- Report: #1374363

Complaint Review: Chrysler Capital - Nationwide

Chrysler Capital Credit Reporting Texas Nationwide

My wife & I purchased a Ram 1500 in March of 2014. When it was purchased I was in the military & Chrysler Capital placed me under the Service Member Civil Relief Act to which I had no knowledge of. We found out in late 2016 that it was not being reported to the credit bureaus. I have filled out paper work for them to report to the three major credit bureaus. Chrysler Capital received the paper work on 12/28/2017. Once I had returned the signed paperwork, I was told that it would take approximately thirty days for it to show up on my credit reports. By the end of February nothing was showing on any of the reports. Since that time I have been calling back regularly to get this added to my credit. So far, as of today May 20, 2017 only one payment has posted. There is over three years of on time payments at this point, and I have nothing to show for it. This has affected where my credit score should be at this time tremendously. I have spoken with the “Office of the President” Numerous times without success. I am tired doing my part in making my payment & Chrysler Capital is not capable of doing their part required by law & reporting to the credit bureaus. I have been getting the run around from this company for almost 6 months & have got nothing accomplished. I would highly discourage anyone from using Chrysler Capital or any of its affiliates.

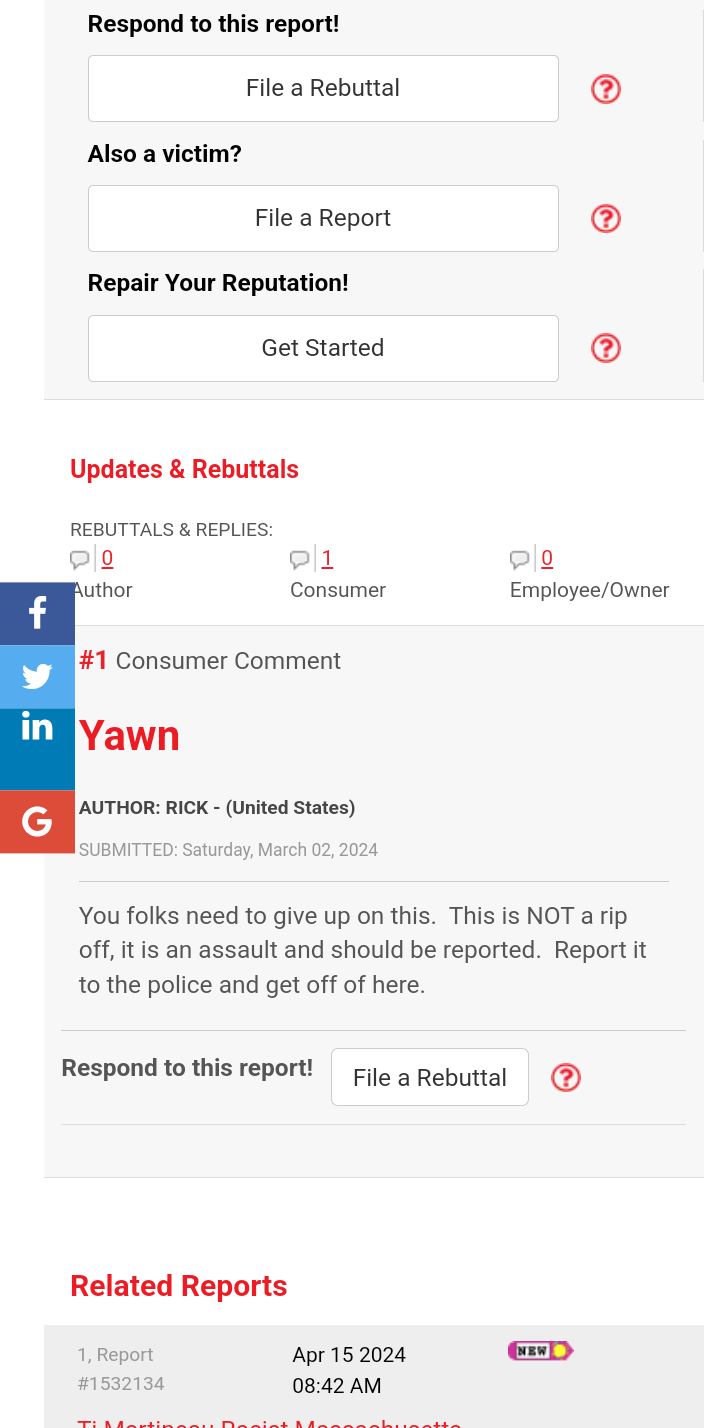

1 Updates & Rebuttals

FloridaNative

Palm Beach Gardens,Florida,

USA

A lender is not required to report to the CRA's

#2Consumer Comment

Sat, May 20, 2017

You have a mistaken idea about lenders being required to report your payments to the CRA's. If a lender chooses to report, then they must report accurately, but there is no law that says they must report.

What you can do is find a credit union and refinance your remaining balance. Make sure the CU reports to the CRA's. It is an easy fix. You may have to show that you made all your payments on time to the CU and you can do that with your bank statements.