- Report: #692494

Complaint Review: Federal Trustee Services - Tacoma Washington

Federal Trustee Services WARNING - Stop foreclosure scam, purposely ripping off consumers, or just operating with extremely poor business practices? Here is my story Tacoma, Washington

*Author of original report: Added Youtube Video

*UPDATE EX-employee responds: your responsible for your home.

*Author of original report: Does not respond to the issues outlined

*Consumer Comment: Come on Lori

*Consumer Comment: Mr. Hennessy Getting foreclosed on....NO WAY?!

*Consumer Comment: Don't Lori me!

*Author of original report: Lori, the equilibrium in your deduction skills seems to be off

*Consumer Comment: Strange Days We Live In ...AND again, Come on Lori

*Consumer Comment: file a claim noah

*REBUTTAL Owner of company: THE FACTS FROM THE HORSES MOUTH

*Author of original report: Allan you've left me in awe

*UPDATE EX-employee responds: Perhaps the horse should pay his employees.

*UPDATE EX-employee responds: Company owner can't afford to pay brand new employees!

*Consumer Comment: Hey Gerald, Welcome to the Party!!

*UPDATE Employee: Why Allen Hennessey's "System" is a sham and why he thinks he doesn have to pay his workers either

*Author of original report: Even stole their website

*Consumer Comment: Quick Update

*UPDATE Employee: Ask Allen Hennessey about Lillian Calvo sometime

*Author of original report: What we have is a pure con man

*UPDATE Employee: Allan Henessey lives in a church -wait... what the hey??

*Consumer Comment: To "Sapphragette":

*UPDATE Employee: An antidote to the Hennessey

*Consumer Comment: Please....

*Author of original report: Received Refund

*General Comment: Way to go!

*UPDATE Employee: YAY Noah!

*Author of original report: Yay, indeed.

*UPDATE EX-employee responds: Update on the FTS-Hennessey Saga

*UPDATE EX-employee responds: Allen gets a new partner (remember our pal "Fake church" Willie Hughes?) - and we cant see Allen for the hyphens

*UPDATE EX-employee responds: Why you shoudn't listen to jailhouse lawyers and why Allen's few remaining friends and business associates could be liable for his debts

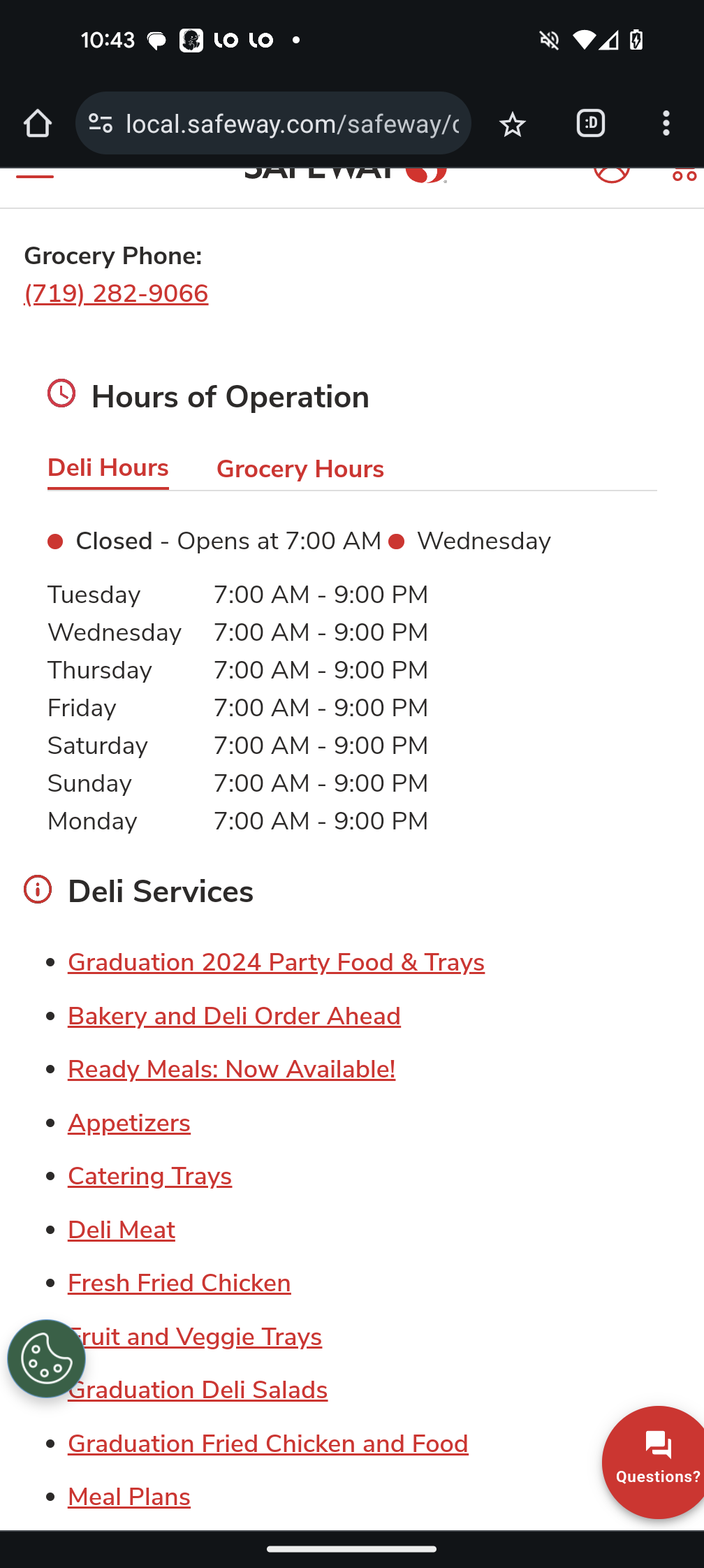

*UPDATE EX-employee responds: Consumer ALERT: Three could get you ten - Allen Hennessey's three-part-tin-foil-hat scheme could land you in trouble with Authorities

*UPDATE Employee: Federal Trustees Slapped by state government for violating workers rights

*UPDATE Employee: Federal Trustees CEO appears onstage with White Supremacists and linked to Cop killer Kanes.

*UPDATE EX-employee responds: You Don't Have to Believe Me - But You Probably CAN Believe a slew of AGs across the country, the Federal Trade Commission, THE FBI and the Federal Consumer Protection Department.

*UPDATE EX-employee responds: Federal Trustees and Mortgage Claim Center Outreach: I've got deja vue all over again and Willie Hughes just won't go away...

*UPDATE EX-employee responds: Work for Mortgage Claim Center and/or Federal Trustees and you too can get a felony conviction (Just like Allen!)

*UPDATE EX-employee responds: Forensic Loan companies like Federal Trustees under fire for fraud from the FTC

*UPDATE EX-employee responds: Federal Trustees Notary loses her license after ignoring sanctions

*REBUTTAL Individual responds: The fact is...Sapphragette that:

*UPDATE EX-employee responds: So...Ms Bennett is a "Victim"...and I am "Slandering" her?? The truth behind a Notary license revocation.

*UPDATE EX-employee responds: More from the Tin Foil hat brigade - and a reminder of the proverb "Lie down with dogs - get up with fleas"

