- Report: #1467758

Complaint Review: First Premier Bank - Sioux Falls South Dakota

First Premier Bank First Premier Bank Mastercard This is a fraud credit card, they charge you secret fees of $50 every month without authorizatio. Since May they charded $400 in fees. I never use the card. Sioux Falls South Dakota

*Consumer Comment: Subprime Card...Subprime Attitude

*Consumer Comment: The "Enforcement Section" of "The Bureau" Just Can't Wait To Get Your Tip!

*Author of original report: Amazing how quickly you replied to this with your scaving responce, yet there is not a person to talk to with issues or concerns

*Consumer Comment: Funny

*Consumer Comment: Makes me very frustrated

*General Comment: Money paid.

*General Comment: subn prime card for sub prime people?

Report Attachments

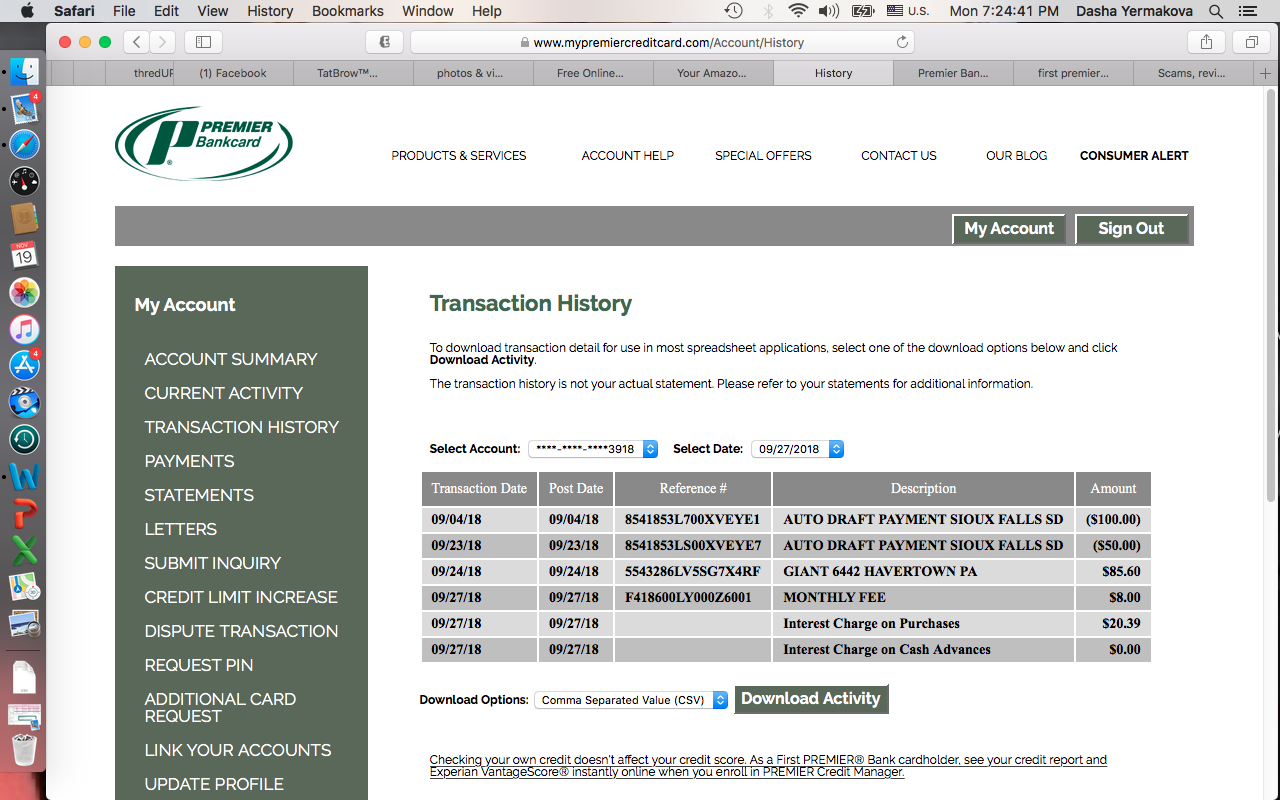

DO NOT sign up for this card. I never use it so was confused how my minimum balance due kept going up, and then it was over the limit. Went to pay the bill, and looked in a bit closer, they have been charging me $50 per month for the last 7 months, on top of other charges. I never authourised it. Nor was aware of it. They only give you 60 days from the time you receive the bill with the fake charges to dispute it. And charge you interest on the fees that they charge you. Complete scam!

