- Report: #1212577

Complaint Review: First Premier - Sioux Falls South Dakota

First Premier First Premier Bank price gouges people on disability and fixed income. First Premier Bank practices are unlawful, Do not stand for their unlawful practices!!! They should have a class action lawsuit brought against them. IT ONLY TAKES ONE TO START A CLASS ACTION LAWSUIT!!! Sioux Falls South Dakota

DO NOT GET THIS CARD!!! I'm on disability and was hospitalized from 12-27-14 to 1-22-15 thus missed January 2015 payment so for February I paid 118.00 (February 3, 2015) as of March 1, 2015 I still have ZERO in available credit. My account says I'm 11.00 over my credit limit despite my February payment and I haven't used the credit card, the only reason I'm over my limit is because of their exorbitant fees. 36% interest and 14.95 per month.

First Premier Bank are a bunch of shameless blood suckers and should be boycotted by everyone!!! They have shady and unethical business practices that often do far more harm than good, and generally speaking and make certain that the Have Not's will continue to have even less. People who are struggling to make ends meet struggle even more if they're stupid enough, like me, to open a credit card account with these crocks. Because they're a business they think they can get away with their shameful business practices. Banks/credit card companies have class action lawsuits against them all the time.

http://www.girardgibbs.com/faq/how-do-i-start-a-class-action-lawsuit/

http://topclassactions.com/start-a-class-action/

http://www.millslawfirm.com/classaction.html

http://www.jacobymeyers.com/questions-about-class-action-l.html

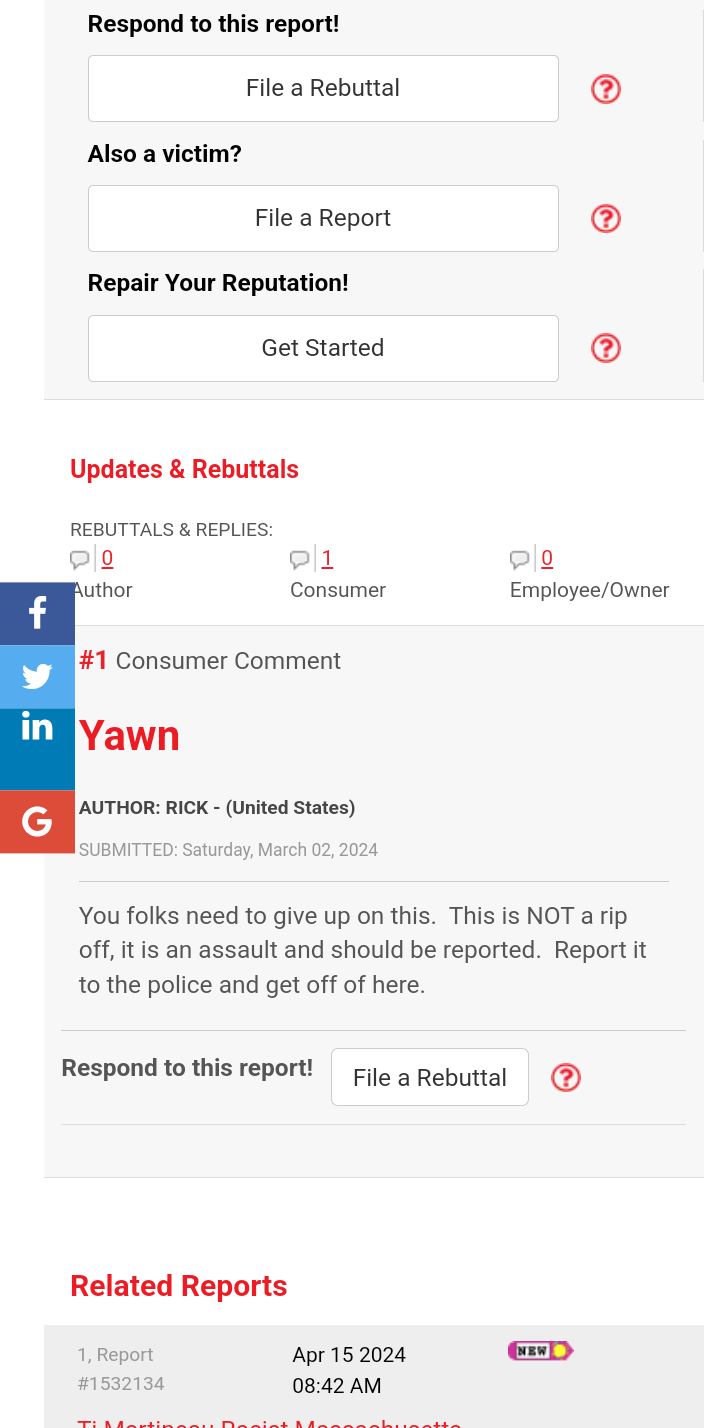

4 Updates & Rebuttals

noones biusness

Bethel,Ohio,

USA

fraud

#2Consumer Comment

Sun, March 22, 2015

I got this stupid card, AND DIDNT AGREE TO ANY OF THE TERMS ,THAT THEY HAVE STUCK ME WITH , I ONLY LEARNED OF THEM AFTER THE ACCOUNT WAS ACTIVATED. EXTRA FEES TACKED ON AND I HAD NO KNOWLEDGE OF THE IMPENDING DOOM.

BANK IS A RIP OFF AND COMMITS FRAUD

Jim

Florida,Here Are The Facts

#3Consumer Comment

Mon, March 02, 2015

If YOU wouldn't have destroyed your credit, then you could have received a better interest rate at a major bank.

The interest rate and fee disclosure was made to you by internet or letter BEFORE you applied for the card. Nobody forced you into this deal.

YOU aren't ENTITLED to any credit card or favorable terms. Your health condition has nothing to do with it. Grow up and get rid of your ENTITLEMENT ATTITUDE.

Robert

Irvine,California,

Then why don't you be the one?

#4Consumer Comment