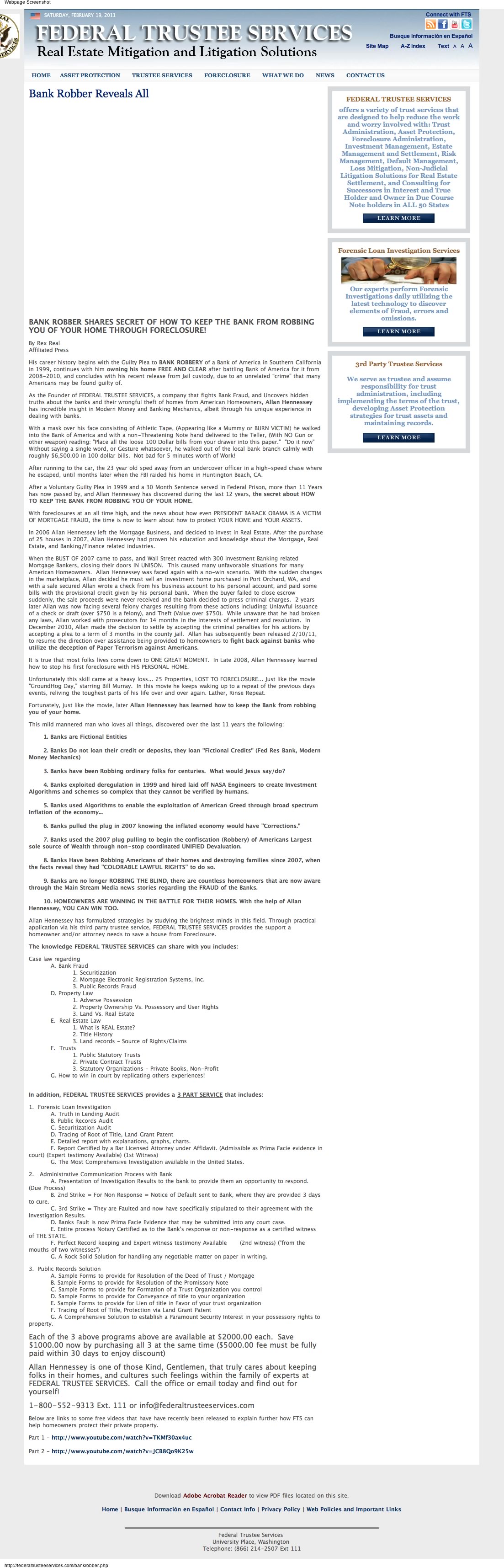

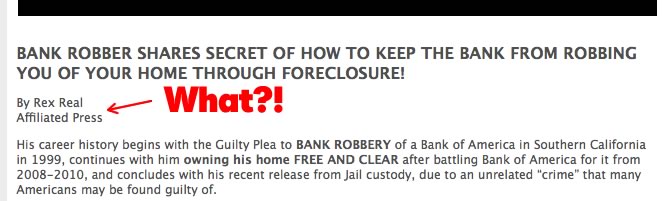

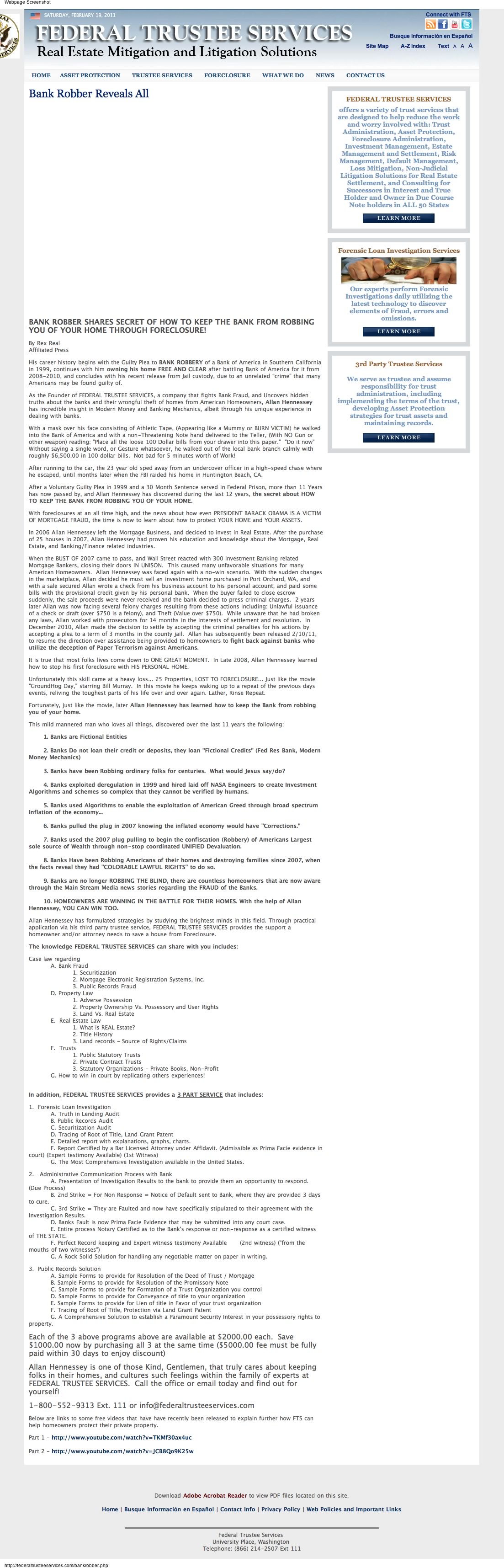

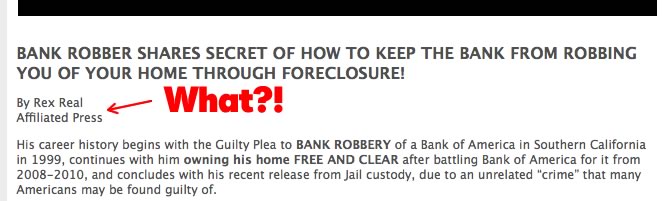

*UPDATE EX-employee responds: I call "Bull" and find out Allen Hennessey Never "Fought the banks and won" - as he claims or used his own "system"

*UPDATE EX-employee responds: Allen Hennessey found guilty of ripping off employees AGAIN

*UPDATE EX-employee responds: Tiptoe though Allens bankruptcy file and ask yourself - If Allen Hennessey "fought the bank and won" his house "Free And Clear" why is he selling it???? And at a low-low-bargain price???

*UPDATE EX-employee responds: Allen claims he just "had to go skiing" instead of paying his employees and we find out (surprise!) that his story about his latest incarceration isn't exactly true...

*UPDATE EX-employee responds: Allen Hennessey gets fined $3000 - and oh yeah - he lies like a cheap rug about his property "history"

*UPDATE EX-employee responds: Oh Allan you're so classy...

*UPDATE EX-employee responds: Lets finalize this

*UPDATE EX-employee responds: Mortgage Claim Center Outreach refuses to turn over documents required by law.

Report Attachments

Here is my story, you can decide for yourself.

http://www.scribd.com/doc/48387189/Federal-Trustee-Services-Review-of-Alleged-Foreclosure-Rip-Off-Company

This is a postmortem review of how (in my opinion) I was mislead and ripped off by this Tacoma, Washington company, claiming to stop foreclosure or help underwater home owners I've posted my story of how I feel I was ripped off by Federal Trustee Services. May this be a warning to others considering engaging with this company.

If anyone has had the same thing happen please file a complaint with the Washington State Attorney General. You can do so online.

49 Updates & Rebuttals

Sapphragette

United States of AmericaMortgage Claim Center Outreach refuses to turn over documents required by law.

#2UPDATE EX-employee responds

Sun, October 16, 2011

On September 29th, 2011 both Las Alturus Organization and Mortgage Claim Center Outreach were served with formal requests for information under the Freedom of Information Act and WA State non-profit law.

For a guy who loves "freedom" as much as Allan Hennessey claims he does - and who claims to know the law and the Constitution as well as Allen says he does - and who claims he runs a legitimate business to help people - its interesting what his response was....

Silence.

His agent wrote to the person who requested the information and said (And I quote here)

"Please call the offi e at 253 813 6679"

and no - that's his typo, not mine.

Under Federal and State law a 501(c)(3) organization must furnish a copy of its Form 1023 exemption application and all financial data immediately to any person who requests a copy.

So any current employees or current customers who think Allan and his company are legitimate - try and ask for this. It should be in the office. They should give it to you immediately. If they don't..well...

A penalty of $5,000 applies for any failure to provide copies of the required Form 990

returns or the Form 1023 exemption application.

A reputable non profit would provide these immediately to anyone who asked. A legitimate non-profit would know that they also need to provide at least the tax docs and Bylaws.

Allan has until the end of this month to pay current claims or risk further fines and (you guessed) it more jail time.

former employee

United States of AmericaLets finalize this

#3UPDATE EX-employee responds

Fri, October 14, 2011

As an ex-employee in a key position with the company, have quite a bit to say but will keep it short and state the facts.

Allan Hennessey owes his hard working employees thousands, and me personally over 4500.00 in back pay.

He is believable, and if you are facing hard times, times will get alot harder if you trust Allan Hennessey. PERIOD.

I fully agree with all the negative press, and DO NOT agree with any positive rebuttals.

I can estimate that Federal Trustee Services, or Mortgage Claim Center Outreach aka MCCO owes clients upwards of 200,000 for not performing as advertised. I am taking time out of my day to warn the public, and don't expect to ever be compensated by FTS. I'm a firm believer in "what comes arround, goes around," Allan Hennessey won't be around long with the people he has burned hunting him.

personally, i can only hope that one day i will turn around and Allan Hennessey will be standing there... he won't like the outcome very much...

Sapphragette

United States of AmericaOh Allan you're so classy...

#4UPDATE EX-employee responds

Mon, September 26, 2011

More evidence of just what a classy guy Allan Hennessey is...

Sapphragette

United States of AmericaAllen Hennessey gets fined $3000 - and oh yeah - he lies like a cheap rug about his property "history"

#5UPDATE EX-employee responds

Mon, September 26, 2011

Let's begin with a hearty shout out to all the employees who complained to Labor and Industries abut Allen Hennessey and his failure to pay his employees...

Not surprisingly, Allan's claims that no one can tell him what to do...and that Kim stole his money...and that it wasn't his fault... and the dog ate his homework... went nowhere and he lost.

Actually he didn't just lose - he pretty mich crashed and burned. Big Time. Not only did he lose but he also got fined for "deliberately" failing to pay his employees... He has until October 26 to come up with just over $6,000 or risk even more fines.

And Oh Yeah...remember that Chapter 11 Bankruptcy he tried to file on behalf of Federal Trustees claiming he was "too broke" to pay his employees AFTER he got cited by Labor and Industries the first time?

It got thrown out of court and (funny this) turns out putting a fake EIN number on a federal document is also a crime... his SECOND federal crime now, poor Allan....

No wonder it seems he skipped town like the big coward he is - leaving his business partners and his employees and his new girlfriend and her children holding the bag for him (his Facebook page says he is living back in Huntington Beach where it all started in the glory days when he was just robbing banks....)

So all is not well this week in the House of Hennessey...

And speaking of houses...

Remember how Allan tells the heartwarming story of how he owned and lost his fortune in the tricky world of real estate and that this "taught him so much" and that's why he founded Federal Trustees in the first place???

Yeah well, turns out that's a big lie... (by now this should surprise no one, of course)

On his OTHER MySpace page where he calls himself "The AUTHENTIC Allan Hennessey" (ooooo....kaaaaay...let's just not go there) which you can see here:

http://www.myspace.com/authenticallan#{%22ImageId%22%3A3150244}

Allan put up a bunch of pictures on this profile about his real estate ventures...these photos are dated December 2007 - when Allan was in his supposed heyday making his fortune...

