- Report: #235465

Complaint Review: First Consumers National Bank - Portland Oregon

First Consumers National Bank Paid through credit couselor for 5 years, now a collection agency is on me Ripoff Portland Oregon

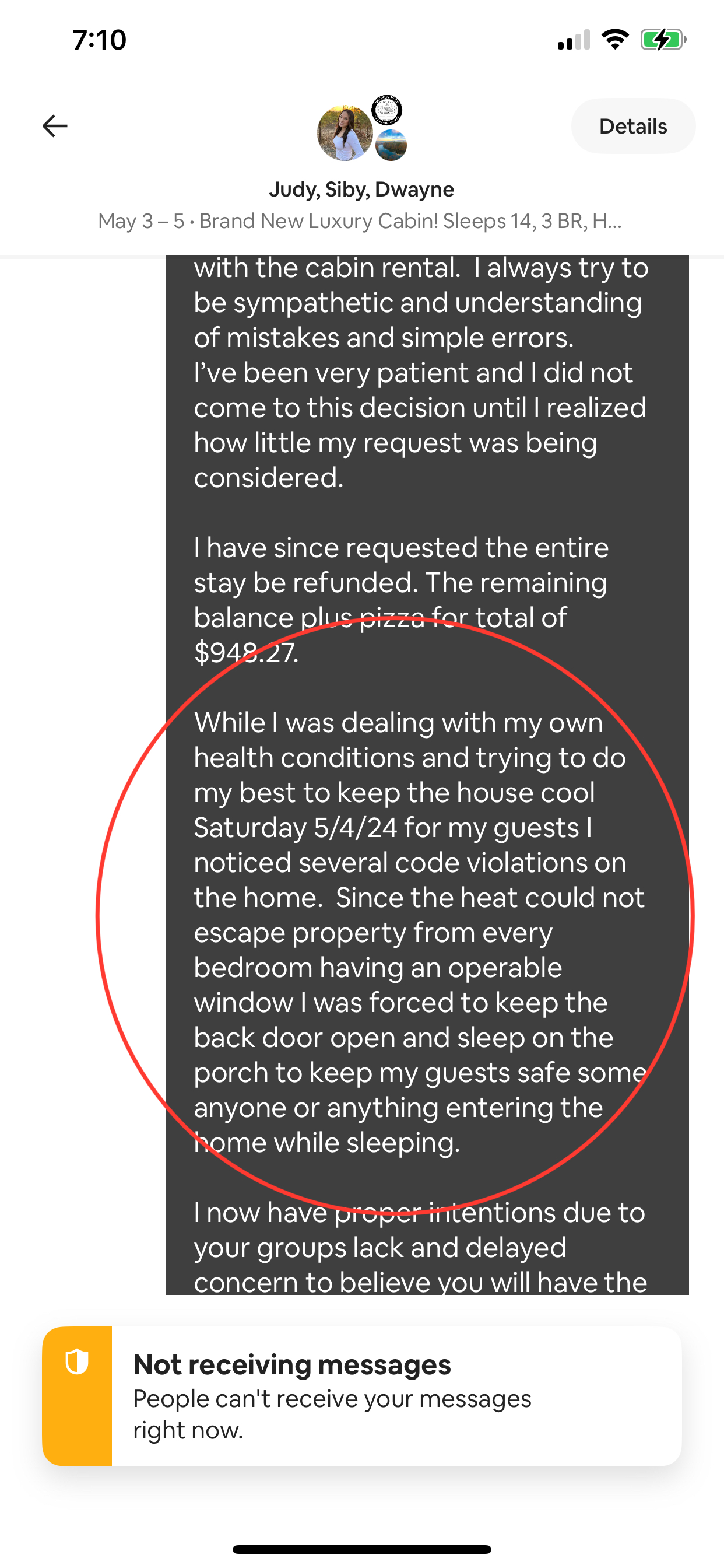

When we checked our credit report we found they had written off our debt and reported it to the credit reporting agencies as a bad debt. Even so we paid on time for 2 years and asked for some kind of statement so we would know what the balance was. Never received any information written or verbal. We continued to pay for a total of 5 years and would ask for a payoff balance occassionally. No response. I stopped paying in 2/06 after our records indicated we had paid over $5,000.00 of a $6,300.00 debt.

