- Report: #492829

Complaint Review: BankAtlantic - Bank Atlantic - Fort Lauderdale Florida

BankAtlantic Yet another Bank Atlantic Victim! Fort Lauderdale, Florida

Office of Thrift Supervision

Department of the Treasury

1-800-842-6929

http://www.ots.treas.gov/?p=ConsumerComplaintsInquiries

WE CAN FIGHT BACK AND TAKE THEM DOWN!

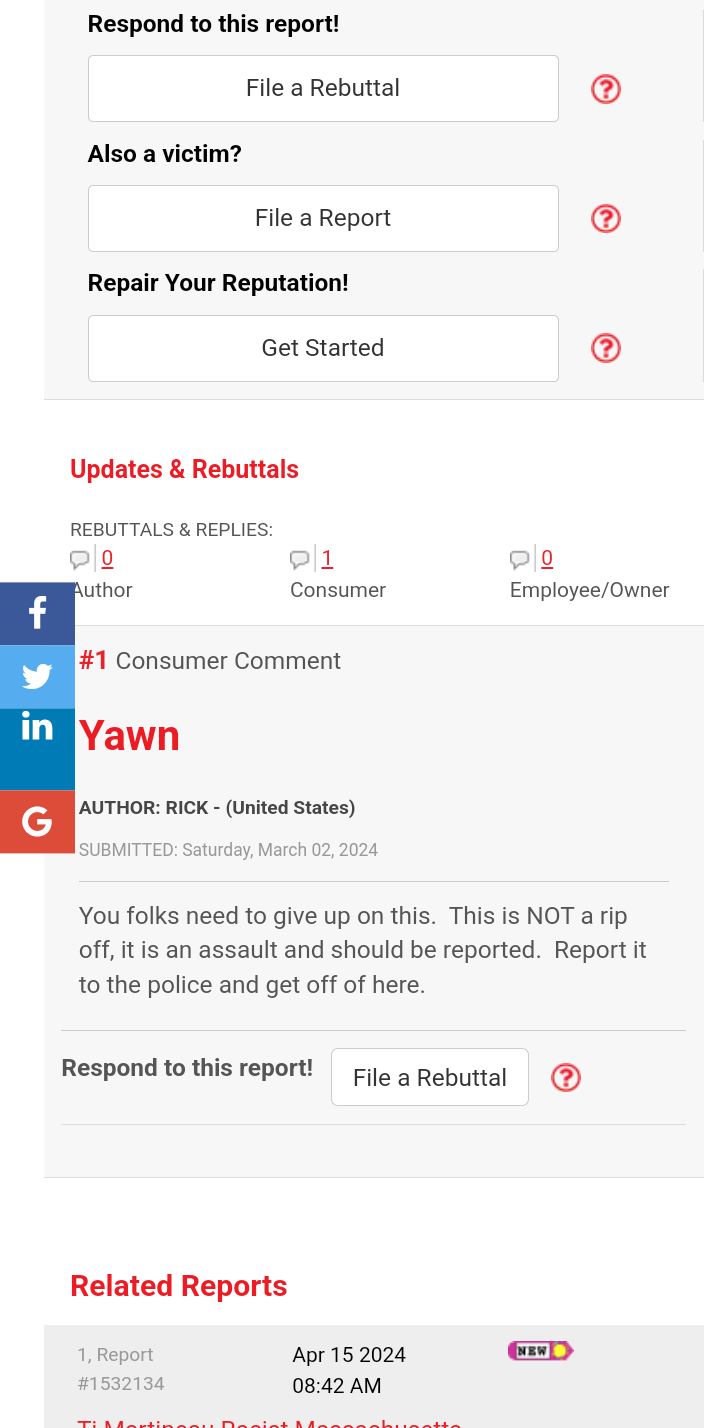

2 Updates & Rebuttals

Ronny g

North hollywood,California,

U.S.A.

Jim has good advice..but that does not mean we "give up".