Except Allan is just dumb enough to put the addresses on these photos.

Exhibit One: He claims a property 3727 S L Street in Tacoma, WA is his "first flip" and shows before and after pics.

Except for the small detail that ALLAN HENNESSEY never owned that property. Ever.

Neither did Gerald-ALlan Hennessey, or Gerald Hennessey or any of his 9 aliases, or any company he was ever attached to.

Follow along...

3727 S L Street was originally owned back in 1999 by a MR Spratt...who got married and the property bounced around from various family members of the Spratt family by Quit Claim Deeds until 2007.

In February 2007, Mr Spratt sold the property to a Marse L Mcnaughton for $177,000.

Now, Marse and his lovely wife Beth are a very nice Mormon family who had a number of children and several of them are local Tacoma celebrities - namely Sean who was drafted by the St. Louis Cardinals and also played for the Philadelphia Phillies and his brother Troy who also played for the Cardinals.

Not surprisingly none of these upstanding members of the community have ever heard of Allan Hennessey...

In July 2007, Marse and Beth McNaughton acting as trustees for the Mcnaughton family Living Will trust sold the property to the Lopez family - Jose and Irene to be exact - for $247,000 (After the Mcnaughtons put in a lot of renovations and fixed the place up)

In 2010 the Lopez family lost the property to foreclosure...and in April 2011 the property was picked up by a Cori Granier who is the owner at this time.

So....unless Allan Hennessey has yet another alias - as a woman - who enjoys sewing and works for a local telecommunications company - he's not Cori Granier.

In short - yet another lie from Allan Hennessey about his real estate holdings...

And I can't resist adding some of the photos available for the viewing public since Allan is too dumb to make them private... perhaps his new girlfriend will get to see them....

Its a wonderful day in the neighborhood - as long as you aren't Allan Hennessey.

Sapphragette

United States of AmericaAllen claims he just "had to go skiing" instead of paying his employees and we find out (surprise!) that his story about his latest incarceration isn't exactly true...

#6UPDATE EX-employee responds

Thu, July 28, 2011

Just after the Christmas holidays in December 2007 Allen Hennessey wrote a bunch of hot checks to pay bills... or so he says.

He told employees at a meeting in February 2011 that he had gone to jail because he "Accidentally wrote some checks" based on some real estate deals he thought were going to go through but didn't...the checks got returned and well (shrugs shoulders) it could happen to anyone - Right?

What he neglected to say that was that the "checks" he wrote were checks made out to himself and deposited at an ATM which he immediately converted to cash.

Then Allen went on a $36,000.00 spending spree that included skiing trips, lunches at expensive restaurants in Gig Harbor and to get cash for himself...and Allen was caught on camera making those fake ATM deposits!

From the declaration of Pierce County Prosecutor dated October 2009 and found in Allen's criminal file currently housed in the Pierce County Court House and available to the public (I'll try to get a jpeg of the original on here soon):

THE REAL STORY BEHIND ALLEN HENNESSEY'S LATEST INCARCERATION:

APRIL D. MCCOMB, declares under penalty of perjury:

That I am a deputy prosecuting attorney for Pierce County and I am familiar with the police

report and/or investigation conducted by the TACOMA POLICE DEPARTMENT, incident number

081230615;

That the police report and/or investigation provided me the following information;

That in Pierce County, Washington, on or about the 28th day of December, 2007, the defendant,

GERALD ALLAN HENNESSEY, did deposit check number 12558 drawn on the Wells Fargo checking account for Green Star Financial into his account with Orange County Teachers Federal Credit Union.

The deposit of the check by the defendant was captured on video.

The defendant is the listed signer on the Green Star financial checking account.

The deposit was made at a BECU ATM inside the Safeway store on North Pearl in Tacoma. The check was made out to the benefit of the defendant for $10,000.00.

The defendant then immediately withdrew $6,500.00 through ATM withdrawals, withdrawals to pay creditors and point of sale/debit card purchases.

On December 31, 2007, the defendant deposited check number 12559 also drawn on the checking account of Green Star Financial with the Wells Fargo Bank.

This check was also made out to the benefit of the defendant in the amount of $26,000.00.

The deposit occurred at the same ATM at the North Pearl Street Safeway. This transaction was also captured on camera.

The defendant then withdrew the money through ATM withdrawals, withdrawals to pay creditors and point of sale/debit purchases.

Both checks were returned for insufficient funds. The credit union re-deposited the checks but

without success.

On March 4, 2008, an investigator with the credit union spoke to the defendant who

admitted to having financial difficulties and was trying to raise money to repay the credit union.

After that the defendant refused to return any phone calls from the credit union.

On May 6, 2008, detectives with the Tacoma Police Department met with the defendant at the

police department.

The defendant was advised of his Miranda Rights and he agreed to talk to the detectives.

The defendant admitted to depositing both checks while knowing that there were insufficient

funds in the Green Star Financial account.

The defendant said that he was self employed and his business was Green Star Financial.

The defendant said that he withdrew the money from the credit union after he

deposited the checks because he needed to pay his employees.

The bank records, however, show that the defendant used the money to pay for a skiing trip with his children to Crystal Mountain and for a meal at the Sunset Grill in Gig Harbor.

The defendant said that he needed to take his kids skiing and that the meal at the Sunset Grill was when he took an employee to lunch.

Now I don't know about any of you - but I think I would know if I had $36,000 in my checking account or not...and if I didn't I probably would not go on an expensive Crystal Mountain ski vacation on the basis of it....

Also - it looks like - once again - Allen doesn't pay his employees, since despite his claims that he "took the money to meet payroll" - there's no evidence that he did anything other than buy stuff and go on vacation.

I'll also bet the "employee" he claims he took to lunch at the Sunset Grill would rather he gave them the money he owed them too...

Sapphragette

United States of AmericaTiptoe though Allens bankruptcy file and ask yourself - If Allen Hennessey "fought the bank and won" his house "Free And Clear" why is he selling it???? And at a low-low-bargain price???

#7UPDATE EX-employee responds

Thu, July 28, 2011

Interesting updates in the wacky world of Allen Hennessey et al...

Seems Allen's "home" at Alturus St West...his former business offices and where Federal Trustees is still registered with the State of WA Dept of Revenue ...which he claims he owns "free and clear" after suig his totally "awesome" "method" is now on the market...for a whole lot less than he (oops - Las Alturus Organization) paid for it in 2006 (when it went for $267,000 and he has now mortgaged it for waaaay more as we'll see below)...

But for more than the "21 dollars in silver coin" that Allen sold it for to when he sold it Las Alturus in November 2010...

Especially sad now that the county has it valued at $228,000.

Allen bought t his property with a mortgage on November 16, 2006 on a Adjustable Rate Mortgage (ARM) which, for a finance "guru" who had "learned so much from his failures" was a really dumb move for $213,600.00 with an interest rate that could float anywhere between 8.24 and 14.24% (really really dumb move).

Now get this - The very next day - November 17, 2006 Allen took out a second mortgage on the Alturus Road property for $53,400.00. (Loan Number 2200061039422 MIN 10007796000286931)

Now remember too - according to Allen this is right at the time when he claims he was amassing that real estate fortune of "twenty seven" properties across the United States - despite the fact that he had only been out of jail at this point for a few months and was still on parole.

At a floating rate in interest between 8.24% and 14.25% (which also tells us his credit was none too good)

Not surprisingly - by November 2008 he was already defaulting and the bank foreclosed on him...

By August 2009 he was declaring bankruptcy - (claiming his house was worth $246,000) and that his "unsecured debt" was a staggering $926, 632.06!!

And FYI - on page 16 of that bankruptcy he claims that his Alturus Road property is "exempt under RCW 6.13.03... " which is correct. So again - it was never part of the filing he claims as "proof".

And that bankruptcy filing??? Worth it's weight in gold for the kind of man Allen Hennessey really is...

In the same bankruptcy he claims he owes the following - all in 2007:

Lillian Calvo: $30,000

but wait there's more!!!

Sandra McWilliams of Palmdale California: $60,000.00

He also had a credit line to "KFG financial" in Scottsdale Arizona for $159,000.00

and another unsecured credit line for "UMTH Credit" of Richardson, Texas for $184,476.00

and another unsecured credit line for "Saxon" of Fort Worth Texas for $53,202 ...

and another unsecured credit line to "CW/BOA" of Dallas Texas for $213,251.00...

Actually...the list keeps going...

By 2008 he had racked up 23 separate lines of credit totaling almost 3/4 of a MILLION DOLLARS!!

Not bad for a guy who lists his assets as:

$100 cash

$200 worth of clothes

$400 computer

and a 2000 Mitsubishi Galant worth $1200.

But he couldn't pay for his over-mortgaged house... or any of his bills...despite this staggering income... and since these are "unsecured" lines of credit he wasn't buying real estate with them either...

Dollars to donuts he didn't tell these folk he was a felon on parole either...

So...where did the money go Allen????

Which is incredible when you consider he claims in the bankruptcy that his income after paying child support (which FYI he didn't until the State sued him) is $332 per month.

Allen also claims that he works as "Field Manager" for "ONESTOPTOOLBOX.COM which operates out of a PO Box in University Place... where he says he worked for 7 months.

