- Report: #1412084

Complaint Review: Brian Rateria Regions Bank - Memphis Tennessee

Brian Rateria, Regions Bank Regions transferred money to my Chase Card, without my authorization, on a credit card that I never activated. Chase sent me a copy of Regions check showing Regions had the wrong credit card number. Regions broke several Federal Regulations by not have the necessary legal documents. They are trying to cover themselves but they’ve ruined my credit, threatened/harassed me, upset/disrupted my family, and they expect me to accept being a victim. Memphis Tennessee

Report Attachments

Feb, 2017, James Smith, at Kirby Branch, initiated, instigated, and the only one that had accessed any information for Regions Bank Credit Card services to illegally transferred funds to Chase Credit Card without my authorization from a Regions Credit Card that was Never activated. They can’t provide the legal documentation and authorization that they followed the proper Federal Regulations for banks institutions. I have all of the dates, letters, emails, documentation, and contact information on the employees, supervisors, managers, upper management were illegally involved in this from the various departments at Regions Bank. The middle of Feb, 2017, I only verbally agreed to send card after James Smith stated that I qualified for a zero interest rate credit card, I received the Credit Card in the mail that I verbally agreed James Smith send, but I never Activated the card. I never signed anything, give James or anyone at Regions any authorization or permission to do a balance transfer to my Chase Card. With that, I don’t know how Regions Bank was able to get away with all of their fraudulent and illegal transactions.

2/23/17 I called Regions Credit Card Services when I received a letter requesting authorization to transfer $1500 to my Chase Credit Card. I talk to Cheryl Miller and her supervisor is Carrie Jackson. She could not do anything to help me since I didn’t know the Line of Credit. They did state that they cannot transfer any funds until the card is activated. Mon 3/6/17 I went online and saw that Regions illegible transferred $1500 balance to my Chase Card without my authorization on a card that was never activated! Chase sent me a letter with a copy of the check, that I requested, with the Incorrect card number. Also Regions charged me $60 transfer fee! Eventually they refunded $60 they promised to my checking account 3/5/17 I called Credit Card Services again and Billy was checking how they got info AND Why did they do transfer especially when the card wasn't activated! Call disconnected & she never called back 3/10/17 Crystal with Credit Card Services said supervisor Craig, Isom, Employee 5024, will call me 3/13/17 Craig called & filed complaint Case number: 170328-002138 GSYS total systems handles the charges. Advised will report investigation that may take 30-90 days. Craig’s Mgr is Julie Godette also aware Craig gave me the Chase Credit Card number 2 times. BOTH times were incorrect since he said 2817 which 2811 is correct. Chase sent me a letter with a copy of the check, that I requested, with the Incorrect card number. 3/19/17 James Smith was the Only one that did this since he knew that my Chase Card started accruing interest, & Able to access Chase Info with recent Chase Transactions & Payments without my providing card number or even signing/authorizing anything. 3/18-3/28/27 Attempted to resolve and find how James did it with Lou Evans Kirby Branch Manager, James Smith Boss 3/28/17 Contacted Regional Branch Manager, Brian Raiteri’s and communication started with Brian’s Asst. Tanya Millican 4/25/17 left message Michael Pardue Brian's Boss 901-580-5743 He past the buck back to Brian Raiteri & Asst Tonya Millican

5/11 - 5/27/17 collection Dept constantly calling 5/27/17 Tonya stated she told collections dept to stop calling me Brian Raiteri, Regional Branch Manager, stated: The Complaint filed 3/13/17 was cancelled. Brian continued : "Based on your expressed concerns, we also initiated a full inquiry into the events of your visit to the Kirby Branch and in to your conversations with the associate, James Smith, who works at that location. As a Regions policy, we do not disclose the findings of any internal research when dealing with associates. "The results of our internal investigation will not be disclosed.” However, if any wrong doing is found, we do consider that a serious matter and act in strict accordance with our company's policy. 6/2/17 - 8/25/27 Regions attempted to settle with letters from their Attorney. I talked to an attorney, that billed by hour, but graciously consulted & Provided me specifics get in settlement to protect me! Regions said they’d me payoff the credit card balance in full, close the credit card, close all my family & my accounts, and Only remove negativity they already reported to credit bureaus. Settlements never included items I stated to protect me.