I was always curious why they did not have an app to check your activity/balance or to make a payment. If you download the statment it comes up as aa excel spred sheet. Screen shot everything you get from them.

Do your self a favor. Do not sign up for this. RUN. I will be reporting them to the BBB, and anyone else who will listen.

They get you on "we will help you rebuild your credit". and the screw you for $100's of dollars. Disgusting.

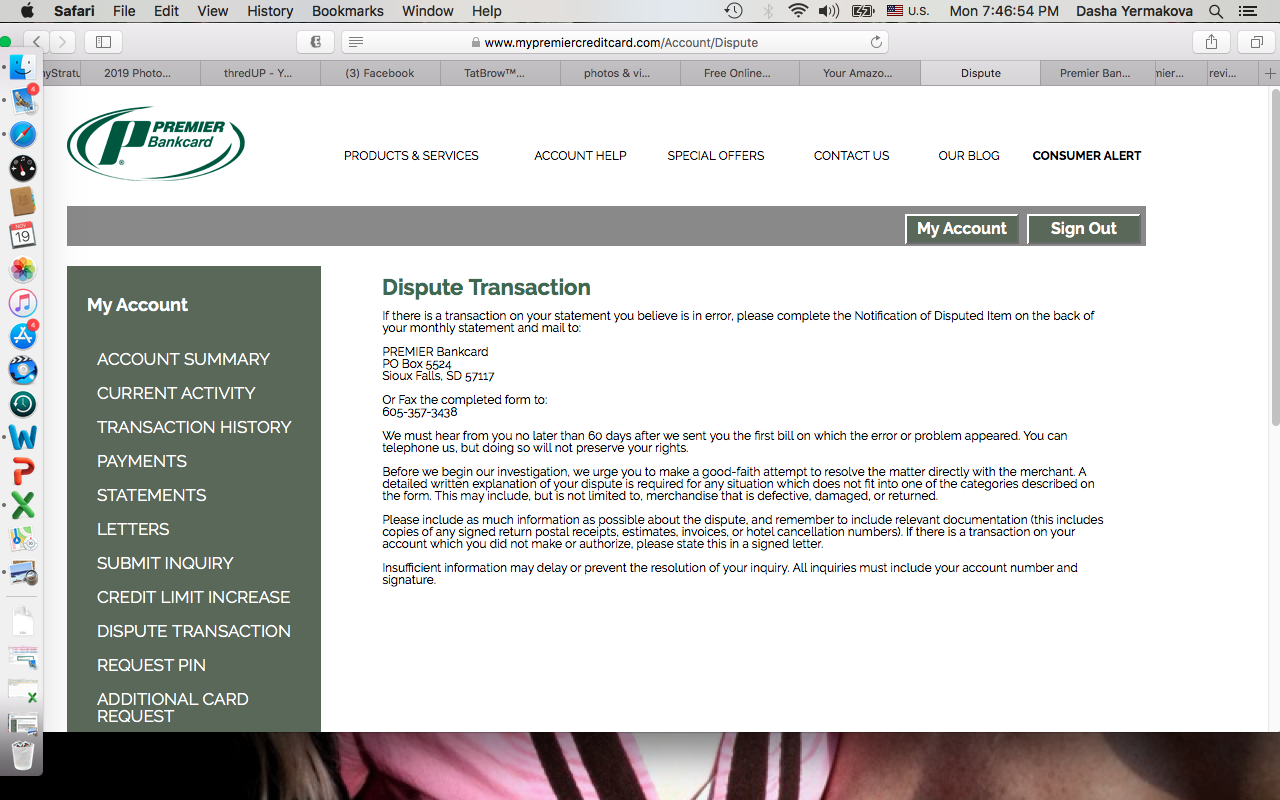

If you call them, there is no real person answering the phone. Just a menu. No e-mail address as well. If you need to dispute a chrge, you have to write them.