FYI - www.onestoptoolbox.com was a previous, low-rent incarnation of Federal Trustees (A do-it-yourself kit he slels online for $99 and has claimed to staff has "nothing to do with him")

But let's leave the tortured world of Allen's finances and go back to Allen Hennessey's house...

and now the true silliness begins...

TO recap our Allen Hennessey time-line:

1999: Allen robs banks

2005: Allen gets out of jail from his California Bank robbery conviction

2006: Allen buys house on Alturus Road

2007: Allen gets $750,000 in credit lines - pays back nada to anyone.

2007: (December) Allen writes bad checks that will land him in Jail in WA

2008: (November): Allen gets his house foreclosed on

2009: (August) Allen files for Chapter 7 Bankruptcy

2009: Allen claims he starts Federal Trustee Services

2010: (February) Allen actually registers Federal Trustee Services with the State of WA

2010: (December) Allen is arrested for theft, writing bad checks and bail jumping

2010: Allen files so many nutty documents he is forbidden by the court to file more

2011: (February) Allen fails to pay employees and is cited by Labor and Industries

2011: (March) Allen claims Federal Trustees is bankrupt tries to file Chapter 11 with a fake EIN

2011: (April) Allen doesn't pay his bills and defaults on his court restitution.

The strange tale of Allen's house:

On February 2, 2010 Gerald Allen Hennessey transferred the property by Quit Claim Deed for "$21 Dollars in Silver Coin" to "Gerald-Allen [Hennessey]" (Document filed with Pierce County #201002080742)

On November 11, 2010 Allen literally transferred the property for "$21 Dollars in Silver Coin" to Las Alturus Organization (Document filed with Pierce County Auditors #201011220937) FYI -Guess who witnessed this particular piece of lunacy??? Ronnai-Kim "I'm not a criminal" Bennett!!

On November 12, 2010 Allen created a trust naming himself "Gerald Allen Hennessey" as "the Lender" claiming "Federal Homeowner Resolution Trust c/o Federal Trustee Services" as "the beneficiary" and "Federal Trustee Services" as "the Trustee" (Document filed with Pierce County Auditors #201011120927)

And just an FYI - that "Federal Homeowner Resolution Trust" has been linked to attempts to defraud people out of property by moving people into "empty" homes that weren't empty... and if you kook real close - Allen former "business manager" Rebecca seems to show up in the video... http://www.komonews.com/news/local/87178432.html

http://www.redfin.com/WA/University-Place/4031-Alturus-St-W-98466/home/2989259

Funny too - remember now - this is the house that Las Alturus Organization claimed they were using as a "Church" - yet all the real estate site shows is pictures of the empty interior - and talks about it as a residence... no evidence whatsoever that this property has ever been used as anything other than Allen's private residence...

Sapphragette

United States of AmericaAllen Hennessey found guilty of ripping off employees AGAIN

#8UPDATE EX-employee responds

Thu, June 30, 2011

When we last left Mr Gerald Hennessey (AKA Allan Hennessey now calling himself "GERALD-ALLEN" Hennessey) Federal Trustees had filed bankruptcy as a way to avoid paying employees money he owed them for back wages, unpaid wages, failing to pay minimum wage and overtime...

On June 24 he received yet another letter from the Department of Labor and Industries Employment Standards program -

It reads as follows:

"Dear Gerald Hennessey:

This is to inform you of the result of L&I's investigation of the wage complaints filed by multiple employees. This investigation shows that the employees are owed a gross total of $3,441.60. This is for unpaid minimum wage, unpaid agreed wage and unpaid overtime during their employment with Federal Trustee Services Co...

Washington law requires full payment of wages for all hours worked on the regularly established payday.

Employee C: $4xx.xx

Employee A: $1,xxx.xx

Employee B: $1,xxx.xx

Your company did not send all the of the payroll and other records requested in writing on May 13, 2011 and again on May 31, 2011.

It's very important for you to either a) Pay the employees or 2) Provide the records we requested by July 4, 2011.

If we don't receive payment of wages documents or other information that would change this decision (Ed note: believe me - they won't. Allan's "you don't have jurisdiction" argument got him nowhere... nor did his "they were all contractors" argument either) we will issue a Citation and Notice of Assessment for unpaid wages, interest and possible penalties for each employee.

Encl: Wage Payment Act

RCW 49.46, 49.48.010 and 49.52.050

WAC 296-126-021

Administrative Policies ES.A.1, ES.A.5 and ES.A.8.1."

If you or anyone you know at any time within the past three years worked for Allan Hennessey, Federal Trustees or any other Hennessey company and were not paid the equivalent of minimum wage in this state at any time during your employment - Please contact your local Labor and Industries Office and file a claim.

http://www.lni.wa.gov/WorkplaceRights/ComplainDiscrim/WRComplaint/default.asp

Sapphragette

United States of AmericaI call "Bull" and find out Allen Hennessey Never "Fought the banks and won" - as he claims or used his own "system"

#9UPDATE EX-employee responds

Sun, June 19, 2011

Remember how Federal Trustees (AKA Mortgage Claim Center AKA mortgageclaimcenter.comLLC) got started?

A poor entrepreneur, just struggling to get by buys some real estate...hoping to get a taste of that American dream....a Horatio Alger of home-ownership.

"Federal Trustee Services President, Allan Hennessey, began his education in the mortgage and real estate industry as a mortgage broker, assisting homeowners in funding mortgage loans in all 50

states. After a successful multi-year run, Allan began to personally invest in real estate. His investments took him to a peak in 2007, with the purchase of 25 properties in 4 states. However with the economy crash in 2008, mortgage funding became generally unavailable. Through changes in the real estate market and a downturn on Wall Street, Allan personally learned the reality of foreclosure as many of the properties previously purchased at foreclosure auction found their way back on the auction block. In the process of losing all 25 homes to foreclosure and a loss of more than 5 million dollars, Allan learned more from each experience about why so many foreclosures were happening nationwide, and how an industry that over a 15 year period created more millionaires that all other industries combined, could go so wrong.

With the information gained through the priceless experience of losing so much, Allan was able to discover the secret to stopping foreclosure in its tracks. Through the use of the techniques and tools utilized exclusively by Federal Trustee Services, Allan was able to field test, and prove its effectiveness by getting a Federal Bankruptcy Court to agree with his position that his home was protected and exempt from sale or foreclosure by any other parties alleging the right to his home. Allan still retains his home today, without fear of foreclosure ever again, and continues to offer his assistance to homeowners all

over the nation that are privileged to share the same outcome of remaining in their homes indefinitely."

Wow. Just makes you go all tingly don't it?

Except that not one single word of it is true.

1) Allen Hennessey was never a licensed mortgage broker. Looking at the timeline he gives - it seems hard since he was in jail from 1999 until 2005.

It can't have been before 1999 since you have to be 21 to have a mortgage brokers license and Allen was 23 when he went to jail. Convicted felons cant hold mortgage licenses so it can;t have been after 2005.... so unless Allen gave all this wonderful advice while he was underage, unlicensed or incarcerated - he simply cannot have been a mortgage broker.

2) Allen Hennessey may have at one point owned "25 properties in 4 states" but it seems unlikely given that by 1999 he was robbing banks and until 2005 he was in jail. From 2005 until he moved up here he was court mandated to live with his parents - so again - It seems unlikely he could possibly have amassed this much property - especially given that he was not allowed to leave the State of California.

In 2007 he was borrowing money from his pal's Mother Mrs Calvo (see above reports) and already claiming he owned "several properties" which Mrs Calvo later found he didn't... she states so in her documents.

So...by Allen's own time line this must have happened between 2005 when he got out of jail and 2007.

Now - if you believe that a bank or a mortgage company (ANY mortgage company) would loan millions of dollars to a recently paroled felon with no income living with his parents to buy 25 investment properties...well...I have some swamp land for you.

3) The economy "Crashed" in 2008 precisely because of people like Allen Hennessey. Like most flim-flam men, Allen tries out a story and then keeps using it if it seems to work on his "marks".

So...If Allen did in indeed get all that money from banks and mortgage companies between 2005 and 2007 - despite being a paroled felon with no income - then they had no business lending it to him in the first place. The real estate market crashed precisely because of people like Allen - buying up homes as "investments" hoping to flip a quick profit.

What Allen most certainly was NOT (by his own admission) was a struggling family with a low income, and crummy credit just trying to get a home they could live in to have a piece of the American dream.

Want to blame someone for the reason you now can't get a loan without a DNA sample and your firstborn child? Blame Allen Hennessey and his ilk. Want to blame someone for why your bank wont negotiate when you get behind and then treats you like a criminal?

Blame Allen Hennessey and his cronies.

The only mortgage "Fraud" that happened regarding Allen Hennessey was his own fraud.

4) Allen never once used the "techniques and tools utilized exclusively by Federal Trustee Services" . He did not save his home by finding exciting evidence of fraud in a "Forensic Loan Audit" nor by using a "Securities Audit". He did not file a UCC claim and "Fight the banks and win".

Allen "saved his home" precisely because he transferred his home to a bogus church and essentially lives there rent and tax free.

So...he didn't "Save his home" from foreclosure simply because he doesn't actually own any property.

There was no court case, no trial, no settlement offer...Allen never "proved fraud in his mortgage" as he claims...there was zip. Allen simply signed a quit claim deed to his bogus church and there wasn;t a lot the state could do about it.

