- Report: #1207530

Complaint Review: Capital one 360 - Internet

Capital one 360 Capital One 360 --Ing Direct How Insecure is Your Money with CapitalOne 360? Internet

Report Attachments

On Capital One's 360 Security Page for online banking, they assure us that our money is safe. Feel secure? Well, don't. Capital One 360 will let fraudulent charges pile up and do absolutely nothing about it. Plus, once you do find out, they will not reimburse you no matter what type of proof you have. I didn't open a Capital One 360 account. Ing Direct became Capital One and I was an Ing Direct customer. I had qualms so I left some money in thinking I could use them for online purchases. Huge mistake! Huge. And it's cost me over $400. I have a clue when it began. Before March 2014, I bought a few things here & there. Mostly gas. Few online purchases from reputable companies. In March Facebook decides to get into the banking arena. With their all new encompassing Policy Agreement, they pretty much say that all or any financial data, including private data used by an FB member on their site becomes theirs also to use when they see fit.

Enter Capital One 360 via iTunes and my money began to be systematically siphoned out every other day, sometimes three and four times a day. How? I would put my Capital One card into iTunes when I used it and then removed it via settings on my iPad. I had been playing a particular game and needed play cash. The $9.99 charge became a $19.99 charge: $24.99; $14.99; $1.99; $2.99; .30cents (yes, .30 cents). These were almost daily charges. Why didn't I know? My mother became ill. I was distracted, driving 250 miles back and forth, helping Hospice and my step father. Plus, I wasn't using the card frequently. Before March 2014 there had been little activity. After March, which coincides with Facebook's new Policy, I was supposedly glued to the internet racking up charges on one, yes...one game. No, not Candy Crush. A game called Pearl's Perils. Did I buy anything? Yes. Unfortunately for me, I bought some play cash to open up land. Was I buying play cash daily? No.

