- Report: #1423025

Complaint Review: Auto Line LLC -

Auto Line LLC After the Christmas holidays, I paid my first car payment. I was late by about 14, the repossessed my car and took my down payment and the first car payment. They lied and said they did not have nor did they know where the car was. Internet

Report Attachments

On November 19, 2017, I purchased a gray 2009 Honda Civic SI. VIN: 2HGFA55569H705789. I put down a deposit of $1, 700.00. My payments were to be $269.44. I did not pick up the car until November 24, 2017. I had minor issues with Auto Line LLC from the beginning, but it didn’t seem to be anything too major. One of the first issues was I could not get the bill of sale from them for the insurance company. It took a few days to get it from them. I don’t remember who my wife or I spoke to, but they were rude. They told us to stop “blah blah blahing in his ear and come pick it up the form”. This was after their customer service reps stated they would send it over via fax.

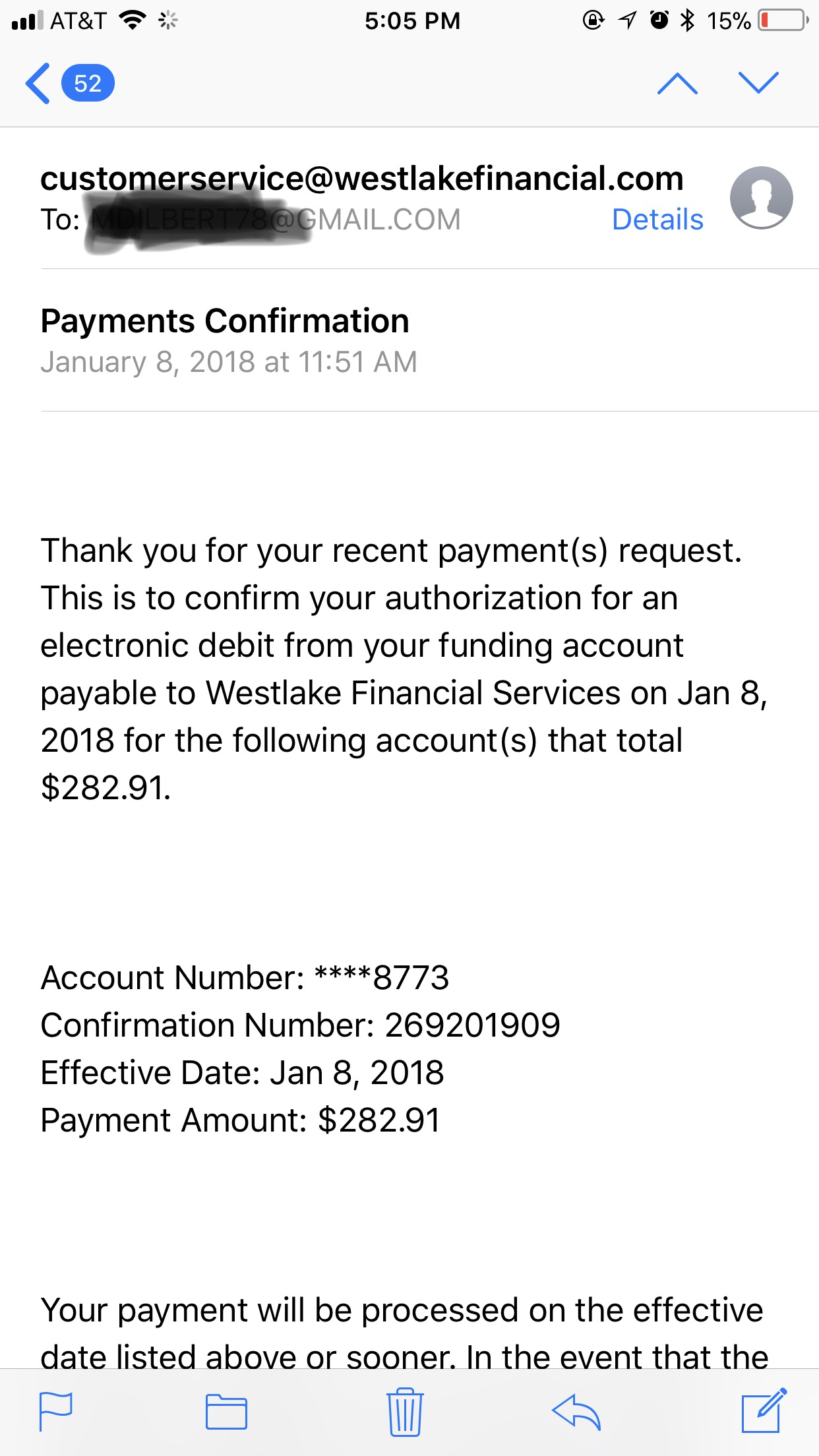