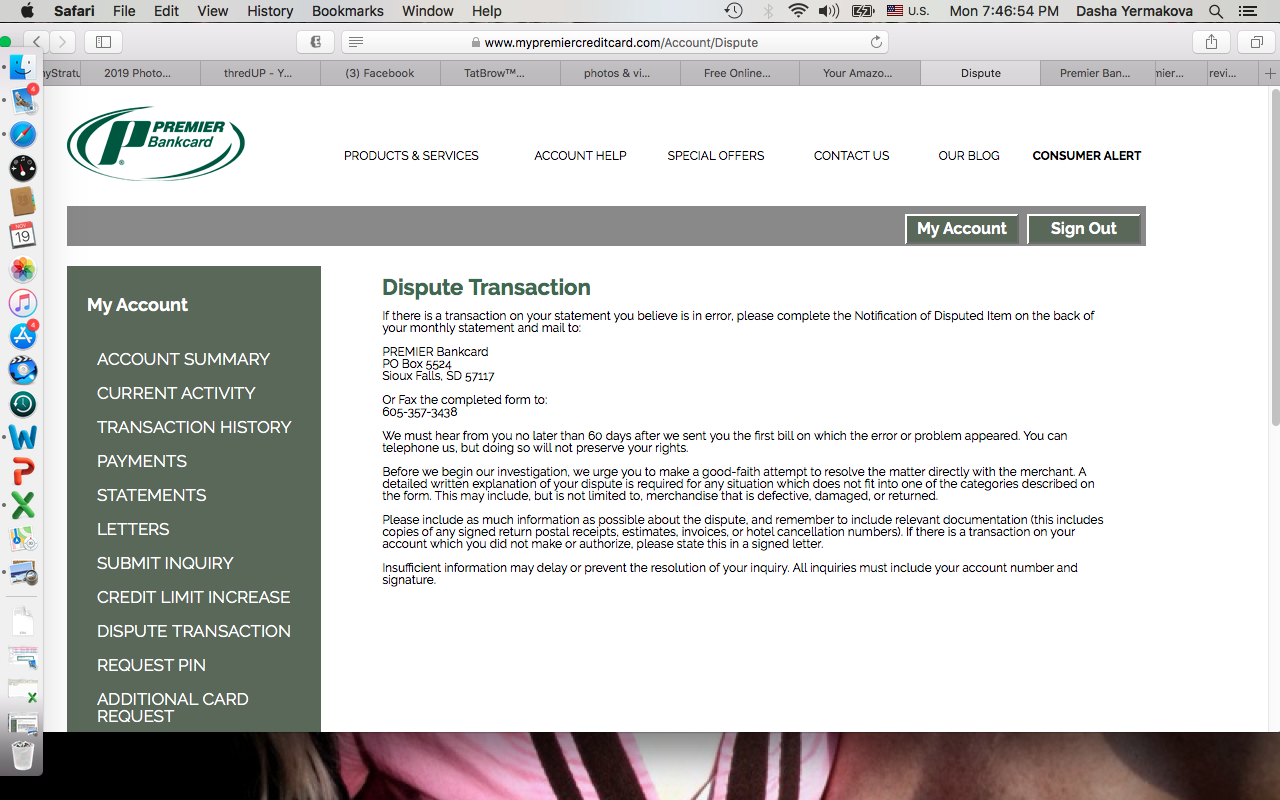

mypremiercreditcard.com/Account/Dispute

7 Updates & Rebuttals

Sal

Olympia,Washington,

United States

subn prime card for sub prime people?

#2General Comment

Tue, January 04, 2022

well aren't you the arrogant narcissist we've been waiting to hear from all day.

SO EXACTLY HOW LAZY AND SUB PRIME AM I THAT I ACCIDENTALLY PAID OFF ALL MY DAMNED DEBT and now have NO credit...PAYING OFF ALL MY DEBT in your eyes makes someone sub prime?

Glad I'm not one of your kids...I'd be in therapy because I will never meet your standards

Shocka

Sunrise,Florida,

United States

Money paid.