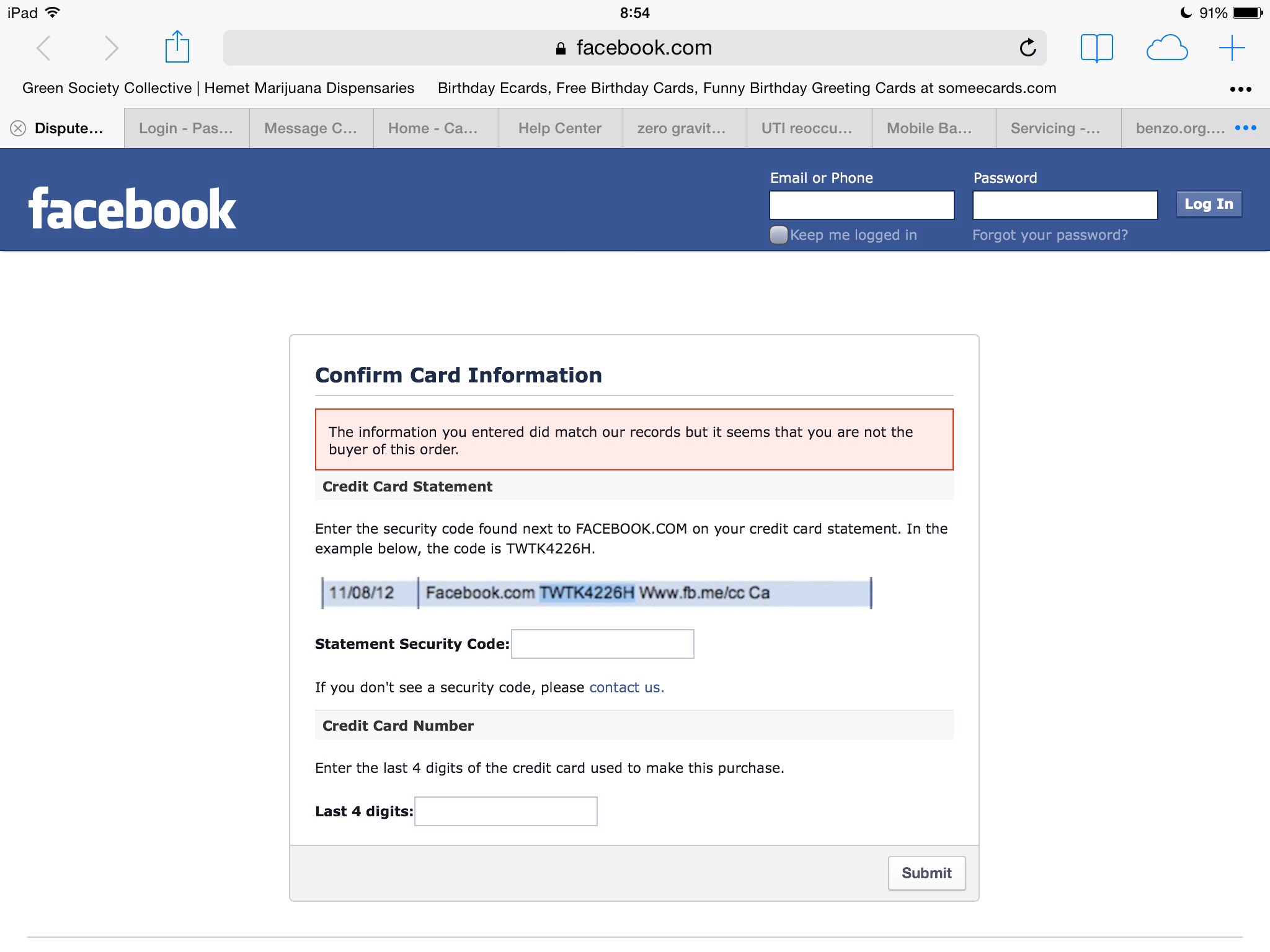

There wasn't any need to buy play cash except occasionally. After my mother's death, I checked my balance on my Capital One 360 card. I almost keeled over. iTunes, iTunes, iTunes. Every single date had iTunes on it. I immediately called iTunes. They didn't even hesitate. They could only reverse 90 days worth. iTunes was obviously very used to reversing online game charges. iTunes had become so alarmed at the extent of the charges, they blocked the game and stopped paying. Now this becomes bizarre. I go into my FB settings to remove the game App and notice PayPal as my FB Account mode of payment. PayPal? How did Facebook get my PayPal Account information? I never used PayPal for anything on FB! How did they get my password? My email associated with PayPal? It gets worse. I log into Paypal and see iTunes charges in there. But next to them, it read "Denied." One line down, it reads: Facepay (or something similar).