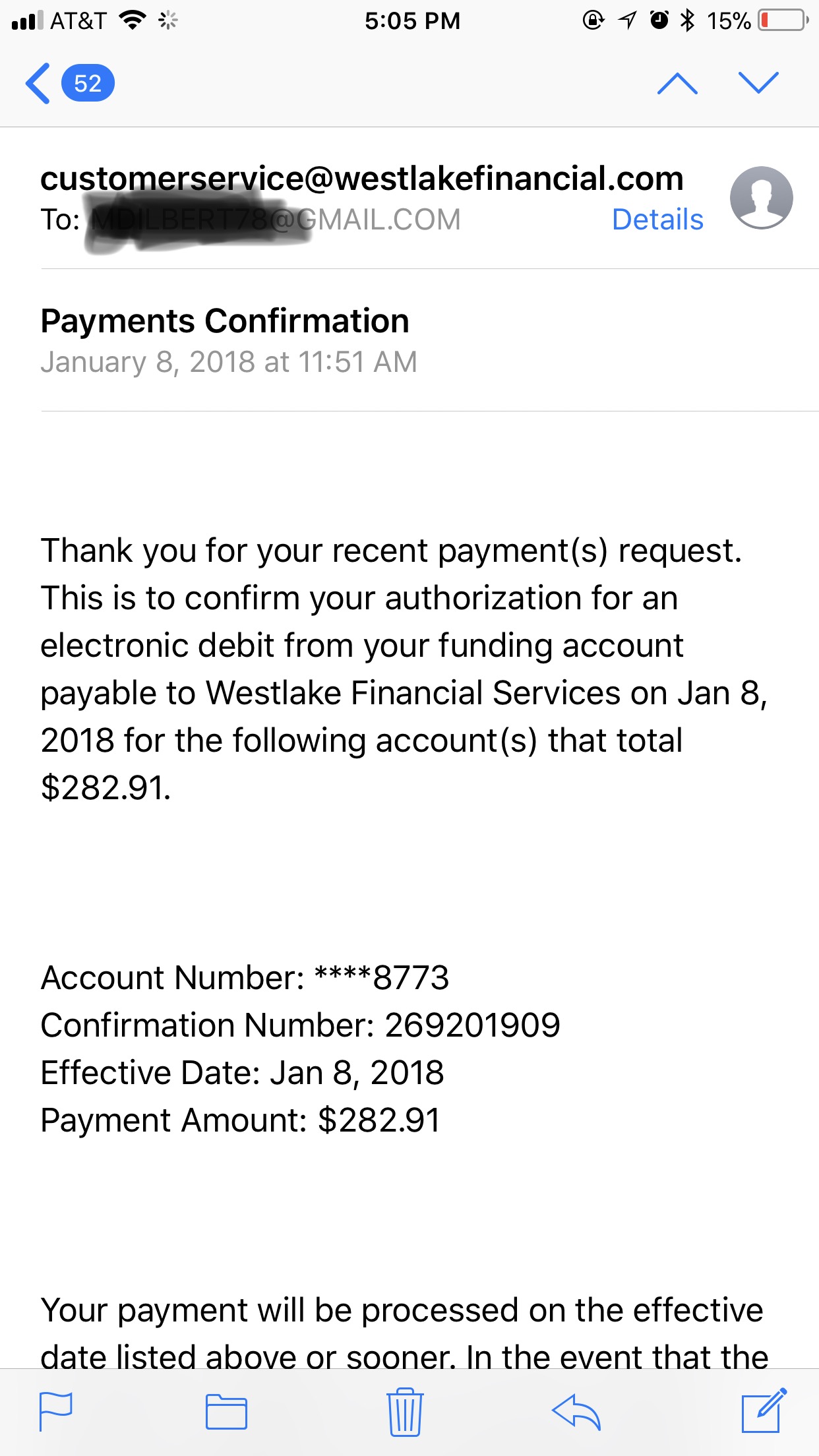

My first car payment was due December 19, 2017. Yes, my first payment was late. It was just after the holidays and we had some family things going on. This was just around two weeks after it was due, but I did make a payment on Monday January 8, 2018. I paid the amount of $282.91 (this included late fees). The bank, West Lake Financial, located in Los Angeles, California, stated that they were not sure if the wanted to continue the loan with me. They said they would take the payment and it could be possible that they could work something out, if not the dealership would possibly have to find me another bank to continue the loan. They did take the payment and I did receive a receipt saying that the payment was made and when I checked my bank account, the payment was withdrawn from my bank account the same day. The next day when I checked my Westlake financial account, it showed the payment was processed and that the next payment was not due until January 19, 2018.