#3General Comment

Sun, August 18, 2019

They're not updating the card.

Florida Native

West Palm Beach,Florida,

United States

Makes me very frustrated

#4Consumer Comment

Tue, November 20, 2018

First, I am just a consumer here in the US, just like you. I am not affliated with this card in any way. I am responding to your post because it is clear you haven't been taught how to read and understand basic accounting, nor payment notations nor credit card management at all. It is clear from your post that you are in over your head. It is very frustrating to see you drowning and no one helping. You have the ability to learn the right way but listening to those around you isn't working out so listen to people that know what they are talking about in the financial arena.

See if you can find a responsible adult to teach you the above now so you understand how debits and credits work. This knowledge will save you a lifetime of trouble. It isn't easy to find an adult that understands how credit cards work today as so many people have unrealistic expectations of what a cc "should" do rather than finding out exactly what it actuallly does (should vs reality). Read the terms and conditions you have signed up for when you applied for this card as a very good start.

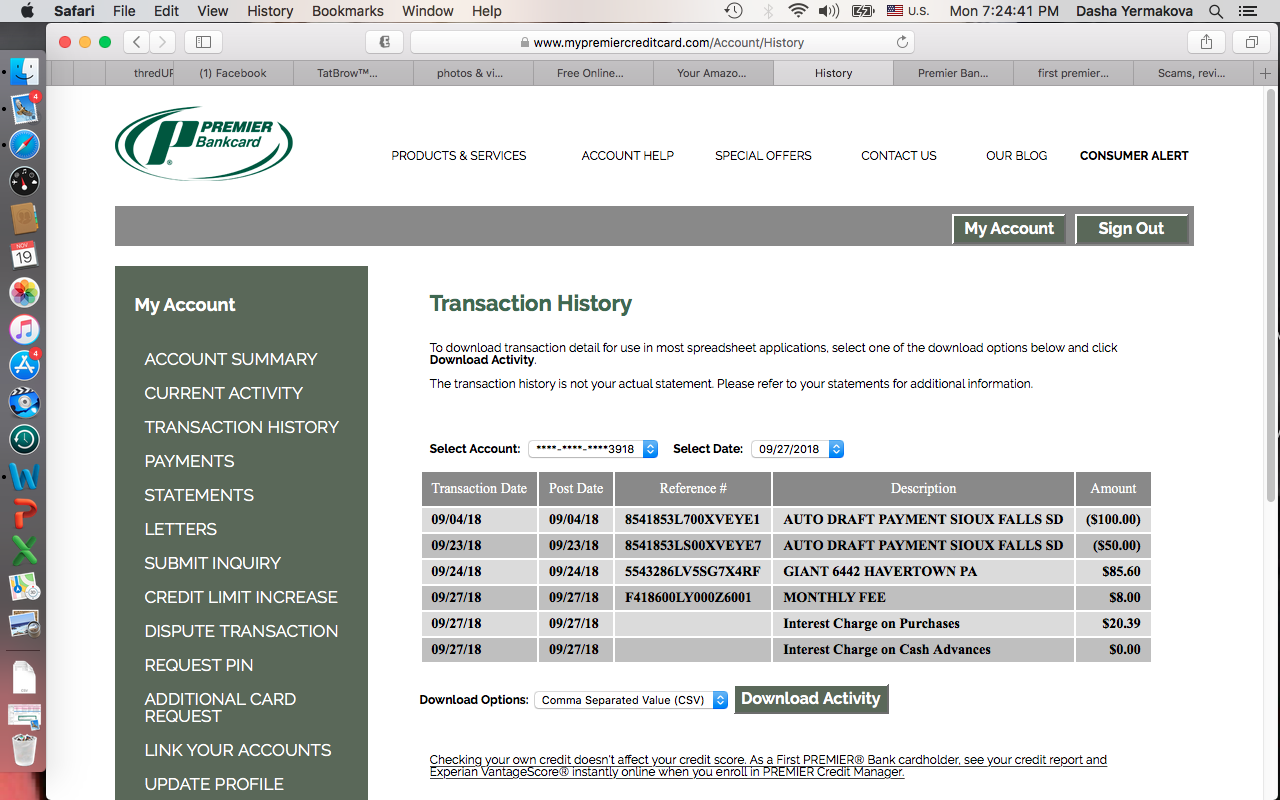

I agree it is a subprime card - also called a "fee harvester" type card. That is not the end of the world at all. You can fix this. You can easily terminate this credit card since you have other, better cards. Just pay off the entire balance to zero and close the account. That way you won't incur the $8 fee per month. Yes, the fee is $8 and not $50. Look closely at your screenshots to see the fee clearly labeled. If you don't have the funds to pay it immediately, pay it down over time and don't charge on the card. Keep an eye out for the zero balance date and when it hits zero, cancel right away. In writing according to the terms and conditions required. Don't just stop paying because you disagree with the card management style. Part of being an adult is being able to handle credit and the different types of billing and payment requirements. Some people never become adults - no matter what their age.

There are a bunch of credit cards that market to different credit groups including those people that don't understand how to read a statement. Most subprime creditors market to people that don't understand credit. That way they maximize their profits at your expense. The more quickly you pay this card to zero and close the account, the faster you will recover from this small misstep. Reporting to the BBB is a waste of time and effort. The BBB isn't a government agency. They are pro business. Good luck.

PS - the other responders aren't affliated with this credit card either. As pointed out, it is a public website and the public is responding to your complaint.

Robert

Irvine,California,

United States

Funny

#5Consumer Comment

Tue, November 20, 2018