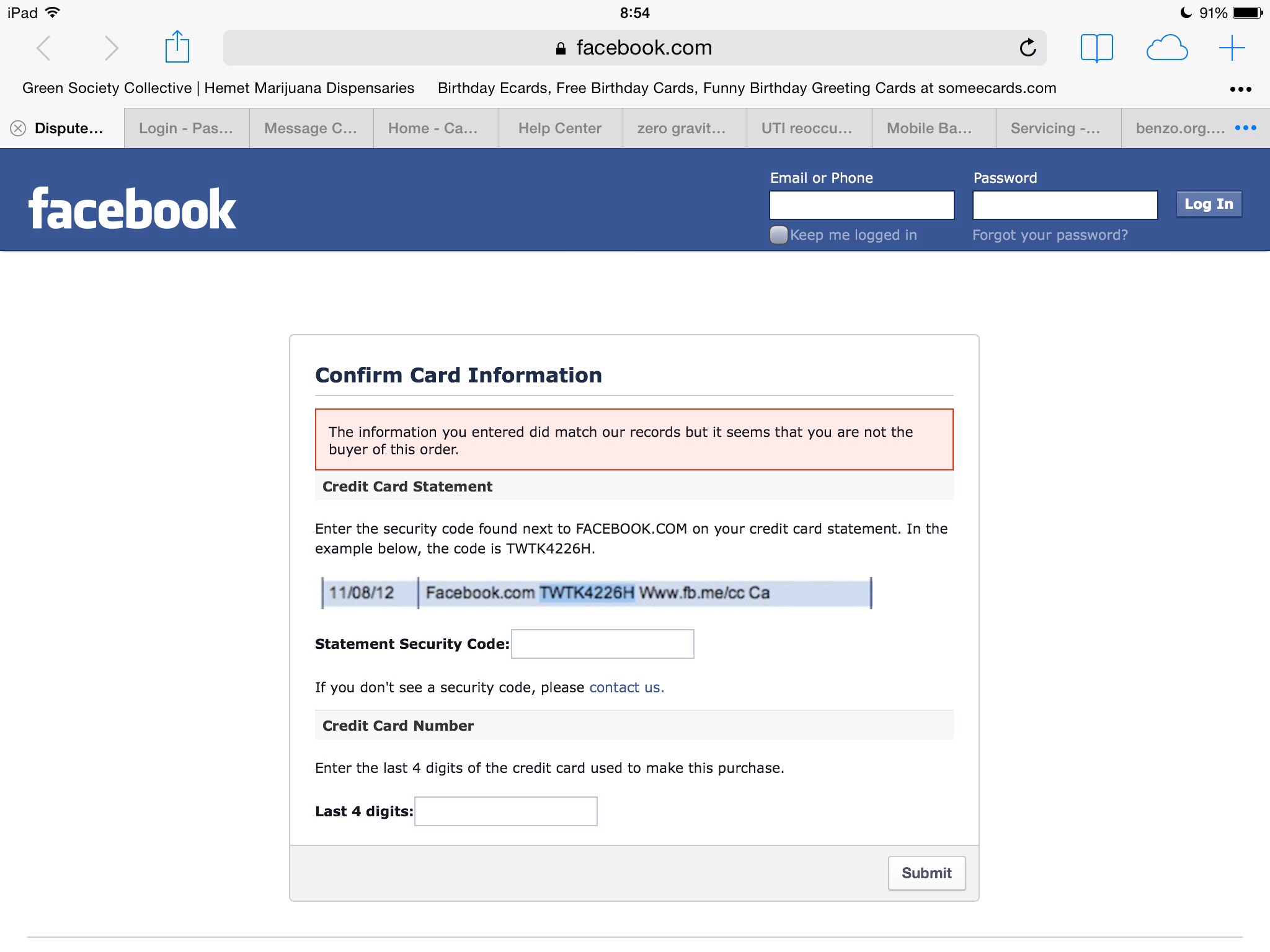

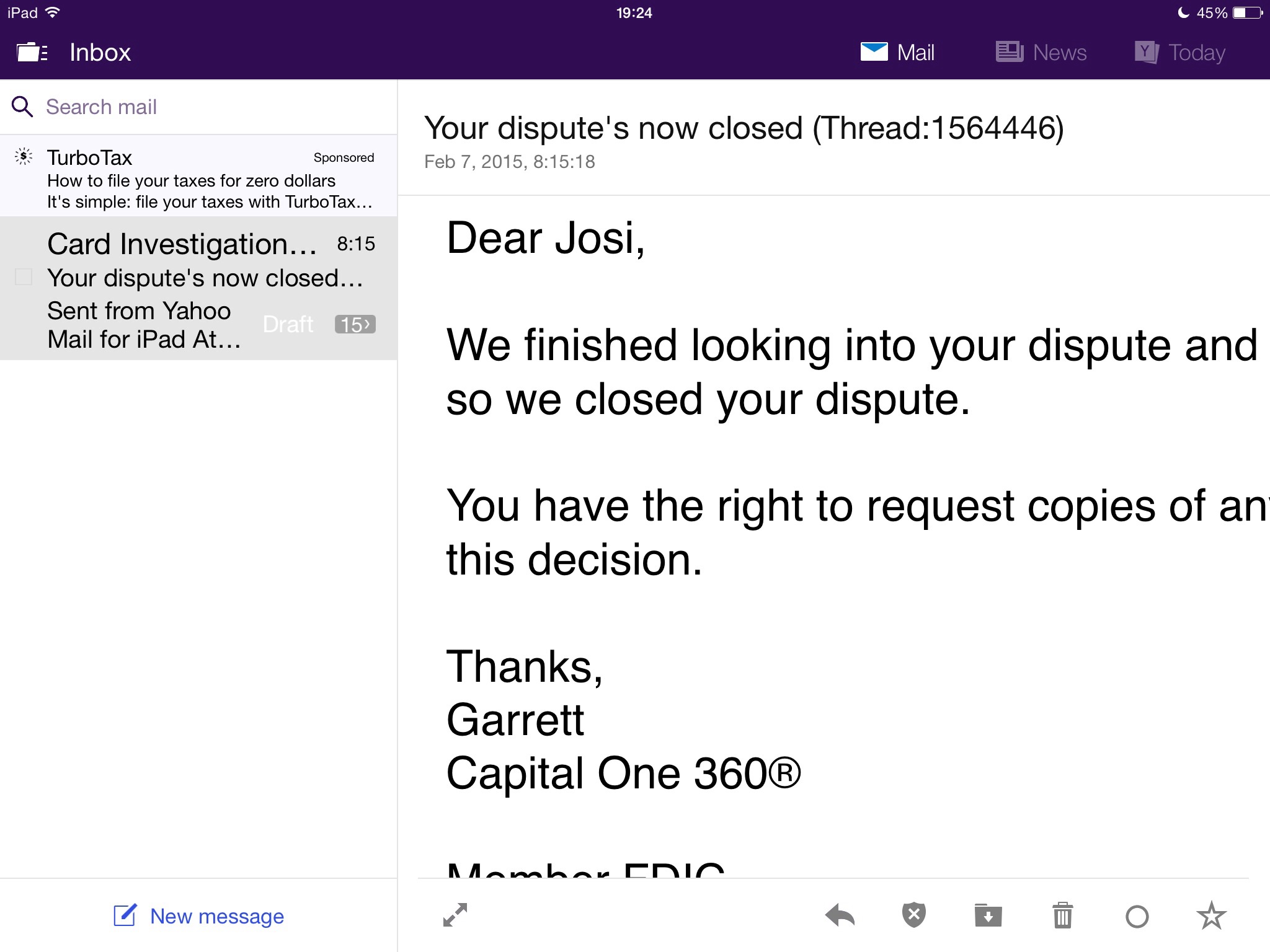

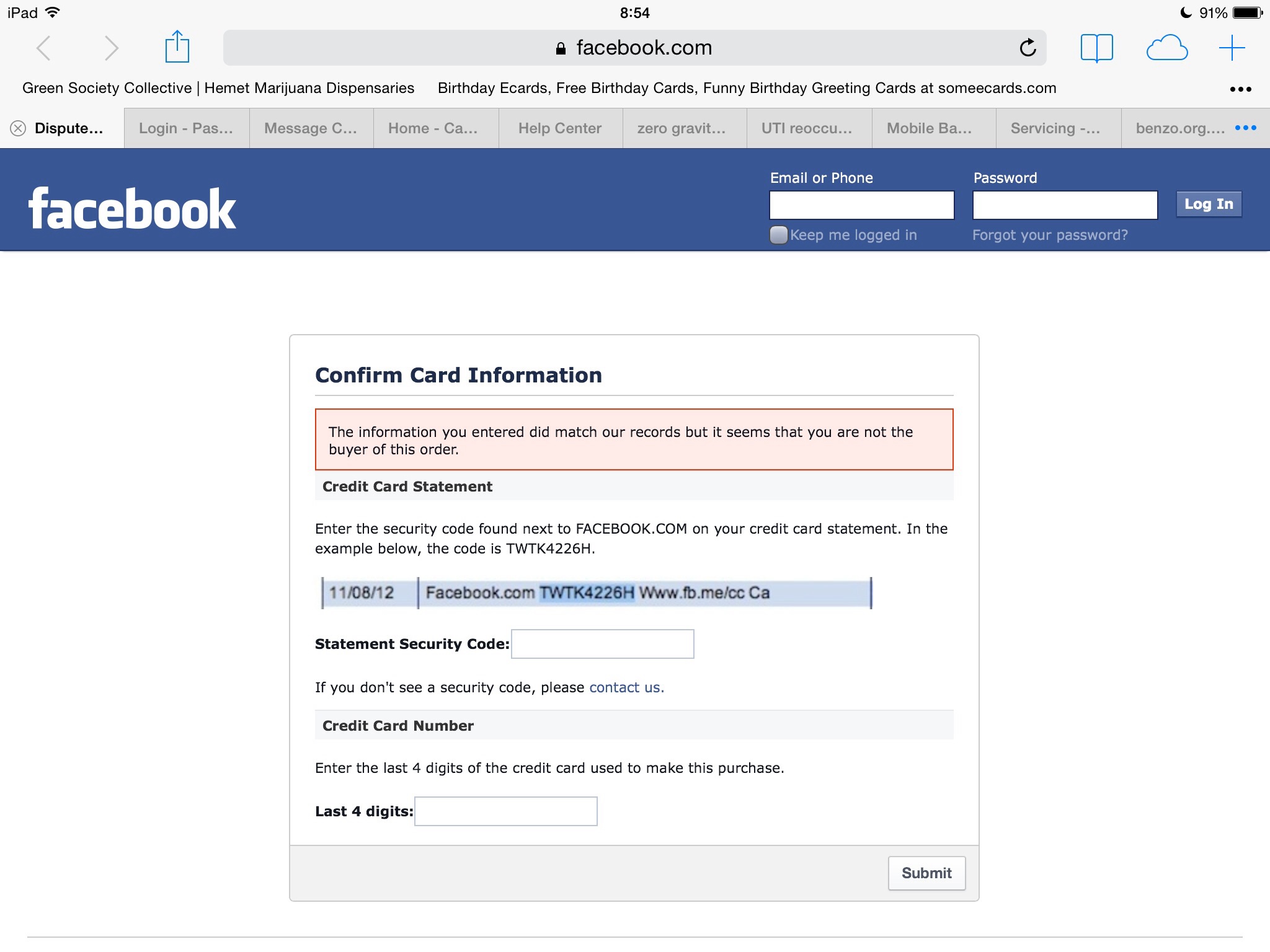

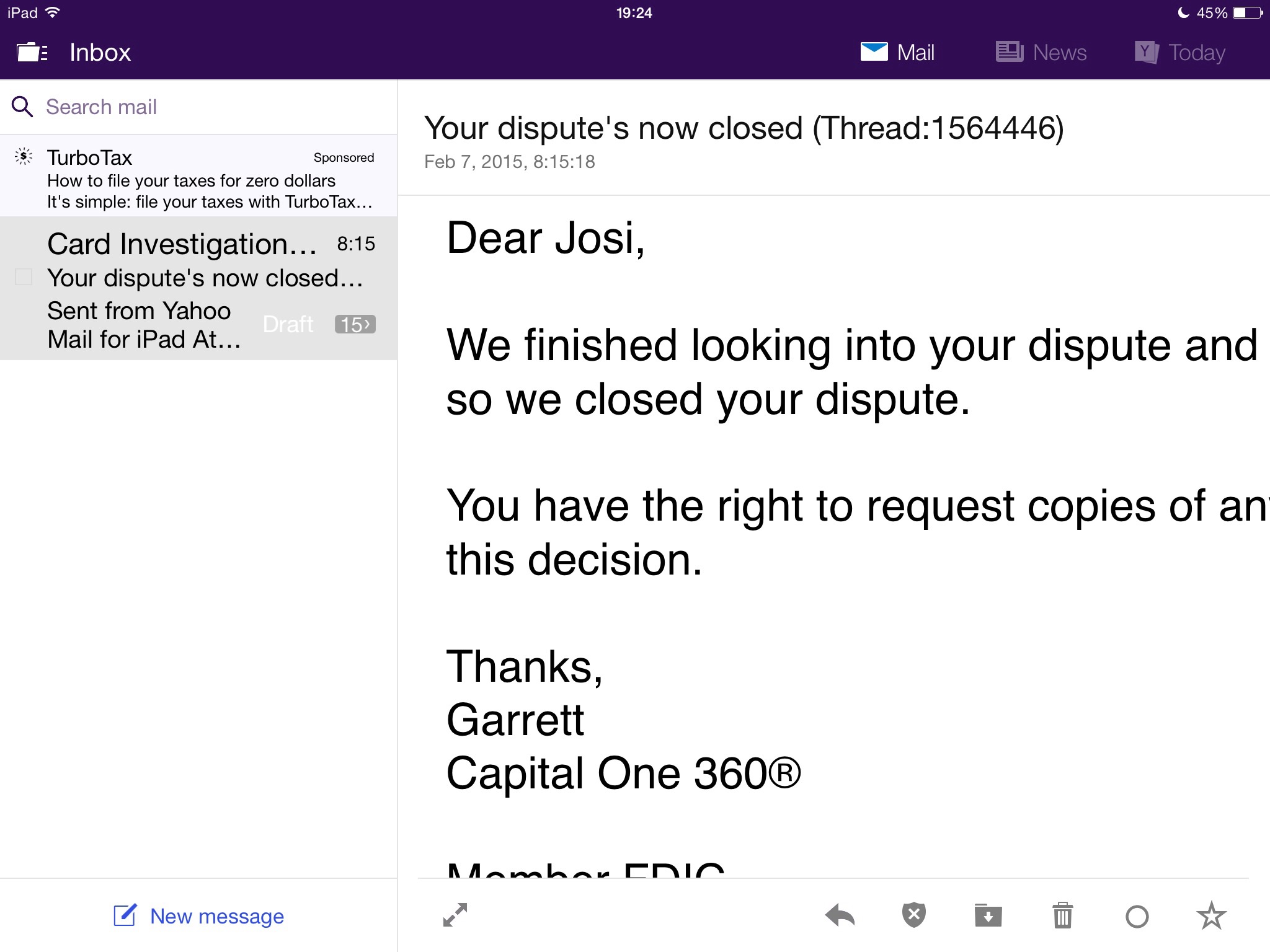

Again: $14.99; $9.99; $24.99 etc. 50 charges, 100 charges. My PayPal Account was being systematically drained. And PayPal had my main bank attached to it. I was beyond myself. To make a very long, horrifying story as short as I can, I called PayPal and was told I had an Agreement with Facebook. I did? When? When I bought something from an online clothing store off of Facebook. What? I immediately called said store. Yes, I bought a tank top there months and months ago on their private website. What did Facebook have to do with where I shop off of their domain? Well, I came across an obscure news article that PayPal's CEO now works for FB. Excuse me? It all came together. PayPal let Facebook in without my knowledge, consent, password or email address. Guess who wouldn't block Facebook Payer? PayPal and Capital One 360. PayPal at least reimbursed me. However, after 3 days of filing the disputed charges, Capital One 360 decides there were no errors.

