- Report: #1496005

Complaint Review: Fair Isaac - San Rafael California

Fair Isaac FICO, mtfico.com Ruined my life. Made it impossible for me to get normal mortgages, credit line cuts San Rafael California

One might ask, how can you get a substandard "cedit score" when you have 15 years of perfect credit histoty?

The reason for this is because the computer programs that generate numeric credit "FICO" scores are patent;y defective.

My life was ruined in 2007, because I couldn't get a conventional home mortgage on my primary residence. The reason cited is my "credit score"

How do you fix something that's not broken?

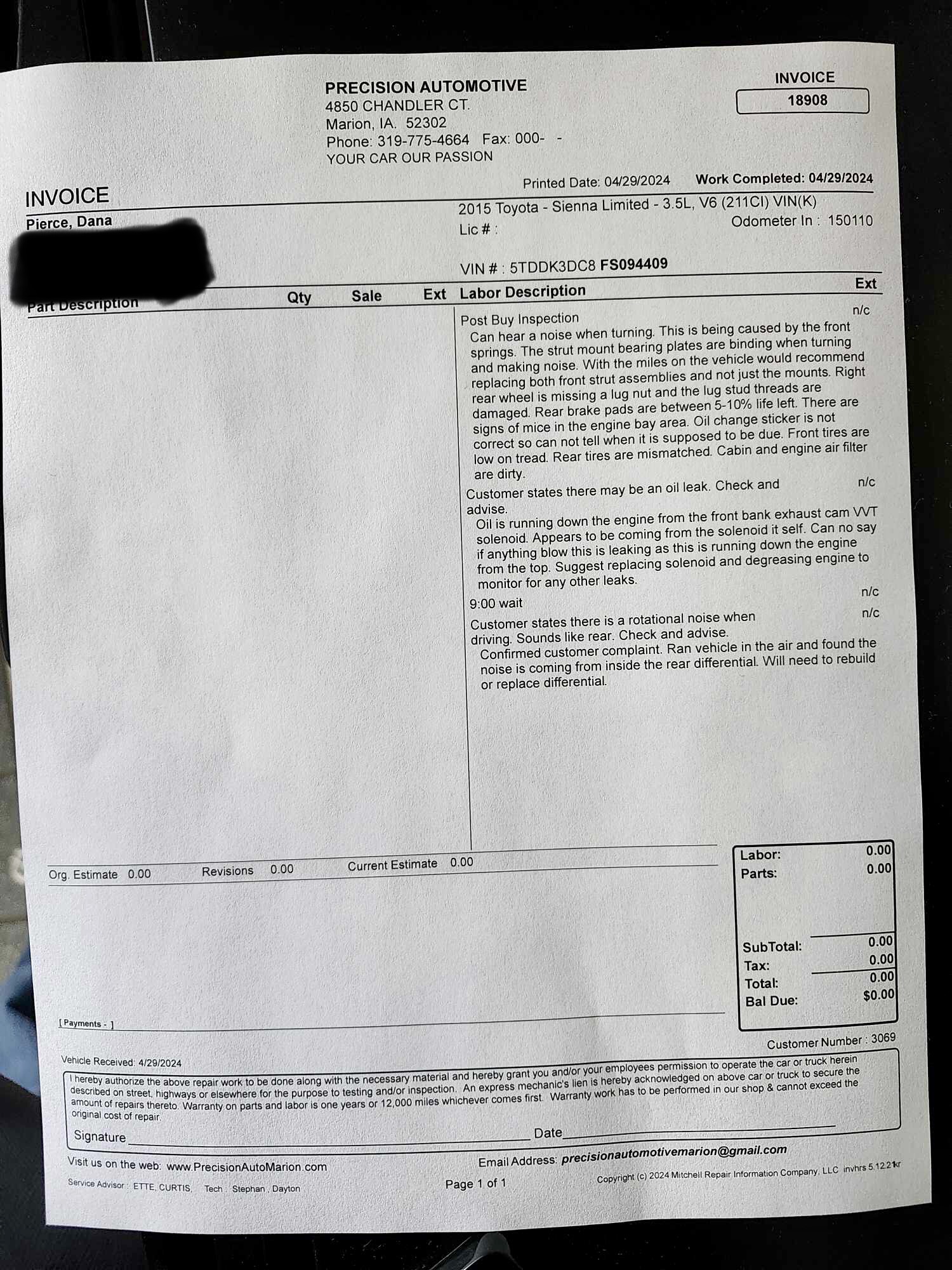

I lost my Boston area home, and summer residence on Cape Cod. because I had mortgages with rates between 7.75% and 12.125%. I was paying $14,000 a month in mortgage service on the sub-prime loans I was forced into. My equity in the two properties was nearly $1,000,000 was wiped out in foreclosure. My wife, who had a diagnosis of Alzheimer's disease, and I, were evicted from our beautiful home of 14 years. She died in a nursing home. I was driven from prosperity to poverty; welfare and food stamps. and living in an apartment infested with rodents and cockroaches. I'm on permanent disability.

I've started to rebuild my credit, and now my credit limits are being arbitrarily cut, because of my FICO scores. The accounts are always in good standing; FICO is cited as the reason why.

I handle my finances resposnsibly. Knowing that I can access a specific credit line figures into how I plan and manage expenses and larger purchases. When one creditor chops my limit, that reduces the ration of available credit to debt, and this causes a s****.>

FICO scoring doesn't predict defaults; FICO scoring causes defaults. Banking industry abuse of the FICO scoring system is what caused the financial crisis of 2008. Unqualified borrowers were being issued not a preapproval; they were given commitment letters on the spot. All that was required other than a FICO score was a property appraisal for an amount equal or greater that a consumer sought to borrow against it.