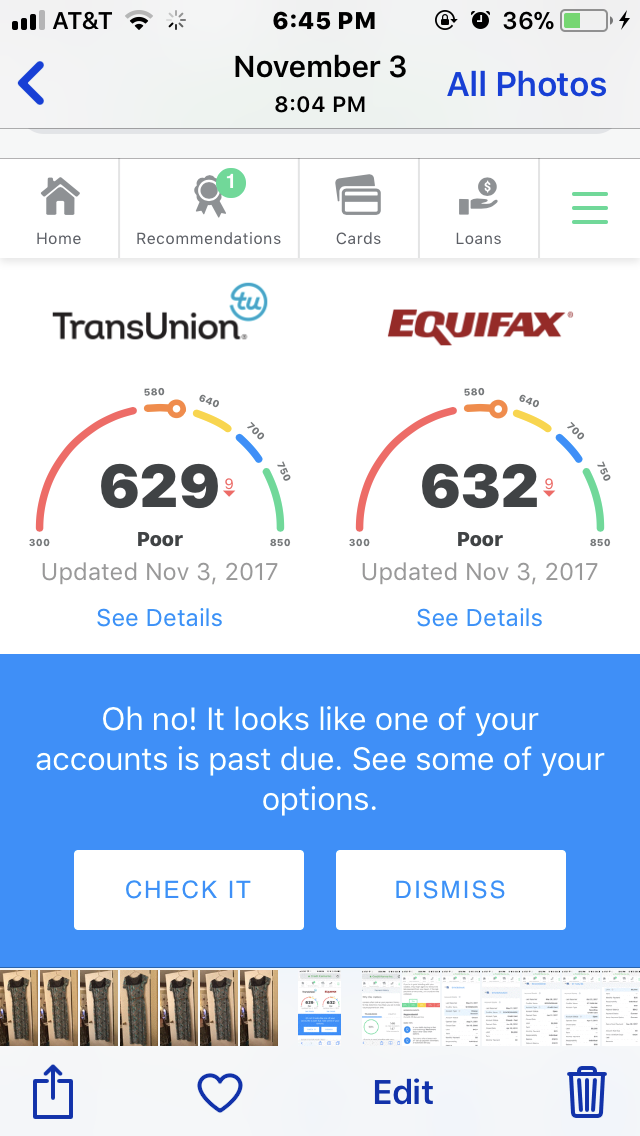

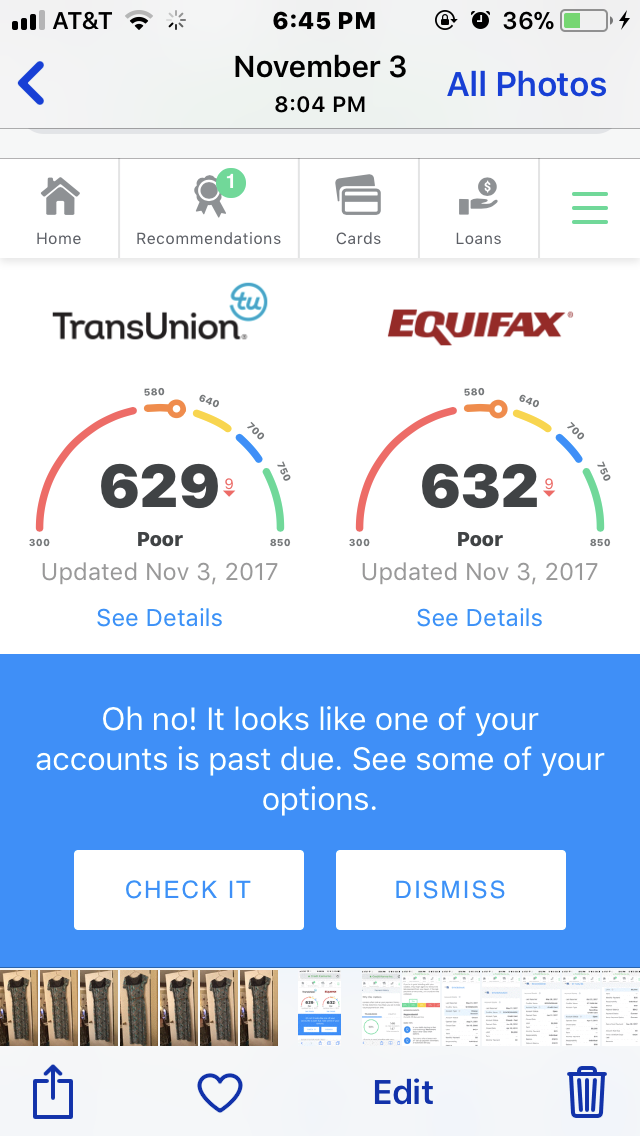

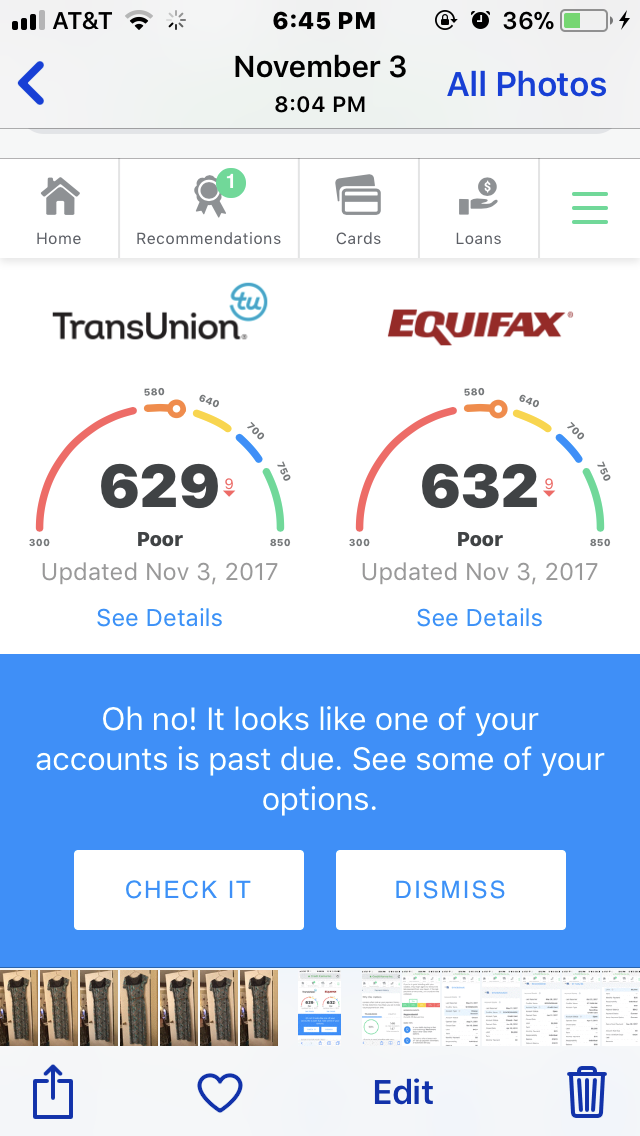

9/25/17, I received a letter stating, "This our final offer - take it or leave it offer. We will not negotiate further. There will not be any additional money given over the amount of the credit card. If you chose not to take this offer, then collections will begin again, up to and including legal action.” "Per your Deposit Agreement, we have the right to end our banking relationship with you at any time. We intend to use that right and end the banking relationship with you.” We will give you 30 days from today to consider our offer. This offer will expire on 10/25/17” 11/3/17 Fri I Received a letter from Brent Pyatt, Regions Dispute Department for $1,800 be paid in full. Several late charges, interest, etc have been added over the months to the initial $1500. Jennifer, CS Rep Dispute Dept profusely apologized stating that on June 29, 2017, Cooperate satisfied the balance, that the letter was sent in error, and I should have never received it especially 4 month later! Jennifer stated that Regions will remove the negative reports to 3 credit bureaus Jennifer said she’d relay my concerns to her supervisor Renee Edwards and call back with respond to: -Why wasn’t I notified they satisfied the debt in June? -Why did they report negativity on my credit to the 3 credit bureaus? -Why was Brian Rateria Regions Divisional Branch Mgr harassing, threatening, & trying to settle If satisfied? 11/8/17, Ms Edwards was very unprofessional and only stated they’d initiate a report to credit bureaus to remove debt.

On 11/13/17 I filed a credit disputes with with Transunion. On 11/15, I received confirmation of their investigation which may take 30 days. 10/30/17 Brian Rateria sent letters to my dad and my daughter that Regions will close all of their accounts in 30 days. Brian even unprofessionally called my dad and upset him stating that he could keep his account if he removed me which would create a lot of legal and practical ramifications. Dad is mentally capable to handle things m, but he add me since I’m POA, I assist Dad with with financial transactions, and I do a lot of shopping for him since he not physically able to do himself. Understandably, Dad feels pressured in regards his 2 income checks that he depends on to pay his bills that are automatically deposited. It infuriates me seeing how Brian’s demand, has upset, worried, and concerned, my dad to where he’s loosing sleep over something that is only between Regions and me! This has caused a lot of friction between my dad and me. I’m wanting both of us to change banks now with the same arrangements. With the deadline approaching Dad feels pressured now and wants to remove me tomorrow which I’ll respect but as stated this will cause even more friction between Dad and me!

Report Attachments