- Report: #1516283

Complaint Review: Bank of America -

Bank of America BOA Bank of America Debit/CC/ATM $1.50 Charge. Baseless Charges

11/2021, I took out a balance transfer to save a lot of money. The transaction fee was paid and the transaction completed. The debit/cc itself had a zero balance.

12/2021, I paid $1,000 more than the 'minimum due' before the due date.

01/03/2022, again I paid $1,000 more than the 'minimum due' and before the due date.

01/20/2022, I had a charge to the debit/cc and paid it off in full 4 days later.

02/01/2022, again I paid $1,000 more than the 'minimum due' before the due date.

02/03/2022, I had a <$20.00 charge to debit/cc.

02/05/2022, I was charged $1.50 fee without cause, on a zero balance due.

02/18/2022, I reported to BOA of the $1.50 charge via phone. He read the agreement and stated the charge was not disputable and non-refundable. I asked what was the charge actually for, not under what circumstances to which I can be charged. He looked and could not find an answer.

He then put me on hold and reported this incident to another department. He then stated the other department also could not find a reason for the $1.50 charge as I always carried a zero balance, paid a mininimum of $1,000 more than the minimum amount due, and nothing to account for a $1.50 charge.

He informed me the other department agreed to refund the $1.50, to which I was refunded the next business day. Bank of America debit/cc are making mint off of others not reporting this baseless charge. I will be reporting this to other agencies to investigate.

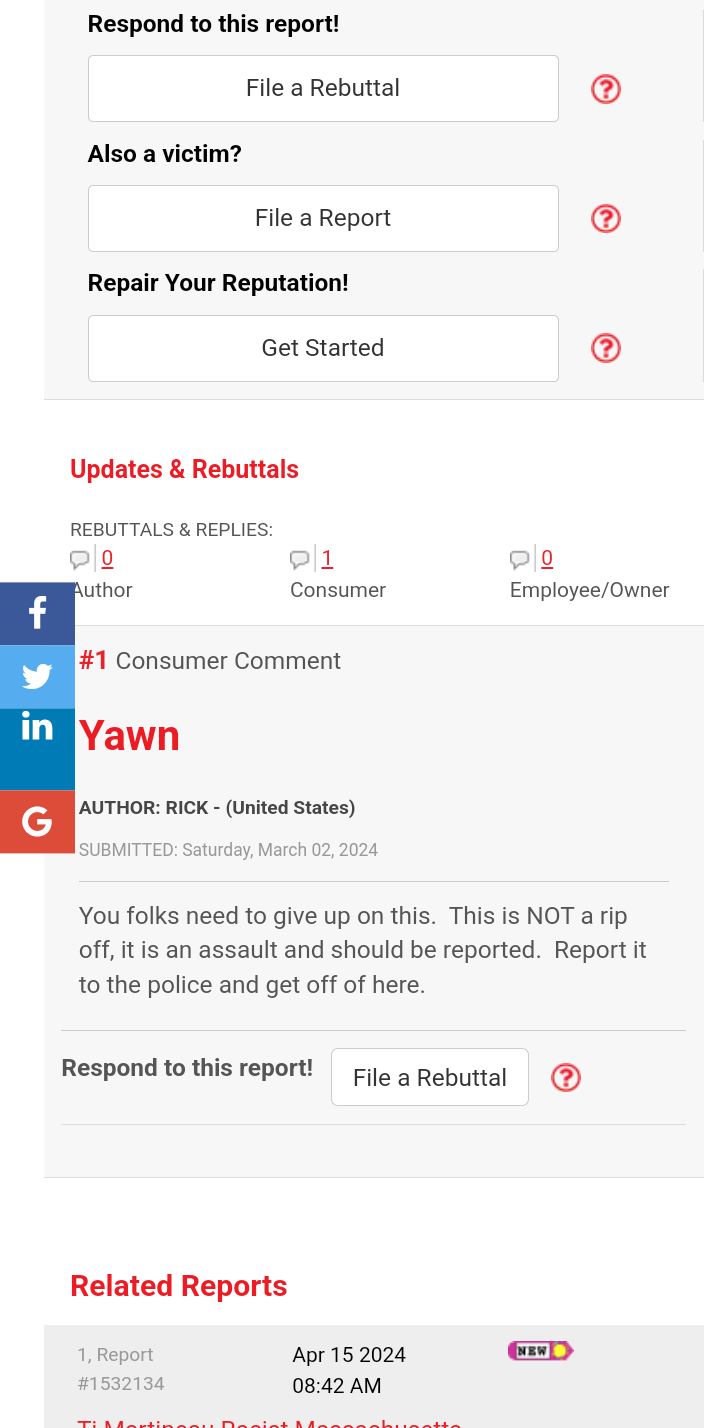

2 Updates & Rebuttals

Earnest

California,United States

Not sure what you mean, but....

#2Author of original report

Wed, February 23, 2022

I don't use this BOA debit/cc as my main card due to possible fraud issues connected to my bank account. Therefore, I've most always had a zero total balance, zero due, zero on the card, nada, nothing. I've only had 2 charges for 2022 and paid back both the charges on the card within a few days. Never, ever outside the 30-day grace period.

For example, charged on 01/20/22, paid back on 01/24/22. The monthly minimum due for the transfer is around $250/month. I pay it a few days early and around $1,300. This would cover the $250/month and also, if I had any sort of balance on the cc, it would more than cover it per BOA policy on fees. The debit/cc operator of BOA stated he did not know why the $1.50 interest/charge fee since I had absolutely ZERO on the cc and paid over $1,000 over the minimum due on the transfer. He brought up the issue to another department. They also did not know why the charged fee of $1.50, nor for what purpose. I was promptly refunded the next business day.

Thank you for your concern. However, if you cannot understand credit card basics, then I question your authenticity as being of genuine concern. Do I need to report your as a scammer?

Robert

Irvine,California,

United States

You wrote a lot but...

#3Consumer Comment

Tue, February 22, 2022

You wrote a lot but...didn't say anything worthwhile.

You said you were charged $1.50 on No Balance "DUE", but you didn't say you had a zero balance.

He then put me on hold and reported this incident to another department.

He then stated the other department also could not find a reason for the $1.50 charge as I always carried a zero balance, paid a mininimum of $1,000 more than the minimum amount due, and nothing to account for a $1.50 charge.

This is a contradictory statement and nothing more than a word salad. You can't say you always carried a zero balance and at the same time, you paid a minimum of $1,000 more than the minimum due. People that truly carry zero balances would not say they paid more than the minimum, they would say that they paid off the balance.

What is your statement's "Billing" Date, "Due Date", your exact running balance, exact payments?

The devil is in the details, and those answers will go a long way to what is going on. The $1.50 charge sounds like a "Minimum Finance Charge", that is if you have a balance subject to interest and that interest is less than $1.50 they will charge you $1.50.

Now, they did refund the $1.50 this time which is good. But if you don't change your credit/payment habits this will likely happen again. And the second time don't expect them to be as generous.