Now we have been contacted by a collection agency trying to collect the balance. Their figure is higher than ours by about $200.00. I do not mind paying what I owe but our concern is how do we know they are authorized to collect the debt? FCNB has also been dropped from our credit report so it will not affect us financially. The collection agency is threatening to turn in a bad report on us in an effort to force us to pay them the balance. We have heard of others who paid and still had collection agencies coming after them. Can anyone offer some advice? How can we find out if this collection agency is authorized to collect for FCNB?

Deborah

Austin, Texas

U.S.A.

3 Updates & Rebuttals

Scot

Duluth,Georgia,

U.S.A.

Is the Credit Counseling office helping you?

#2Consumer Suggestion

Fri, June 29, 2007

Deborah, Have you contact the Credit Counseling Service you used for assistance? Since part of your monthly payment to them, included a "service fee" to handle these accounts on your behalf, they should step in to help figure this out. After all, you paid them too. Good Luck, Scott

Scot

Duluth,Georgia,

U.S.A.

Is the Credit Counseling office helping you?

#3Consumer Suggestion

Fri, June 29, 2007

Deborah, Have you contact the Credit Counseling Service you used for assistance? Since part of your monthly payment to them, included a "service fee" to handle these accounts on your behalf, they should step in to help figure this out. After all, you paid them too. Good Luck, Scott

Angela

Portland,Oregon,

U.S.A.

Debt Validation

#4Consumer Suggestion

Sat, May 12, 2007

Hopefully you have your issue solved by now. I feel for you. These morons have hurt ALOT of people. Now here is what you should do. Contact the agency and ask them to validate your debt. Not alot of people know what that is or how to use it. Pretty much it is your right to challenge a debt and recieve written verification of a debt collector/ or collection agency. If a you make a timely request for debt validation and a debt collector fails to provide proper validation or does not respond at all, the debt collector may not legally continue to pursue the debt. If collection activity continues, you may file a law suit in state or federal court for violation of the Fair Credit Reporting Act. If they do not respond at all it means that the agency may not even legally be entitled to collect the debt from you. Think of it in these terms: Even if you suspected you might owe Joe (original creditor) some money, and Bob (collection agency) came up to you and asked for Joe's money - would you just hand over the cash? No. No one would. These might be some of the thoughts you would have: *How do you know that Bob is actually collecting for Joe? What legal documents does Bob have to prove that he is legally authorized to collect? *How much is the actual debt? What payments have already been made on the account? Where is the accounting of the debt, including all interest and fees? Are these fees and interest amounts legit? *Do you really owe Joe the money? Or was it actually a third party, Sam? Where is the contract showing that you made a deal with Joe and not Sam? If you keep all the legalese out of it when thinking of legal proof, you'll have an easier time figuring out what to ask a collection agency (Bob) for to validate a debt. Proof that the collection company owns the debt/or has been assigned the debt. (Bob is legally entitled to collect this particular debt from you.) This is basic contract law. It is very difficult to get a judgment without a direct contract between collection agency and the original creditor. At a minimum, some account statements from the original creditor. If you really want to get sticky, you can pin them down on the amount of the debt by requiring complete payment history, starting with the original creditor. (How the heck did Bob calculate this debt? What fees/interest Bob has tacked on to this debt and how he determined these fees?) Copy of the original signed loan agreement or credit card application. (Your contract with Joe establishing the debt between you.) However, account statements from the original can fulfill these requirements. Why should you care if a debt is purchased or assigned? In an assignment, the collection agency does not own the debt, and therefore you do not technically owe them any money. There is no way for a collection agency to prove that you owe them money because there is only an assignment of the debt and not a contract between you and the creditor. One loophole: Some contracts have the wording "debtor agrees to be responsible for payment of this debt to creditor OR ITS ASSIGNS." This IS a contract between you and the debt collector as well as the creditor and if they can provide you with a copy of a contract that states this (with your signature!), you are pretty much stuck and need to negotiate So, if a creditor can't verify a debt: They are not allowed to collect the debt, They are not allowed to contact you about the debt, and They are also not allowed to report it under the Fair Credit Reporting Act (FCRA). Doing so is a violation of the FCRA, and the FCRA states that you can sue for $1,000 in damages for any violation of the Act. I hope these tips have encouraged you. Good luck on pursuing financial freedom!