#2

Fri, September 11, 2009

Yes..follow Jims advice..it may not prevent an overdraft from ever occuring..but it is a safer bet then depending on the banks online statement..which seems to be designed to encourage overdrafting...and why not?? if the bank can get away with charging all these addition fees..they will do it.

As far as the bank re-sequencing transactions..many feel this is unfair, and it is reasonable to assume overdrafts are going to occur from time to time..for many reasons that a register may not prevent.

I am one of those also who wish to help change some laws to better protect consumers..here is what I have so far...

I am not allowed to give out websites or phone numbers here it seems but if you google "Finkelstein Thompson LLP" you can find out how to contact them to help with an "investigation" if you have been a victim of this "re-sequencing" which directly caused the ADDITIONAL fees on top of the actual legitimate overdraft(s). Well instead of "victim" it should be "Plaintiff".

Not unlike so many other rip off reports on the banks doing this..almost every one thinks this should be illegal. Whether it is or isn't..we all agree it should be so we can either sit on our laurels and do nothing..or fight a little for it.

It is alleged that some banks, are in violation of 12 U.S.C. 4303(b)(1) for their failure to disclose that the condition precedent of a pre-existing overdraft could cause the assessment of additional overdraft fees. Instead, the banks have been lying to consumers that the condition precedent was insufficient funds.

[The true reason why you were assessed the additional overdraft fees that you did NOT cause is because you actually had a pre-existing overdraft in your account that the bank used to manipulate your account to create additional overdraft fees by a creative accounting practice].

[The bank then falsely accused you of being at fault for the additional overdrafts you didnt cause by lying to you about having insufficient funds in your account. In fact, without the pre-existing overdraft(s) in your account (condition precedent), it would have been IMPOSSIBLE for the banks creative accounting practice to have assessed additional overdraft fees against you that you did not create].

[That is why the bank engages in tactics to make you overdraft your account. For example, the bank will not immediately post your correct available balance or the bank will drop a hold on your account to only apply it later to make you believe you have more available funds in your account then you do. The bank will also split two pre-existing overdrafts created on the same date so it can create additional overdraft fees on two different posting dates instead of one].

As well...

H.R. 946, introduced in the US House of Representatives on February 8, 2007, would increase regulation of overdraft loan programs. The proposed legislation would Amend the Truth in Lending Act (Regulation Z) to clarify that overdraft fees are covered, require written consent before enrollment in the overdraft loan program, require financial institutions to warn the customer when an ATM withdrawal will trigger a fee, and prohibit financial institutions from changing the order of check clearing or delaying the posting of deposits solely to increase overdraft fees. This bill was referred to committee in April 2007 and died in committee.

As of February 2009, the FDIC was taking comments on the issue.

Jim

Anaheim,California,

U.S.A.

They Can Not Help - Only You Can Help Yourself

#3

Thu, September 10, 2009

The Office of Thrift Supervision can only help you if you have a legitimate complaint or violation. Resorting transactions highest to lowest, posting debits before credits, and depositing checks while debits are still pending are items that are not only not a legit complaint, but are practices found to be legal in court.

Here are some things that will help you:

1. Keep an accurate check register: Nowhere in your complaint do you even reference that you use one. Let's remember this very carefully; the balance the bank shows you online is not your balance. That's their balance on your account. Your balance is different and should be far more accurate than the banks. If you don't keep a register, you can't complain because you don't even know what your bank balance is.

2. Stop Using A Debit Card: A debit card is convenient for you to use because it means you don't have to carry as much cash around, right? In reality, it's really more convenient for the bank as a revenue source. See, when you overdraft and you use a debit card a lot, the number of overdraft fees increases substantially. So when you overdraft your account, who does it become more convenient for? Not you.

3. Stop Looking Online for your balance: That is a guaranteed way to incur more fees. The only reason you should ever look online is to record EFT's, electronic debits that don't get picked up in your register, and to make corrections to your register. In no way should the online tool ever substitute for your check register.

Moving your account won't help you because all banks transact business this way; the only person who can help you is you. Start by taking these three steps and you will be on your way to fixing the issue you have with your bank.