It is funny how you spent 3/4 of your response ranting on how bad this companies web site is and how you have all of these other credit cards, and the other 1/4 just copying and pasting what I posted. Now, why is it funny? Because you are the one who posted on a PUBLIC web site, and as such the PUBLIC may respond. Where, and this may be a shock, the public may give you different alternatives to the narrative you are trying to put out. So if you haven't figured it out, I am not now or have I ever worked for this company or any bank for that matter. Oh and if you are wondering how you got a response so fast. Well it was just timing, as if you look at the top of the site there is a nice little link to view the latest reports and yours happen to be at the top.

It is interesting how you didn't dispute anything I said though, that tells me that I hit the nail on the head and you truly are that uninformed where you are mistaking payments for fees.

By the way disputing it any other ways other than in writting may not preserve your rights. They may accept the dispute, but if push comes to shove they could deny the dispute because you did not put it in writing. You may want to take a look at the following link that is from a totally independent credit card site.

https://www.creditcards.com/credit-card-news/fair-credit-billing-act-1282.php

Or perhaps you would like the actual FTC site

https://www.consumer.ftc.gov/articles/0219-disputing-credit-card-charges

You will notice a couple of interesting requirements to dispute a charge

Exercise Your Rights

To take advantage of the law's consumer protections, you must:

write to the creditor at the address given for "billing inquiries," not the address for sending your payments, and include your name, address, account number, and a description of the billing error. Use our sample letter.

send your letter so that it reaches the creditor within 60 days after the first bill with the error was mailed to you. It’s a good idea to send your letter by certified mail; ask for a return receipt so you have proof of what the creditor received. Include copies (not originals) of sales slips or other documents that support your position. Keep a copy of your dispute letter.

The common theme in those two links. You must dispute it in 60 days and you must mail your dispute in. I don't make the laws, I am just making you aware of them.

By the way you can of course also verify all of this by researching the Fair Credit Billing Act as well.

The Dog

United StatesThe "Enforcement Section" of "The Bureau" Just Can't Wait To Get Your Tip!

#6Consumer Comment

Tue, November 20, 2018

The "Bureau" does have a "barracks" close to this card's headquarters. It would not surprise me one bit, if they won't prepare their Swat Team for an operation! The "Bureau" will no doubt set up their MCP (mobile command post) in their parking lot. I suspect they will also bring in their mobile courtroom complete with a robed judge and jury. Thanks to you, they will judge them guilty as charged and sentence them on the spot to a long term at their exclusive BBB penitentiary in upstate New York. That place is so secretive it's never been photographed, no one has ever escaped and nobody ever gets an early parole! Thanks to you turning them into the "Bureau", it would not surprise me if the media got involved and covered the BBB trial from gavel to gavel! I can even see the media using such notables as Marcia Clark, Roy Black and F. Lee Bailey as commentators! Wow! Are you ever going to get something started! Yes, you report them this could end up being the trial of this century!