On the morning of Thursday January 11, 2018, I went to leave for work at 5:30AM, only to find that my car was gone. I was not sure what to do or who to call. We had an uneasy feeling and I had my wife call around and that morning my wife called Auto Line LLC, to see if something happened. She spoke to a Sebastian. We asked if they had the car, they said no, and that the bank had it. They stated that they had no clue where it was. Auto Line said they were told that we did not make a payment. My wife stated that we did and that we had the receipt to prove it. She relayed the message that the if bank did not want to continue the loan, that they (Auto Line LLC dealership) would have to find us a new bank. Sebastion stated that they did have to do anything at all. The only thing that they could do was have my wife fill out a new credit application, and have her put the same car in her name. The dealership stated that it was up to West Lake if they wanted to continue the loan.

When we finally got in contact with Westlake Financial, they said they did not want to continue the loan and they sold the car and title back to the Auto Line LLC. They said everything was already finalized. They said (Westlake Financial) did not have the car, that they did not request for it to be repossessed and that Auto Line LLC was the one that requested it. West Lake had no clue where the car or the possessions inside were. My wife kept the rep from West Lake on the phone and called Auto Line LLC directly. With the West Lake rep on the phone, Auto Line diverted from their previous statement. The Auto Line rep said they indeed did know where the car was and they gave my wife the phone number of 800-301-5010 (American Repo Recovery). They once again stated that they could have my wife fill out a new credit application and have the car put into her name. She did fill it out online but this did not seem right to us. We had made the initial car payment. Doing a new loan would mean the car payment would go up, plus we already made a significant deposit. My wife was then in contact with Eduardo at Auto Line. She asked if the loan could be put back into my name and he could try. We kept trying to call Eduardo back to see if it was possible. We didn’t trust them but they had our $1,700 down payment and my $282.91 that was paid to West Lake.

On Friday January 12, 2018. Edudaro contacted us back stating my wife was approved for this new loan for the same Honda Civic. When she spoke back to him I was told that we would have to pay an additional $1, 300.00, plus they said I owed $100 to the DMV for a tag (even though I had my same tag from my previous car). They stated American Acceptance would be the new bank and our payments would be $350. 00. At this point we don’t want anything from them other than my down payment and this off of my credit report.

1 Updates & Rebuttals

Robert

Irvine,California,

United States

Typical Sub-Prime thinking

#2Consumer Comment

Mon, January 15, 2018

You couldn't even make the first payment on-time, and somehow think that you are the one getting ripped off.

Your "around 2 weeks after it was due" was actually 1 day short of 3 weeks late. Unlike you they did exactly what they said they would do. Take your payment and then see if they wanted to continue the loan with you. They decided against it. Now your complaint isn't really against the first finance company, but it is an important part because it is YOUR failure in not making that payment that is causing your current issue.

Of course now that they took the car back, and charging you a lot more because of your history you just want to get your down payment back and this to be off your credit. Sorry, but you are living in a fantasy world. Where if this actually happens, the next thing to do is go to buy a lottery ticket because you are the luckiest person on earth.

You don't get a "free ride" for that 6-7 weeks you were driving the car. There was most likely some sort of "use clause" that stated if they took the car back you are obligated to pay so much per day for the use of the car. If this didn't eat up all of the money you paid, it ate up most of it.

How they deal with the "repo" will determine the rest. If they just decide to take the car back, you may get out just losing the down payment and regular payment you made. This is probably your best case scenario. If they treat it as a true "repo". It will go on your credit, you will be held to all of the repo fees as well as the use fees. Then if by chance they sell the car for less than you owed on the loan(very likely) you are still legally responsible for the balance.

Oh and before you even say it, no the reason you were late does not matter and it is very unlikely any other dealer/finance company would be any different.