5) As for the PROOF offered at Mortgage Claim Center:

The document Allen and Co cite at the Mortgage Claim Center Outreach website at "PROOF" on the Mortgage Claim Center tab does anything BUT prove his claims that his methods work if you look closely:

http://www.scribd.com/doc/53878069/FreeNclear-Proof

- Those "official looking" stamps all over the document saying "Void for Fraud" and "Please note"?? Not official at all (that's why you'll see "unofficial copy" across the document). For starters - courts don't do that. Run down to any stamp store and you can get one made up. Those stamps belong to Federal Trustees. They aren't legal - or even remotely official.

- That "transcript" they claim as an "Attachment" their "PROOF" ??? Well, for starters it wasn't an attachment to anything like the document they produce online. I's a part of a heavily edited transcript from Allen's 2009 Chapter 7 personal bankruptcy case - which (guess what)... Does not include any real estate holdings.

Simply put, Mr Henessey claimed no real estate property in this bankruptcy filing because he did not actually own any real estate. - and he still doesn't.

In fact, Mr Hennessey own no property in the state of Washington where he currently resides after being released from a California jail - nor does he own property in any other state in the United States.

His current home is in the name of a fake shell organization that has claimed (and still does in some places) to be a Church (though they changed their filing with the Secretary of State after we pointed it out here) .

The "officers" of this fake church and non-profit are friends of his who let him live there virtually rent free - while he takes your money for a scam operation he wouldn't even use himself!

Allen Hennessey never even used his own method - and he certainly didn't succeed in it. He just perpetrated yet another scam.

But please do yourself a favor and contact your nearest HUD approved housing assistance center before you give these people ANY money:

http://portal.hud.gov/portal/page/portal/HUD

And don't say we didn't warn you.

Sapphragette

United States of AmericaMore from the Tin Foil hat brigade - and a reminder of the proverb "Lie down with dogs - get up with fleas"

#10UPDATE EX-employee responds

Thu, June 16, 2011

If you currently doubt the disturbing links between Federal Trustees (AKA Mortgage Claim Center Outreach) and the so-called "Sovereign citizens" movement you might enjoy this November 2010 radio interview with "My-notary-license-got-revoked-but-it-wasn't-my-fault" Kim Bennett and Sovereign wing-nut radio host "Druanna MysticZone".

http://www.blogtalkradio.com/illuminatingminds

Just in case you still wanted to invest your money with and trust your home to these folks - you should know that Ms "Druanna MysticZone" describes herself on her Facebook Page as :

"I give psychic empathic Advice to those in need and help them to create the reality they choose rather then playing the victim role. I give them the tecniques [sic] t...o [sic] use in manifesting what they wish which begins with good health, eating more live foods, excercising [sic], meditation, Sound therapy etc. "

(NB I left in her nutty spelling and grammar errors for your edification)

http://www.facebook.com/DruannaPsychicAdvisor

And describes her radio show as:

"Illuminating Minds where we discuss various topics on being a Sovereign being, evolution, Commercial Remedies, Current events, conscious awareness, 2012, Ascension, health, government conspiracies, ...

politics, ufo, paranormal, psychic abilities, opening up our third eye, meditation. If you like Coast to Coast am and Prison Planet, You'll love this show! :) "

http://www.blogtalkradio.com/illuminatingminds

Druanna currently is said to be living in Mexico.

And her last name is Johnson, not Mystikzone.

And just an aside that "Prison Planet" radio show she loves is the 'brainchild' (and I use that term loosely) of one Alex Jones - who makes all of them look positively mentally healthy.

http://www.prisonplanet.com/

Alex Jones believes (and I quote here) that "the elite, again, the so-called establishment kings, those that know best, the visions of the anointed ones, are obsessed with the occult, from presidents to governors to heads of industry. We've all seen the stories of presidents and first ladies obsessed with their astrologers, making national policy decisions upon their recommendations. Spiritual guides, shamans in the White House, my friends..."

In short he believes the President of the United States, the head of Walmart, your local mayor and city council folks - all those guys are actually Devil Worshipers (or Canaannites, or Babylonians - he's a bit fuzzy on the details).

Oh yeah - he also predicted 9/11...

Well... what he actually said was something along the lines of "I always said a terrorist attack was going to happen...sometime...and it will probably be by Al-Qaeda" after the attack happened which is kind of the journalistic equivalent of saying "I told you so" after you let your kid stick their finger in a light socket and saying you "predicted" it.

Read more about Mr Jones here:

http://conspiracies.skepticproject.com/articles/alex-jones/

And if you still think Kim Bennett is a Federal Trustees "Victim" who's learned the error of her Federal Trustees ways you might want to watch this rather weird video taken just a few months ago with her and Ms Druanna:

In this video an off-screen Kim is introduced as Druanna's "Good friend" who she's "Staying with in WA state".

Now...admittedly this "Kim" doesnt appear on screen, but she is described as Druanna's "good friend", "Form Washington State" and who is a "Mortgage and Foreclosure expert" who "Helps people save their homes".

Then Druanna talk about how she and Kim are going to "Help people make money...and tons of dough" in mortgage redemption schemes - and then she blabbles on about "energy and consciousness" ...

Also in this video (where you can hear Kim Bennett talking in the background and who's distinctive voice is easily recognizable from the tons of other files and videos she has of herself on the internet) after Druanna finishes burbling nonsense about "heart chakras" she gets to her point...

Which is how to "get out of child support"..."using the Protection of Interpol"..

Oh...and how excited she is that her son will be joining her in the revolution 'just like in Egypt'. (FYI you can hear Kim cheering in the background and saying how nice it is Druanna will be with her son).

And by the way - the video (recorded in March this year) is actually called "Druanna and Kim in Washington State" (in case you were still confused about Kim's involvement with this nuttiness)

You can watch it here:

http://universallyaware.ning.com/video/druanna-kim-in-washington?xg_source=activity

It also shows up here on another nutty conspiracy website along with (Shock! Surprise!) Allen Hennessey's FTS videos:

http://www.contour2002.org/videos/druanna--kim-in-washington-state-ecovillage/VOuokfxzPLE

And that "Council of 12" Druanna talks about? They're linked to a terrifying group known as the "World Freeman Society"...

For a taste of the WFS's particular brand of violent Nuttiness you might want to look at this random page I selected from their publicly accessible web ring where they calmly discuss how and when you are "allowed" to draw a gun on a police officer who asks you to step out of your car at a traffic stop... (eerily echoing the recent shooting of officers in the Kane case in Tennessee that I've referenced before) and what a great guy felon "Chris" Piccollo is:

http://forum.worldfreemansociety.org/viewtopic.php?p=34427

Read a sensible report of this story here:

http://www.beloitdailynews.com/articles/2010/05/04/news/top_news/news402.txt

I don know about you - but I sure wouldn't want to be giving my money to folks like that...or even be caught hanging out with them...

But then... I'm not planning to make..now what was the Druanna used?

Oh yeah - "tons of dough" selling scam mortgage redemption to desperate people with knowledge I learned from White Supremacists and Sovereign citizens.

And Kim - if you're still out there... maybe your victim story would be easier to believe if you weren't still lying down with dogs.

Cheers.

Sapphragette

United States of AmericaSo...Ms Bennett is a "Victim"...and I am "Slandering" her?? The truth behind a Notary license revocation.

#11UPDATE EX-employee responds

Thu, June 16, 2011

Well...let's give a big shout-out to Ms Ronnai -Kim Bennett - former Federal Trustees Notary and Sales Rep who is currently on a big email campaign to find out my identity!!

So let's review the strange case of Ms Bennett's Notary license.

Firstly - it wasn't "Suspended", she wasn't "sanctioned", she wasn't told "Oh there was a clerical error and we're going to have to give you a teensy weensy fine and then we'll fix that right up" - her license was revoked.

You can see that notice from the State of WA here:

http://www.dol.wa.gov/about/disciplinary/disciplinarynotary.html

And it's duly noted on the State of WA licensing site:

License Details:

License Informaton:

Name: BENNETT, RONNAI-KIM

License Type: Notary Public

License Number: 19924

License Status: Revoked

First Issued Date: Nov 19 1999

License Issued: Dec 9 2009

Expiration Date: Nov 30 2013

So just how does a notary get their license revoked in WA State?

Well first they get a sanction for violating one of the RCW standards found here:

http://apps.leg.wa.gov/rcw/default.aspx?cite=42.44.080

In short (so you don't have to plow through the boring legalese unless, like me. you like that) - Notaries can get in trouble for things like not making sure someone is who they say they are, for not making sure someone is legally competent to sign a document. They can't legally notarize a document for themselves....and other things.

Basically - Notaries get in trouble for not checking that everything is on the up-and-up at the time they slap that notary seal and their signature on a document.

Ms Bennett's right - a number of Notaries have been in trouble this year lots of things - but you'll see from the link I provided that only a handful have had their licenses actually revoked.

Now Ms Bennett claims that all this wasn't her fault.

She writes:

" A series of administrative errors were made by an employee of said organization. I caught the errors and brought those to the attention of the person overseeing that department to make the corrections that I flagged on all pages. I know now that those errors were not corrected and were instead sent out"

Which basically means that Ms Bennett admits not only that she went ahead and notarized a document that she knew was incorrect (A violation)...but she then proceeded to notarize a document that she knew was going to be altered AFTER she had already notarized it... (a really big no-no).

Let's ponder this:

Firstly - she had no business notarizing a document that had errors on it in the first place.