Dasha

Drexel Hill,Pennsylvania,

United States

Amazing how quickly you replied to this with your scaving responce, yet there is not a person to talk to with issues or concerns

#7Author of original report

Tue, November 20, 2018

I am amazed at how quickly someone responded to this post, yet I can not and could not get a person to reply to my e-mail or answer my call when I contacted you initially with specific questions.

I appreciate your scaving response. I hope your company does better job with training their employees and dealing with clients. You are NOT the ONLY credit card that offers credit to high risk clients who try to rebuild their life. Some of us had issues that might have been out of their control, like health care expenses, loss of income, and/or other life events. Though I know, to you we are nothing but business and the enormous interest rate. I have other "credible cards", that have actual people who answer the phone when you contact them with any issues. Who reply to the e-mails within 24 hours. Who have a legitimate website, and high tech technology to track your spending and paying bills.

Though I appreciate the opportunity that your company gave me, you have NO customer service. There is zero ability to talk to a human in order to resolve an issue or have questions answered. Your website is antiquated and you don't even have an app in order to simplify on ways to keep track of your balance or pay bills. Obviously you don't care to make this convenient for your clients, and given your customer service, it speaks volumes. You look at the people who are building or re-building their life as the bottom of the barrel, uneducated and a way to take advantage of for your benefit. If you gave a hoot, you would at least invest in updating your 1990's website, and in to creating an app in order to make it easier for your clients. Your "downloaded statements" go in to en an Excel spread sheet, not as an actual statement.

Every credit card I have, I can call them at any time to report a dispute, or do it on line. You are the only company that requires to have a paper letter sent to you, just like before we had computers. And ALL credit card companies accept disputes past 60 days, I had disputes resolved from over a year. Your response

"As for the dispute, the 60 day limit is FEDERAL law. By the way it is also law that the dispute must be in writing. if you don't like that then talk to your Member of Congress and get them to change the law. Of course when you do, you should perhaps remember that they send you a statement every month, so you had TWO opportunities to file a dispute. The ONLY reason you were not aware of any transaction is because YOU failed to monitor not only your credit card but regular bank account. As that would have given you at least 14 opportunities to realize something was wrong. As I said there is no need to try and explain why you are with a Sub-Prime card, your actions tell us all we need to know" ... Is BS. You rip off your clients, and hope they miss the dead line, so you can slam them with fees and additional fees.

You are a BS company! Your hosting your web sight through Amazon. How professional You can't even have a real professional website. At least use Go Daddy. You are nothing but scammers.

Robert

Irvine,California,

United States

Subprime Card...Subprime Attitude

#8Consumer Comment

Tue, November 20, 2018

This is a "Sub-Prime" card, that is a card for people that have not proven they can handle credit. Because of this you are considered a high risk, and with high risk comes higher fees and interest. The reason you have this card doesn't matter, so if your first reaction is that you are stuck with this card because of something that "wasn't your fault"..don't bother. Your report speaks volumes.

Their monthly fee, as shown in YOUR screenshot is only $8/month. The $50 "fee" you seem to be inquiring about isn't a fee, it is a PAYMENT. I honestly don't know where to go from here if you think that a payment is some sort of fee, but let me try. When you make a payment, you are paying back money you have previously borrowed from them from using the card. The less money you borrow, the less interest you pay, and the more money you save. So the ONLY thing that is happening by making a payment means you are giving them less money from interest. This, if you haven't figured out is a GOOD thing.

As for the dispute, the 60 day limit is FEDERAL law. By the way it is also law that the dispute must be in writing. if you don't like that then talk to your Member of Congress and get them to change the law. Of course when you do, you should perhaps remember that they send you a statement every month, so you had TWO opportunities to file a dispute. The ONLY reason you were not aware of any transaction is because YOU failed to monitor not only your credit card but regular bank account. As that would have given you at least 14 opportunties to realize something was wrong. As I said there is no need to try and explain why you are with a Sub-Prime card, your actions tell us all we need to know.