FICO was granting the best mortgages to people who didn't even have a job. I was locked out because the mysterioys black box didn't spit out a high enough number. Yes, I had alot of debt, mostly real estate loans. My income was also quite sufficient to carry it, and I never went above 80% loan to value.

See my website, www.ficovictims.com.

Congress made this system of underwriting statutorially exempt from any and all consumer challenges.

Had I been qualified for normal Fannie Mae/Freddie Mac financing, I would not have defaulted on anything.

Fannie and Freddie both went belly-up, into receivership-- once the fourth and first largest privately vested corporate entities in the world. I predicted this a decade before it all played out~~ not that it helped, but I'm sure proud of the C- I got in Ecconomics 101 at Harvard. I just turned 60, I speak five languages, and now I have no income other than Social Security, and no assets at all. I started planning my retirement in my 30's, based upon owndership of beautiful real property. That's all gone now, because of FICO scoring.

The FICO-bound financial crisis of 2008 added roughly $7 trillion to the national debt.

1 Updates & Rebuttals

Robert

Irvine,California,

United States

A C- in Economics

#2Consumer Comment

Fri, June 05, 2020

We can see why you got a C- in Ecomonics.

First you seem to contradict yourself. One does not work on Rebuilding their credit if they have a perfect credit history. You can't have 15 years of perfect history if you got your houses foreclosed on in 2007. You aren't approved for intrest rates in the 7%+ in the early 90's(being that you had your house for 14 years) with good or even fair credit. Unless you were one of these people who were given loans they shouldn't have been approved for.

Second FICO does NOT "grant" mortgages. They provide a Credit Score based on a Standard Algorithm that takes information from your Credit Reports. The leders then use that Credit Score to determine if they will approve a line of credit, mortgage, or other loan.

Let's get real here. You didn't lose 2 homes because of FICO, so don't expect much sympathy. You are not "forced" into anything. Especially when you are talking about a mortgage for a "vacation" home. You obviously were living beyond your means and are now facing the consequnces of your actions.