Sun, March 01, 2015

If you truly believe it only takes one to start a Class Action Lawsuit, then why haven't you started one?

Now, while you think about that..let me help you out with a few things.

First of all First Premier is a Sub-Prime card, and yes pretty much the "last resort" credit card for people. As they guarantee just about everyone a credit card regardless of your past. However, because the people that get this card have not proven they can handle credit you are considered a much higher risk. Higher Risk = Higher Interest and fees.

If the interest rate and fees were a problem for you, then why did you get the card? Because everything was disclosed to you before you signed up(of course it still takes effort on your part to read it).

Next, as a Sub-Prime borrower you feel that a Credit Card for some reason has to account for all of your issues and needs to take into consideration about your "problems". Well that is EXACTLY why you are with a Sub-Prime card in the first place, and while until you change your attitude as why you will continue to be a Sub-Prime borrower for many years to come. YOU made a LEGAL agreement to abide by their terms, you all of the sudden can't decide you no longer want certain things to apply(like Interest Rates) if things get "tough".

As for people struggling to make ends meet. Those people also shouldn't be trying to get a credit card that is costing them $14.95/month + interest. This may be a shock for you but a Credit Card is not a requirement. Just about every bank offers a Debit Card that can be just used like a credit card in 99.99% of the situations that a person is likely to run into.

Oh and back to that Class Action Lawsuit...the ONLY people that make any money on it are the lawyers and perhaps the original person who filed the suit. Everyone else...if you get $15 from any "settlement" you better be thanking your lucky stars.

Charles

United States,Alabama,

Class action lawsuits are a total ripoff the only people who get the big settlements are the lawyers not the victims the victims only get $1

#5Consumer Comment

Sun, March 01, 2015

Class action lawsuits are only for lawyers to get big settlements. Some companies pay $38 million but does any of that go to the customers NO it only goes to the lawyers and the customers who got done wrong only get a very small tiny portion which is $1.00.

A $1.00 settlement is a insult to the customers and the company pays of millions they still deny any wrong doing. I would tell the court they can keep their $1.00 and tell them its an insult them paying that little. Class action lawsuits are "EVIL".