Secondly - she had no business notarizing a document on the basis that they were going to alter it after she already claimed it was true when she slapped her stamp on it.

But let's give Ms Bennett the benefit of the doubt - maybe she didn't realize those errors until AFTER she notarized everything (though if she'd followed proper procedures its hard to see how this happened - there just simply should never be errors you find out "after the fact" if you do your job properly).

The thing is: it was still her responsibility. It was her license on the line - her duty of care to fix - not some nameless administrative assistant or even the "person overseeing the department"

A wrongly notarized document with errors in it should have been immediately shredded or destroyed and then new documents drawn up and re-executed - not notarized with errors on it and left on some clerk's desk to be "Accidentally" sent out.

So - Ms Bennett got a fine and a sanction and was mandated to take a class in notary ethics and rules.

Which she did not do. She did not fulfill the requirements from the Dept of Licensing. She did not pay her fine, she did not take her class and her license was revoked.

But apparently that wasn't her fault either (again).

Ms Bennett writes:

"The organization was to pay the fine. They did not. I opted not to renew my notary license."

Now maybe it's just me - but if my license was on the line for disciplinary actions - I'd be pretty pro-active about getting that taken care of.

If I was Ms Bennett and my license was going to be revoked and put out all over the internet as a matter of public discipline records - I'd have been on whoever was supposed to pay my fine for me like a bad rash.

Heck - if the deadline loomed and the company still didn't pay - I'd pay the fine myself and then demand they reimburse me.

What I probably would NOT do is trust a former bank robber running a scam mortgage redemption company to do the right thing.

Which apparently is exactly what MS Bennett did, which I'm not sure classifies her as a victim as much as it makes me wonder about her...on a lot of levels.

If it was me - I'd have cleared up my stuff and then - If I didn't want it renew it or be a notary anymore - I'd let my license expire when the time came so that nasty disciplinary thing wouldn't come back to haunt me.

Then the license would be expired - not revoked for disciplinary actions and not a matter of public record that there had been a violation of state code.

But that's just me.

Now - as for that SCRIBD document that MS Bennett has got all twisted up about:

I never said that it was linked directly to her license revocation.

What I did was point out the irony in Mortgage Claim Center's "PROOF" which they so proudly proclaim on their website as "THE TRUTH" that their methods work .

I think its ironic that this this "PROOF" of "THE TRUTH" (as they put it in all caps) is a document that is witnessed by a now-defrocked notary and signed by an attorney who is currently under investigation for ethical violations.

Which is a true statement.

Ms. Bennett has had her Notary license revoked, and the attorney is being investigated by the Bar Association.

Which...if I remember correctly from my law classes is a complete and total defense against defamation - not slander as MS Bennett complains. (slander is about verbal things dear - but you'll want to check with an attorney on that)

And, for the record I am NOT AN ATTORNEY - I have an advanced law degree but am not admitted to practice in the US and never have been.

What I am is a darn good investigator.

But FYI MS Bennett - attempting to harass someone at their home or place of business; calling them names and claiming they are the "attorney for FTS" on the internet with intent in an attempt to discredit them and ruin their professional reputation IS actually defamatory.

But you'll want to talk to your attorney about that.

And that's not really taking the "moral high ground" now is it?

Cheers.

Anonymous

Federal Way,Washington,

United States of America

The fact is...Sapphragette that:

#12REBUTTAL Individual responds

Thu, June 16, 2011

A series of administrative errors were made by an employee of said organization. I caught the errors and brought those to the attention of the person overseeing that department to make the corrections that I flagged on all pages. I know now that those errors were not corrected and were instead sent out. The State mailed me a copy of the paperwork showing the errors.

The link to the ScribD document that you inserted in your posting above is in no way associated with the notary violation and the notary violation is in no way linked to a "mortgage fraud scam" as you say. Seeing that you took the time to look up notary violations you will see that I am not the only notary in the State of Washington that received that same violation. There are at least 50+ notaries listed. You also didn't bother to mention in your posting the other notaries, with the same violation, who also got sanctioned and had also notarized documents for the said organization.

The "non-profit" organization was notified about the paperwork being sent out and that I had received a fine. The organization was to pay the fine. They did not. I opted not to renew my notary license.

Like you, and many others, Sapphragette, I too, was not paid by said "non-profit" organization. However, I have chosen to take a higher path rather than slander innocent people on the internet.

Sapphragette

United States of AmericaFederal Trustees Notary loses her license after ignoring sanctions

#13UPDATE EX-employee responds

Fri, June 03, 2011

This just in from Washington State Department of Licensing:

May 2011:

Ronnai-Kim Bennett Federal Way

Finding: Violated the standards for notarial acts.Action: License revoked until February 8, 2016, after she failed to comply with sanctions (pay fine and complete notary education course).

Lets see how long it takes before this document also disappears from the web:

http://www.scribd.com/doc/53878069/FreeNclear-Proof

"Mortgage Claim Center Outreach" proudly displays this as their "Proof" - a document signed by an attorney being investigated for ethics violations and a Notary who violated standards and failed to comply with sanctions.

Sapphragette

United States of AmericaForensic Loan companies like Federal Trustees under fire for fraud from the FTC

#14UPDATE EX-employee responds

Fri, May 27, 2011

Let's see how many similarities we can find between this case in which the FTC added "Forensic Loan Audit Experts" to its growing list of defendants...

and Mortgage Claim Center, Mortgage Claim Center.com and Federal Trustees...

The Federal Trade Commission has named several new defendants and added new charges concerning so-called forensic audits to its lawsuit against an operation that allegedly bilked homeowners who were trying to lower their mortgage payments....

1. The Defendants offered "forensic audits": CHECK

According to the FTCs amended complaint, the new defendants... offered forensic audits checking a homeowners loan documents for law violations that would give them leverage in negotiating with lenders to obtain a loan modification...

Mortgage Claim Center Outreach (AKA Federal Trustees) claims in its "MCCO"

http://www.scribd.com/doc/56187171/MCCO-Brief-v4

Page 2:

STAGE 1: WE PROVIDE A FORENSIC LOAN INVESTIGATION:

"We provide an extensive investigation into the "truth" regarding a homeowner's "loan" documents/transaction, and includes information regarding whether or not the transaction should have been done in the first place and other elements of fraud...

*Tip - By getting the banking parties into a default position there is now more than just a one-sided argument... Often at this point the banks just go away and the homeowner keeps their house..."

Federal Trustees claims on its website:

"In order to prevent foreclosure, it is strongly recommended homeowners take action by investigating the potential fruad practiced by the banks. Fighting back against the bank can steer a homeowner in the right direction with regaurds to protecting your well-being. "

2.The Defendants offered false claims of success for Forensic investigations in their ads: CHECK !

The FTC brief notes that: "Their ads stated, We have found that between 80-90% of all loans that we have audited have some form of rights violations.

On p 6: MCCO claims:

"We are proud to offer a 100% money back guarantee if the results of the investigation reveal no clam for the homeowner to pursue..."

Federal Trustees claims on it's website:

"Wake up folks MERS is a SHAM. Everyone knows it and there is no factual basis to support their assertions to rights to foreclose. One word sums it up: FRAUD."

3. The FTC charged the new defendants with falsely claiming that as a result of forensic loan audits consumers would obtain completed short sales or loan modifications that would make their mortgage payments substantially more affordable...CHECK!

Federal Trustees claims on its website:

"With the information gained through the priceless experience of losing so much, Allan was able to discover the secret to stopping foreclosure in its tracks. Through the use of the techniques and tools utilized exclusively by Federal Trustee Services, Allan was able to field test, and prove its effectiveness and [that] his home was protected and exempt from sale or foreclosure by any other parties alleging the right to his home. Allan still retains his home today, without fear of foreclosure ever again."

Allen himself had this to say in a radio interview which he proudly displays on his website:

" Now, the majority of our clients, the far majority, we find fraud in their case, and sometimes its as simple as just looking at what the public records documents reveal. So, at the end, most of our clients

they end up with evidence and information and a record of the communication between the bank that reveals that essentially the facts translate that there is no debt on the property..."

Mortgage Claim Center claims on its website:

"With the information gained through the priceless experience of losing so much, our experienced staff, through co-op, has been able to discover the secret to stopping foreclosure in its tracks. Through the use of the techniques and tools utilized exclusively by Mortgage Claim Center Outreach, our staff has been able to field test, and prove effectiveness... that many homes are protected and exempt from sale or foreclosure by any other parties alleging the right to the homes.

Many of our staff are clients and still retain their homes today, without fear of foreclosure ever again, and

continue to offer their assistance to homeowners all over the nation that are privileged to share the same outcome of remaining in their homes indefinitely."

4. The defendants charged customers $1,500 based on the alleged false promise that it would get homeowners loans modified to make their mortgage payments more affordable - CHECK!

Mortgage Claim Center p 5:

WHAT OUR PROGRAM COSTS:

1st Stage: $2000

2nd Stage: $2000

Third Stage: $2000

2nd mortgages are prices the same and must be paid for in addition to the original mortgage.

Take advantage of our $1000 discount and pay a total of $5000 with purchase of all three stages when paid in full within 30 days ($2000 minimum needs to be paid before services can begin).

5. The FTC alleged that defendants falsely claimed that they had helped more than 90 percent of their clients, and that they would refund consumers money or pay a penalty if they failed.

CHECK!

In a recent letter to the Disciplinary Counsel of the Washington State Bar Association Mr Hennessey's personal and corporate attorney (who also was and still is an employee of the firm) boasted that Federal Trustees has "helped 100's of clients".

