- Report: #1497352

Complaint Review: Chuck Hughes - Options Trading - Nationwide

Chuck Hughes - Options Trading Misleading advertising. Nationwide

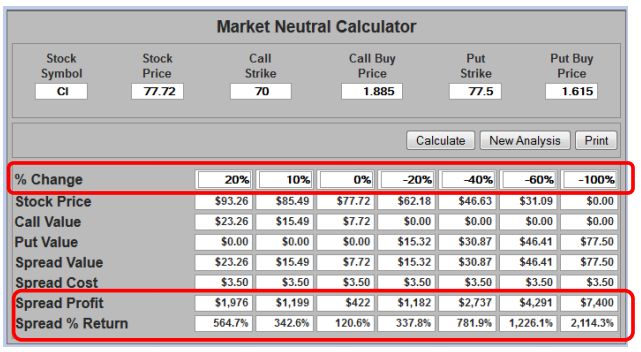

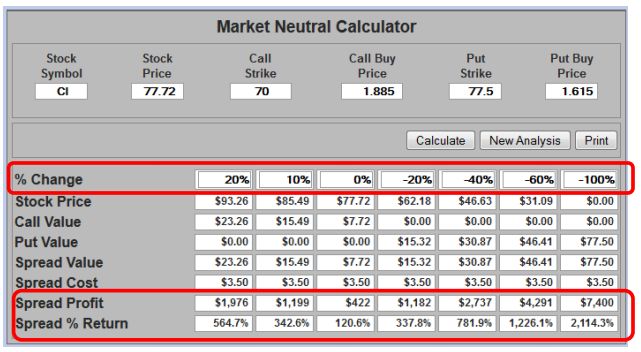

I have been getting solicitations from this guy for over 3 years now. In the last year he has sent several 20 page hero folders of his "success". Problem is - he includes a chart on his "market neutral calculator" that is intended to deceive.

This spreadsheet shows a simulated trade in COST - with "what ifs" for the stock not moving - or moving 20, 40 and 60% one way or another. With a "100.8% return at 0% movement and bigger gains going way out - he states in red "minimum profit 100.8%" This is patently untrue - and would get someone with a license in hot water.

Truth is - in that unshown area between 0-20% - which is much more likely - the returns are often negative. He knows it - that's why he goes outside of that to make it look like you can't lose.

I have sent copies of this to him twice suggesting he knock it off - yet it came again today 7/8/2020.

Hey Chuck - if you are such a genius - why do you have to lie to people. I hope you get a visit from a consumer watchdog group over this.

1 Updates & Rebuttals

Sam

Merchantville,New Jersey,

United States

This Is Chuck's GROW Strategy

#2Consumer Suggestion

Fri, October 02, 2020

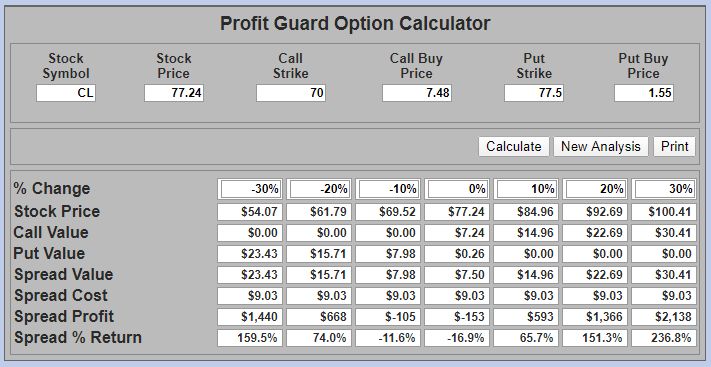

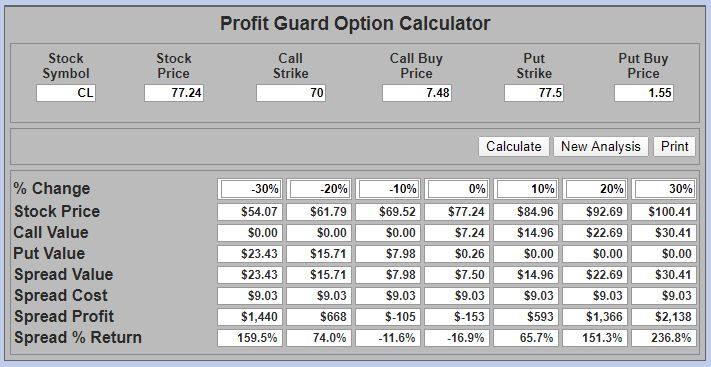

I have studied Chuck's presentation in detail and have written it up in my recent book An Investor's Guide to Stock Market Scams and Strategies. He calls it his GROW strategy, standing for Guaranteed Real Optioneering Winners. He claims that he has invented a strategy with no loss scenario and which can only return a profit. The "market neutral" calculator Chuck uses is designed to evaluate a straddle, which is a combination of a purchased put and call and is intended to take advantage of a large stock move in either direction and always returns a loss in the area between the two strike prices, even if they overlap.

The reason the first calculator has no loss area is because it uses phony data. If CL is 77.72 it would not be possible to buy a strike 70 call for 1.885 because it already is in the money by 7.72 and its price would have to be greater than 7.72. The second calculator shows the same trade with actual market prices. Two of its columns show negative returns.

What Chuck has done is purchased a call, wait until it became profitable, and then purchased a protective put and put both prices in the same calculator. That's not the right way to use one. I think the FTC eventually will get around to him.

Report Attachments