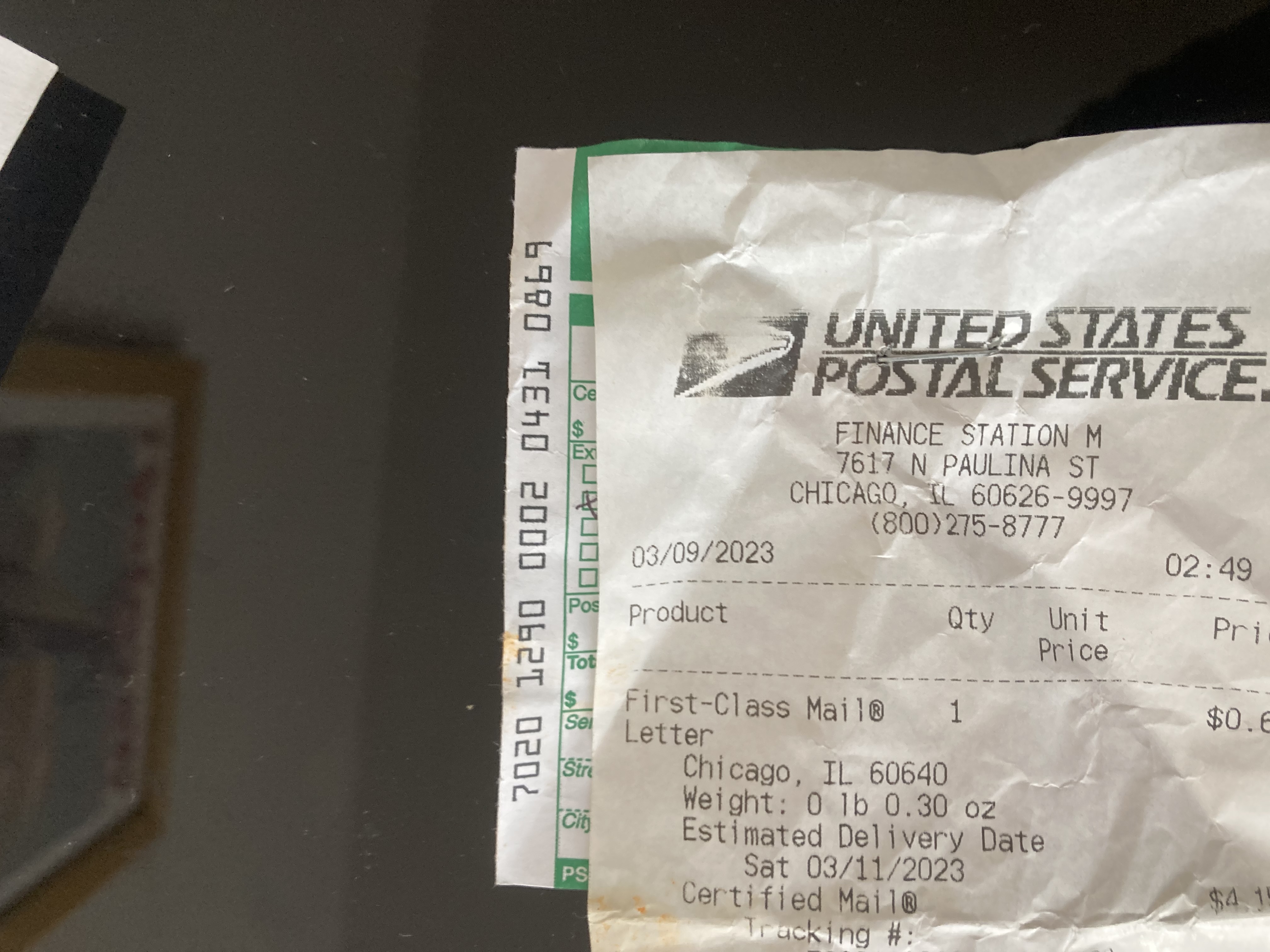

If you have proof..go after them and look at the remedies in the FCRA and FDCPA that would allow you to file suit against them. If you don't have proof of payment then start that now. DO NOT talk to them on the phone, only send letters through the mail. DO NOT pay them a single dime until you have an agreement in writing that says the amount you will pay..pays the account in full.

Yes I know this is a lot of general items, but if you take a look at the FCRA, FDCPA, and "Debt Validation Letters" you may find your situation is not as hopeless as you think.