Allen himself claims in the above interview:

"Yeah, you know, weve had a long standing guarantee that if we dont find fraud or some sort of claim with regard to the transaction, then we refund everybodys money 100%. Like I said, that is a rarity."

On its Twitter account Mortgage Claim Center claims:

"how Foreclosure works http://bit.ly/foreclosureworks we give you the facts to take to court to stop foreclosure http://bit.ly/mortgagefacts"

Mortgage Claim Center on its website even claims Obama was falsely foreclosed on(!):

"Discover how Americas Commander in Chief is included in the list of victims of mortgage fraud, specifically with regard to the public recordand the robosigning phenomenon that has taken the financial industry bystorm"

But wait there's more!!!

Here's what happened to some of Allen's fellow partners in crime:

- Segal and Workman allegedly ran a bogus mortgage foreclosure relief operation that misrepresented both the loss mitigation services it offered and the earnings potential of the business opportunity it sold...Pending court approval, would ban Jeffrey Segal and Michael Workman from working in the loan modification industry and bar them from misrepresenting material facts in selling any goods or services. The settlements also would impose suspended judgments of $5,462,432...

- The FTC has obtained a stipulated order that bans Thomas Ryan from offering mortgage relief services. The FTC alleged that his Web sites bailout.hud-gov.us and bailout.dohgov.us, which featured an official looking seal and the names of federal homeowner relief plans misled homeowners that he was the U.S. government. The settlement order also bars Ryan from making misrepresentations about financial related or any other goods and services.

- The FTC has obtained a partial settlement that, pending court approval,will prohibit the allegedly deceptive practices of Brian Blanchard, soleowner of B Home Associates, LLC d/b/a Expert Foreclosure, and MichaelGrieco, both of whom are part owners of Home Assure, LLC. misrepresenting material facts about any goods or services and selling or otherwise disclosing personal information about anyone who paid them.The orders impose suspended judgments of $3,849,919.84 and$3,721,807.84 on Blanchard and Grieco. They falsely promised consumers that they could stop foreclosures, regardless of how much money consumers owed, charged up to $2,500 in advance, and promised a full refund if they failed

http://www.loansafe.org/ftc-broadens-case-against-mortgage-relief-scheme-charges-that-forensic-audits-were-unlikely-to-help-homeowners

http://www.ftc.gov/opa/2009/11/stolenhope.shtm

Report Attachments

Sapphragette

United States of AmericaWork for Mortgage Claim Center and/or Federal Trustees and you too can get a felony conviction (Just like Allen!)

#15UPDATE EX-employee responds

Fri, May 27, 2011

An employee of a "mortgage rescue" scam similar to that offered by Mortgage Claim Center and Federal Trustees is now doing time - 'cause these schemes are a crime...

FTC law forbids mortgage relief companies like Mortgage Claim Center/Mortgage Claim Center.com/ Federal Trustees from:

- Charging up-front fees

- Pretending affiliation with the government or government programs

- Telling homeowners to stop communicating with lenders

- Making false claims about successful modification rates

The FTC notes in its latest brief:

"It can be difficult to track the total number of mortgage relief companies trying to scam homeowners, but the FTC estimates that at least 500 are currently operating. State governments alone have gone ederal Trustee Services running a foreclosure scam, purposely ripping off after 450 such companies since 2008.

In response, the companies will often change names, addresses and phone numbers, in order to prevent

having to refund customers and to make them less visible to enforcement agencies..."

Local man sentenced in loan fraud case

May 13, 2011 7:06 AM

THE RECORDER

Albert J. Carazolez, 43 of Porterville was sentenced Wednesday to 300 days in county jail, five years felony probation and ordered to pay over $20,000 in restitution for foreclosure and loan modification fraud, the Tulare County District Attorneys Office reported Thursday.

According to the District Attorneys Office, the case began in July of 2009, when Investigator Dwayne Johnson began looking into complaints against Carazolez Porterville business, Quick Action Paralegal Services. The investigation revealed that Carazolez was illegally offering to provide loan modification services and negotiated the services for an up front fee, usually around $1,500. Most of the modifications, the DA reported, did not work out and as a result, some victims lost their homes.

Carazolez pled no contest to four felony counts of foreclosure rescue fraud, four misdemeanor counts of foreclosure rescue fraud, nine counts of demanding up front payments for loan modification services, two counts of practicing without a license, one count of violation of loan

modification contract disclosure laws and one count of failure to register as a legal document assistant.

He was ordered to repay $20,630 to 15 named victims, $5,000 of which he had already paid, the DA reported.

Accepting advanced fees from persons facing foreclosure has long been illegal in

California. Con artists typically demand large advance payments and then perform little to no work of value.

During the current real estate crises, the problem has extended to loan modifications as well. Citizens should know that no reputable company will demand an advance fee for working on a loan modification, the DAs Office reported in a statement.

This case was prosecuted through the Real Estate Fraud Program of the Tulare County District Attorneys Office.

http://www.recorderonline.com/news/county-48747-sentenced-fraud.html

Sapphragette

United States of AmericaFederal Trustees and Mortgage Claim Center Outreach: I've got deja vue all over again and Willie Hughes just won't go away...

#16UPDATE EX-employee responds

Thu, May 26, 2011

Recently an unknown "customer" calling him or herself "M.K" wrote this on another site:

"Mortgage Claim Center is its own independent entity and has taken over all clientele and files from Federal Trustee Services and continues to offer services for existing and future homeowners. I have been working with Mortgage Claim Center for some time now and have only received excellent customer service and am very satisfied with the results of my enrollment. I suggest that individuals

take it upon themselves to conduct their own research before making fictitious and libelous statements.

So...let's examine the connection between Federal Trustees and "Mortgage Claim

Center Outreach" and "Mortgage Claim Center.com" :

"Mortgage Claim Center" in it's various incarnations is just as bogus an operation as Federal Trustee Services is - probably because exactly the same people behind Mortgage Claim Center Outreach and MortgageClaimCenter.com LLC are behind the still-in-business (and

just as bogus) Federal Trustee Services.

From the public records:

MORTGAGE CLAIM CENTER OUTREACH

UBI Number 603063451

Category REG

Nonprofit

Active

State Of Incorporation: WA

WA Filing Date 11/16/2010

Expiration Date 11/30/2011

Registered Agent:

Agent Name WILLIE HUGHES

Address 1402 AUBURN WAY N #116

City AUBURN

State WA

ZIP 98002

MORTGAGECLAIMCENTER.COM, LLC

UBI Number 603094483

Category LLC

Profit

Active

State Of Incorporation WA

WA Filing Date 03/10/2011

Expiration Date 03/31/2012

Agent Name MORTGAGE CLAIM CENTER OUTREACH

Address 102 PREFONTAINE PL S

C/O WILLIE HUGHES

City SEATTLE

State WA

ZIP 98104

FEDERAL TRUSTEE SERVICES CO

UBI Number 602992396

Category REG

Profit

Active

State Of Incorporation WA

WA Filing Date 02/10/2010

Expiration Date 02/29/2012

Registered Agent Information

Agent Name WILLIE HUGHES

Address 102 PREFONTAINE PL S

City SEATTLE

State WA

ZIP 981042614

Governing Persons:

HENNESSEY, GERALD-ALLAN

102 PREFONTAINE PL S

SEATTLE, WA

The mysterious M.K claims to have been working with "Mortgage Claim

Center for some time now" - which seems to bend the space time continuum since that company only came into existence in March 2011 - and only after Federal Trustees was investigated by the State of Washington Department of Labor and Industries for non-payment of

wages and underpaying its employees, and after the employed complained and after the offices of Federal Trustees mysteriously moved to exactly the same offices that "Mortgage Claim Center" operates out of...

Hmmmm.

Also - on the "independent entity" website for Mortgage Claim Center at http://mortgageclaimcenter.com is a nifty little tab marker PROOF in all capital letters.

This nifty tab leads you to a website at: www.http://www.scribd.com/doc/53878069/FreeNclear-Proof.

And a very handy PDF file which was prepared by one Lakisha Morris Esq at Federal Trustee Services for that notorious Alturus Drive property "owned" by Mr Gerald Allen Henessey.

Ms Morris headed up the "Forensic Audit" program at Federal Trustees.

And just to reiterate here:

1) Mortgage Claim Center Outreach and MOrtgageclaimcenter.com LLC claim to be "independent" of Federal Trustees.

2) They have exactly the same corporate officers and address as Federal Trustees.

3) They operate out of the same offices that Federal Trustees moved to

4) Which are the same offices as Lakisha Morris Esq operates out of (who acts as Allen Henenssey's personal Attorney)

5) Which uses "PROOF" (to quote them) which eerily echo the exact same claims made at http://federaltrusteeservices.com/ ; use Allen Hennessey and his infamous property on Alturus Drive as their "PROOF" (to use their wording) of the validity of the work done by Mortgage Claim Center, follow the same process as Federal Trustee Services and use the same pay scale.

Soooooo...M.K. either this is one hell of a set of coincidences between Federal Trustees and Mortgage Claim Center - or you just got Hennessied.

Sapphragette

United States of AmericaYou Don't Have to Believe Me - But You Probably CAN Believe a slew of AGs across the country, the Federal Trade Commission, THE FBI and the Federal Consumer Protection Department.

#17UPDATE EX-employee responds

Sat, May 21, 2011

The Federal Trade Commission (FTC), is the largest consumer protection agency in the US.