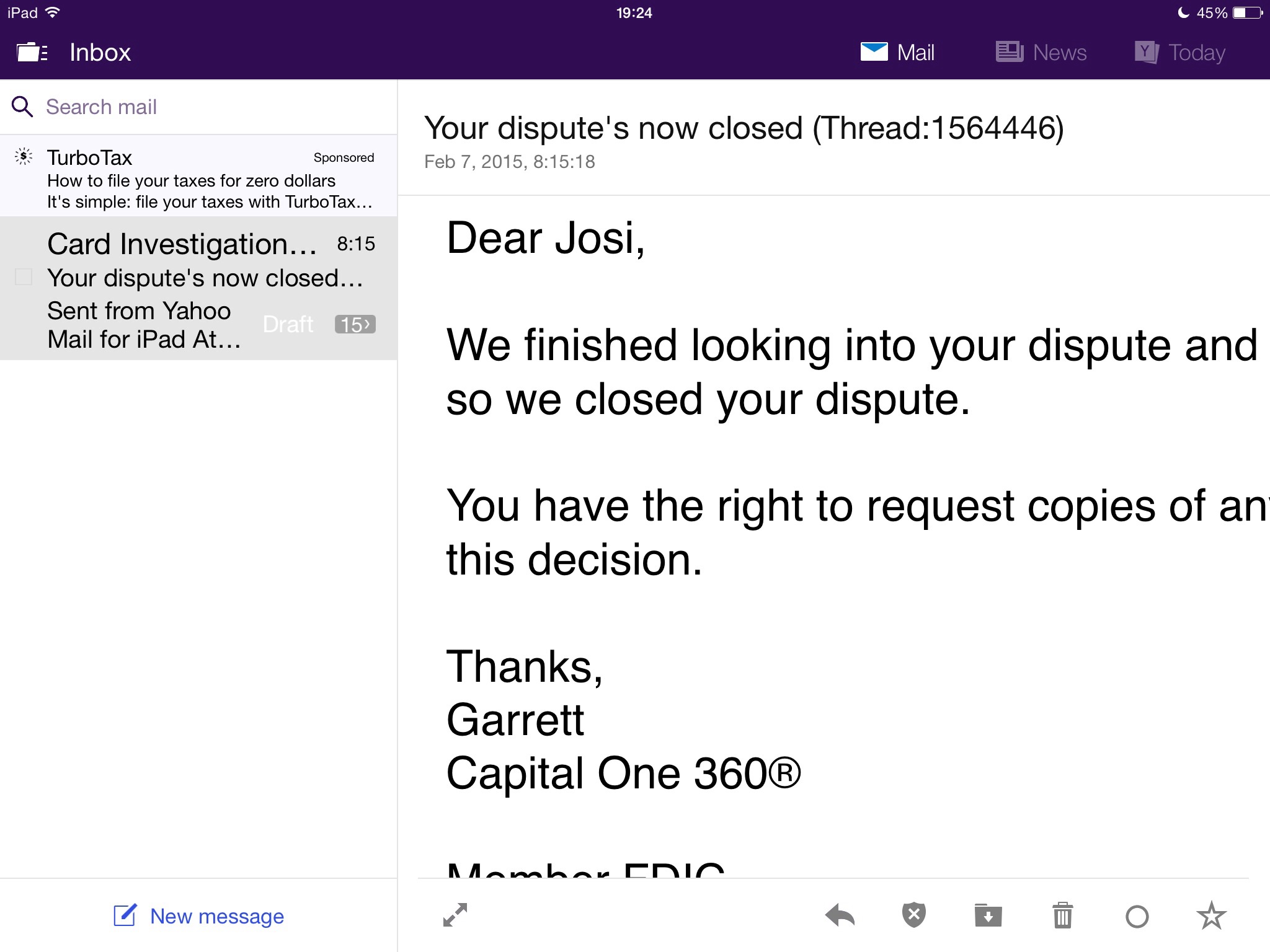

Despite my sending them a receipt I found from FB saying the charge was unauthorized. I didn't make it. A hacker was non-existent. The developers of the game were padding my account and iTunes w/my Capital One card, not on file, paid them. They, however, reversed all of the charges for a 90 day period. PayPal reversed the whole year. Capital One? Not one penny. Dispute Closed, read their email after 3 days! Really? I don't think so. I've closed PayPal. I've transferred all money left to another bank. I've changed all of my passwords and closed all online banking except for one online bank that will block On Capital One's 360 Security Page for online banking, they assure us that our money is safe. Feel secure? Well, don't. Capital One 360 will let fraudulent charges pile up and do absolutely nothing about it. Plus, once you do find out, they will not reimburse you no matter what type of proof you have. I didn't open a Capital One 360 account.

Direct Ing became Capital One and I was an Ing Direct customer. I had qualms so I left little money in thinking I could use them for online purchases. Huge mistake! Huge. And it's cost me over $400. I have a clue when it began. Before March 2014, I bought a few things here & there. Mostly gas. Few online purchases from reputable companies. In March Facebook decides to get into the banking arena. With their all new encompassing Policy Agreement, they pretty much say that all or any financial data, including private data used by aan FB member on their site becomes theirs also to use when they see fit. Enter Capital One 360 via iTunes and my money began to be systematically siphoned out every other day, sometimes three and four times a day. How? I would put my Capital One card into iTunes when I used it and then removed it via settings on my iPad. I had been playing a particular game and needed play cash. The $9.99 charge became a $19.99 charge: $24.99; $14.99; $1.99; $2.99; .30cents (yes, .30 cents).

These were almost daily charges. Why didn't I know? My mother became ill. I was distracted, driving 250 miles back and forth, helping Hospice and my step father. Plus, I wasn't using the card frequently. Before March 2014 there had been little activity. After March, which coincides with Facebook's new Policy, I was supposedly glued to the internet racking up charges on one, yes...one game. No, not Candy Crush. Another game. Did I buy anything? Yes. Unfortunately for me, I bought some play cash to open up land. Was I buying play cash daily? No. There wasn't any need to buy play cash except occasionally. After my mother's death, I checked my balance on my Capital One 360 card. I almost keeled over. iTunes, iTunes, iTunes. Every single date had iTunes on it. I immediately called iTunes. They didn't even hesitate. They could only reverse 90 days worth. iTunes was obviously very used to reversing online game charges. iTunes had become so alarmed at the extent of the charges, they blocked the game and stopped paying.

Now this becomes bizarre. I go into my FB settings to remove the game App and notice PayPal as my FB Account mode of payment. PayPal? How did Facebook get my PayPal Account information? I never used PayPal for anything on FB! How did they get my password? My email associated with PayPal? It gets worse. I log into Paypal and see iTunes charges in there. But next to them, it read "Denied." One line down, it reads: Facepay (or something similar). Again: $14.99; $9.99; $24.99 etc. 50 charges, 100 charges. My PayPal Account was being systematically drained. And PayPal had my main bank attached to it. I was beyond myself. To make a very long, horrifying story as short as I can, I called PayPal and was told I had an Agreement with Facebook. I did? When? When I bought something from a clothing store off of Facebook. What? I immediately called said clothing store. Yes, I bought a tank top there months and months ago on their private website.

What did Facebook have to do with where I shop off of their domain? According to that online store, they never sell customer's information. I did more research. Well, I came across an obscure news article about how PayPal's CEO now works for FB. Excuse me? It all came together. PayPal let Facebook in without my knowledge, consent, password or email address. Guess who wouldn't block Facebook Payer? PayPal and Capital One 360. PayPal at least reimbursed me. However, after 3 days of filing the disputed charges, Capital One 360 decides there were no errors. Despite my sending them a receipt I found from FB saying the charge was unauthorized that I didn't make it, Capital one doesn't care. A hacker was non-existent. The developers of the game were padding my account and iTunes w/my Capital One card Not on File paid them. They, however, reversed all charges for a 90 day period. PayPal reversed the whole year. Capital One? Not one penny. Dispute Closed read their email after 3 days. Really? Ya think?

Report Attachments