They have this to say about "Forensic Loan" Programs:

" In exchange for an upfront fee of several hundred dollars, so-called forensic loan auditors... backed by forensic attorneys offer to review your mortgage loan documents to determine whether your lender complied with state and federal mortgage lending laws.

The auditors say you can use the audit report to avoid foreclosure, accelerate the loan modification process, reduce your loan principal, or even cancel your loan.

Nothing could be further from the truth. According to the FTC and its law enforcement partners:

There is no evidence that forensic loan audits will help you get a loan modification or any

other foreclosure relief, even if theyre conducted by a licensed, legitimate and trained auditor, mortgage professional or lawyer.

Some federal laws allow you to sue your lender based on errors in your loan documents. But even if you sue and win, your lender is not required to modify your loan simply to make your payments more affordable.

If you cancel your loan, you will have to return the borrowed money, which may result in you losing your home..."

You can read the whole document here on the official FTC website: http://www.ftc.gov/bcp/edu/pubs/consumer/alerts/alt177.shtm

The California Department of Real Estate recently issues similar warnings:

http://www.dre.ca.gov/pdf_docs/ConsumerWarningForensicLoanAudits.pdf

and recently took lawyers to court seeking million of dollars in damages for "Forensic loan audits"

http://www.law.com/jsp/article.jsp?id=1202473115182&rss=newswire&slreturn=1&hbxlogin=1

Attorney's General across the country have also issued consumer warnings:

In Idaho:

http://www.ag.idaho.gov/media/consumerAlerts/2010/ca_05192010.html

In Montana:

http://www.doj.mt.gov/consumer/foreclosure/default.asp

In Virginia:

http://www.vaag.com/PRESS_RELEASES/Cuccinelli/030611_Consumer_Protection_Week.html

In Florida (particularly interesting since this one advises folks to avoid "businesses that use names or symbols which mimic federal and state programs or falsely suggest they offer legal services or are affiliated with an attorney or law firm.":

http://www.myfloridalegal.com/NewsBrie.nsf/OnlineAlerts/1C1F471E8F807DA38525756E005D98AA

The State of New York is actively shutting down companies like Federal Trustees:

http://www.ag.ny.gov/media_center/2010/mar/mar25a_10.html

And If all that doesn't sway you - you may want to read this - the new guidelines put out by the FTC for companies like Allen's as of November 2010:

"The most significant consumer protection under the FTCs new rule is the advance fee ban. Under this provision, mortgage relief companies may not collect any fees until they have provided consumers with a written offer from their lender or servicer that the consumer decides is acceptable, and a written document from the lender or servicer describing the key changes to the mortgage that would result if the consumer accepts the offer...."

http://www.ftc.gov/opa/2010/11/mars.shtm

Please do NOT do business with this company now also calling itself "Mortgage Claim Center LLC"

Sapphragette

United States of AmericaFederal Trustees CEO appears onstage with White Supremacists and linked to Cop killer Kanes.

#18UPDATE Employee

Sun, April 17, 2011

Just a final note -

Allen Hennessey's current mortgage-foreclosure prevention playbook comes straight from the squirrelly mind of one Roger Elvick of "Patriots for Profit" and the so-called father of the "Redemptionist" movement. (Roger is mentioned in an earlier post here on The Ripoff report)

Elvick's "Redemptionists" have been linked to Neo-Nazis and the White Supremacist movement, and are generally considered the the repository of the more bizarre legal theories held by Sovereign citizens.

In addition many "Redemptionists" subscribe to the beliefs of the Christian Identity

movement which espouses such choice religious theories as people of color have no souls and that salvation can only be achieved by white people.

Elvick has claimed among other things that since his birth certificate was in "ALL CAPS" that this was a "legal fiction" (Just like Allen does in his UCC filings and what he tells people in his trainings and what staff are told specifically to do in all reports and documentation).

Mr Elvick then claimed he couldn't go to jail for fraud since ROGER ELVICK committed any supposed

crimes not "Roger Elvick".

During the 1990's Elvick devised a series of farm loan scams, mortgage "recovery" scams

and other financial and legal shenanigans based on a slew of his nutty "Redemptionist Theories" taken from a combination of Canaanite Law and the movies The Matrix and The Wizard of Oz.

Elvick and his followers also claim that UCC filings are completely legal and that by doing things like adding hyphens to your name, you can create a "New" legal identity for yourself.

Elvick was in federal custody for fraud and other charges for several years but was released in 2010.

One of the first things he did when he got out was appeared onstage with...Allen Hennessey at a special "Winston Shrout" event.

See the link here: (Go to the tab marker "resources")

http://www.commercialredemption.com/index.html

The Southern Poverty Law Center which monitors hate groups have been Roger Elvick, Winston Shrout and their various groups and offshoots for years.

http://www.splcenter.org/get-informed/intelligence-report/browse-all-issues/2010/fall/the-sovereigns-leaders-of-the-movement

This event was where Allen was filmed a "Winston Shrout event" at which Roger Elvick was the featured speaker :

See here:

http://www.youtube.com/watch?v=TKMf30ax4uc

And here:

http://www.youtube.com/watch?v=JCB8Qo9K25w

So while Mr (insert alias here) Hennessey may be nothing more than a sleazy con artist and shyster fleecing a desperate public trying to save to heir homes by any means possible - he has concrete links to some very serious, and potentially dangerous folks.

Just to also point out - on the same page you'll see links to seminars on mortgage redemption being given by Jerry and Joe Kane.

The Kane were killed last year in a bloody shootout with police - killing two officers.

See the report here:

//abcnews.go.com/WN/deadly-arkansas-shooting-sovereign-citizens-jerry-kane-joseph/story?id=11065285

No wonder Allen doesn't think the law applies to him.

Sapphragette

United States of AmericaFederal Trustees Slapped by state government for violating workers rights

#19UPDATE Employee

Sun, April 17, 2011

The state of Washington Department of Labor and Industries Employment Standards Program found Federal Trustee Services Co guilty of violating WA State law for failing to pay wages and overtime to one of their Investigators and for failing to pay these wages and overtime on a regularly established payday.

FTS tried to argue that the employee was a "contractor" but NONE of their arguments were held to be valid.

Once again - FTS is found to be in the wrong, and both Allen and Federal Trustees have no idea how the law and judicial system work.

If ANY current or Former employees of Federal Trustee Services read this - you have 3 years to file a claim with the Washington State Department of Labor and Industries. If you were an Investigator or other staff in the Investigations Department you are entitled to AT LEAST minimum wage each week ($8.67 per hour so $346.80 per week for a 40 hour week) and overtime for each hour over 40 that you worked (at time and half of $13.01 per hour). If your work did not add up to minimum wage then FTS by law must pay you the difference.

FTS Investigations staff (including the folks who work on the UCC documents, office staff and others) are entitled to hourly wages and overtime.

In addition Associates may also be able to claim for overtime and minimum wage - though the rules are a little different for folks who are doing "outside sales" call your local Labor and Industries office and talk with them about what you can do.

Sapphragette

United States of AmericaConsumer ALERT: Three could get you ten - Allen Hennessey's three-part-tin-foil-hat scheme could land you in trouble with Authorities

#20UPDATE EX-employee responds

Tue, March 15, 2011

Just a final update - "Allen" Hennessey's "Three Part Plan" can also potentially land you in severe hot water with the federal government, IRS, local and state tax authorities and even potentially land you in jail on federal fraud charges.

1) Allen will encourage you to have everything sent to a PO box or other address instead of your actual address

This could make you liable for: Occupancy Fraud and tax evasion

If you’re a home owner, or simply own more than one property, it’s critical that your bank and other financial statements are mailed to your primary residence each month.

If you claim one house to be your owner-occupied property, but your bank statements and other financial materials are currently going to another property or a PO Box (unless you live in a rural area or have some other legitimate reason for this) , the underwriter and fraud folks will surely question just who is actually occupying your home and why you don't want them to know about it.

In the eyes of your bank, it doesn’t make sense for you to have mortgage statements, cable bills, and other financial statements sent to a property where you don’t live for the sheer reason it just doesn't make sense to do so. This is actually a huge red flag banks and local and federal tax authorities look out for and it can, in some cases, be considered evidence of an intentional fraud since it looks like you are trying to claim tax breaks and other benefits as an owner-occupier on a property you don't actually live in.

Even if you do live in the property - it means you still have to go through the mess of an investigation while they make their determination - further damaging your reputation with the bank and your credit.

2) Allen will tell you to file your UCC paperwork with your name in "ALL CAPS" and this will "protect your assets" because you are creating a "new legal entity".

This could make you liable for Nominee/Straw Buyer fraud

This area of fraud can be really confusing, since there are some genuinely legitimate legal ways to use this kind of tactic. Unfortunately Allen Hennessy's loony way isn't one of them.

A good way to figure out if this is a legitimate way to transfer your property and stop foreclosure is to ask an actual attorney.

Make sure to ask an actual attorney (NOT one of Allen's "employee" attorneys and not Allen's tin-foil-hat pals on the Internet either).

The problem for people who follow Allen's ALL CAPS scam is there's a fine line between utilizing "investors" and using a straw buyer.

Allen and his nutty conspiracy pals will tell you, for example, that the fact that whenever your name is printed in ALL CAPITAL letters it means you as a person (your name in small letters here) "don't exist" and are therefore (you in small letters) are legally "invisible" .